By Sara Sjolin, MarketWatch , Ryan Vlastelica

IBM shares decline

U.S. stocks rose modestly on Friday, suggesting major indexes

would close out a positive week on the back of strong corporate

earnings, although the prospect of a looming government shutdown

kept buyers in check.

While a shutdown is seen as having little impact on the pace of

economic growth, such an outcome would add another element of

uncertainty to a market that is already seen as trading at lofty

levels, and which hasn't seen even a mild decline in more than a

year.

Read: A government shutdown 'could reintroduce investors to the

fact that markets go down'

(http://www.marketwatch.com/story/a-government-shutdown-could-reintroduce-investors-to-the-fact-that-markets-go-down-2018-01-19)

What are stock indexes doing?

The Dow Jones Industrial Average fell 10 points to 26,009,

essentially unchanged on the day. The S&P 500 rose 6 points, or

0.2%, to 2,804. The Nasdaq Composite Index rose 19 points, or 0.3%,

to 7,314. The S&P is poised to set a record at the close of

trading on Friday, as it will mark 395 sessions since it has fallen

5%, an unprecedented length of time

(http://www.marketwatch.com/story/heres-another-milestone-the-sp-500-could-surpass-this-month-2018-01-03).

All three are trading within 1 percentage point of record

levels. For the week, the Dow is up 0.9%, while the S&P 500 has

gained 0.7% and the Nasdaq is up 0.8%.

Both the Dow and the S&P are set for their third straight

weekly advance, as well as their eighth of the past nine. The

Nasdaq is also set for its third positive week in a row, as well as

its fifth positive week of the past six.

Read:Here's how stocks handled past government shutdowns

(http://www.marketwatch.com/story/heres-how-the-stock-market-has-handled-past-government-shutdowns-2018-01-16)

Even with the uncertain political backdrop, stocks have been

able to continue their march higher in 2018. The S&P 500 is up

4.7% this month, while the other major benchmarks have jumped more

than 5%. The solid start to the new year comes on signs economic

growth remains strong and corporate earnings are picking up.

Read: Why ditching stocks in this bull market is a 'dangerous'

move

(http://www.marketwatch.com/story/dont-ditch-the-bull-market-its-dangerous-to-be-out-of-stocks-top-uk-fund-manager-says-2018-01-16)

What are strategists saying?

"I would characterize a shutdown as just the kind of political

news that the market has demonstrated, over the past year, a

willingness to ignore," said Hank Smith, co-chief investment

officer at Haverford Trust, which manages $8 billion. He said that

"the market is reacting to GDP growth both here and abroad, and

corporate profits, which are growing by double-digit rates and are

healthy, interest rates that remain low despite a gradual uptick,

and benign inflation."

Boris Schlossberg, managing director of FX strategy, in a Friday

note, said: "The government shutdown per se may not have much

economic impact on the U.S. economy, but the specter of uncertainty

that it could spread through the general economy could dent

investor sentiment especially if the drama in DC turns into a

protracted battle of the wills."

Which stocks are in focus?

Chipmakers rallied on optimism over the group's upcoming

earnings, with Mizuho analyst Vijay Rakesh saying that chip pricing

trends were positive

(http://www.marketwatch.com/story/chip-pricing-trends-could-boost-amd-nvidia-and-micron-results-analyst-2018-01-19).

Advanced Micro Devices Inc.(AMD) rose 3.1% while Nvidia Corp.(NVDA)

was up 2%.

Shares of International Business Machines Corp.(IBM) dropped

2.3% after the tech company late Thursday reported a fourth-quarter

loss

(http://www.marketwatch.com/story/ibm-shares-fall-despite-first-revenue-growth-in-5-years-2018-01-18)

due to a $5.5 billion one-off charge from the recently-passed tax

legislation.

American Express Co.(AXP) fell 2.6%. The credit card company

late Thursday recorded its first quarterly loss

(http://www.marketwatch.com/story/amex-reports-first-loss-since-1992-due-to-tax-hit-2018-01-18)

in over a quarter-century and said it would suspend its share buy

backs in response to a hit from the corporate tax cut.

Shares of Acorda Therapeutics Inc. (ACOR) rose 9% on reports

that it was closing in on a buyer

(https://seekingalpha.com/news/3323826-potential-suitors-eyeing-acorda-therapeutics-shares-ahead-9-percent-premarket).

Shares of Square Inc. (SQ) rose 5% after analysts at Instinet

raised their target

(http://www.marketwatch.com/story/square-stock-jumps-after-instinet-raises-price-target-to-64-new-street-high-2018-01-19)

price to $64, by far the highest among Wall Street analysts tracked

by FactSet.

Tobacco companies rose, with Philip Morris International

Inc.(PM) up 1.8% and Altria Group(MO) adding 1.6%. Both were among

the biggest gainers in the consumer staples sector, which was

itself the top-performing industry of the day, up 0.6%.

Travel retailer Hudson Ltd. (HUD.V) set the terms for its

planned initial public offering on Friday

(http://www.marketwatch.com/story/travel-retailer-hudson-sets-ipo-terms-to-offer-349-million-shares-at-19-to-21-a-pop-2018-01-19),

saying it will offer 34.9 million shares priced at $19 to $21

each.

Read:More than half of S&P 500 stocks are up 20% or more

since Trump took office

(http://www.marketwatch.com/story/more-than-half-of-sp-500-stocks-are-up-20-or-more-since-trump-took-office-2018-01-19)

What's on the economic calendar?

At 10 a.m., Eastern consumer sentiment for January is slated for

release.

Federal Reserve Vice Chair Randall Quarles will speak on bank

regulation to the American Bar Association in Washington at 1

p.m.

See:MarketWatch's economic calendar

(http://www.marketwatch.com/economy-politics/calendars/economic)

What are other markets doing?

The ICE U.S. Dollar index was down 0.1% at 90.350

(http://www.marketwatch.com/story/dollar-slides-back-to-3-year-low-on-fears-of-government-shutdown-2018-01-19),

with currency traders paying more attention to the shutdown issue

in Washington.

Oil prices also slumped

(http://www.marketwatch.com/story/oil-prices-sink-1-head-for-biggest-weekly-loss-since-oct-2018-01-19),

staying lower after the International Energy Agency said shale

producers would help drive U.S. production to levels not seen since

the 1970s.

Gold prices

(http://www.marketwatch.com/story/gold-bounces-back-as-dollar-falls-on-us-shutdown-concerns-2018-01-19)(GCG.T)

rose 0.5%, getting a boost from the weaker dollar.

Asian stock markets closed mainly higher

(http://www.marketwatch.com/story/asian-markets-start-off-quiet-with-investors-eyes-on-us-shutdown-2018-01-18),

inspiring an upbeat session in Europe as well.

(END) Dow Jones Newswires

January 19, 2018 10:00 ET (15:00 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

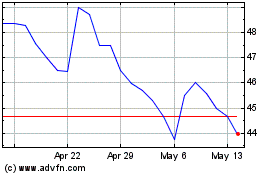

Guardian Capital (TSX:GCG.A)

Historical Stock Chart

From Mar 2024 to Apr 2024

Guardian Capital (TSX:GCG.A)

Historical Stock Chart

From Apr 2023 to Apr 2024