By William Watts, MarketWatch

Emerging-market worries resonate after long run of economic

growth and strong markets

As if global trade spats weren't exciting enough, August has

defied its sleepy reputation to bring investors a taste of an

old-fashioned currency crisis in Turkey.

The underlying worry is that other countries that, like Turkey,

heavily rely on external financing in currencies other than their

own are vulnerable to a continued rise in the U.S. dollar could

begin to face trouble, causing problems for financial institutions

that hold that foreign-denominated debt.

"I think we're far from that right now, but I think it weighs on

investors' minds," said Michael Arone, chief investment strategist

at State Street Global Advisors, in a phone interview.

Indeed, Wall Street analysts and economists don't seem overly

afraid that Turkey's woes will morph into a global crisis that will

threaten U.S. economic growth or corporate earnings -- the Dow on

Friday posted its highest close since February -- but that doesn't

mean geopolitical headlines won't continue to inject volatility

into financial markets.

While there are some crucial differences between Turkey's woes

and the emerging-market woes that led to the Asian financial crisis

of 1997-98, "man-made financial crises tend to occur at the end of

a long run of strong economic growth/financial asset returns, and

every investor knows this," wrote Nick Colas, founder of DataTrek,

in a Wednesday note.

"That's an important reason why the situation in Turkey

resonates as an important risk factor just now," he said.

Meanwhile, investors might be underestimating the impact that

dollar volatility is having on the overall market, Arone said,

noting that a touch of the binary, "risk-on/risk-off" framework

that prevailed in global markets in the aftermath of the financial

crisis has re-emerged this summer amid trade turmoil and other

geopolitical turmoil.

Read:Does Donald Trump really love a strong dollar?

(http://www.marketwatch.com/story/does-donald-trump-really-love-a-strong-dollar-2018-08-16)

The phenomenon appears to emanate from the dollar, which tends

to rally on haven-related buying inspired by negative headlines on

the trade front or the Turkey situation, while setting back on

positive developments. Stocks have tended to move in the opposite

direction of the greenback, while within the market, defensive

sectors lead when the dollar is strong and global cyclicals

strengthen when the buck weakens.

As Turkey's lira plunged, the dollar saw broad strength, pushing

the ICE U.S. Dollar Index to a 14-month high on Wednesday. Hopes

for a breakthrough on the trade front saw the index retreat,

leaving it on track for a 0.3% weekly decline.

U.S. stocks, meanwhile, were lifted sharply Thursday on plans

for U.S. and China officials to resume trade talks. Equities got a

further lift Friday after The Wall Street Journal reported that

Washington and Beijing were drawing up a road map

(http://www.marketwatch.com/story/us-china-plot-road-map-to-resolve-trade-dispute-by-november-2018-08-17-141032446)

for talks to end their trade impasse culminating with meetings

between President Donald Trump and Chinese leader Xi Jinping in

November.

The action left the S&P 500 up 0.6% for the week. The Dow

Jones Industrial Average advanced 1.4% on the week, bouncing back

from weakness earlier in the week as the dollar strengthened.

"As an investor, you want to see, not dollar weakness, but

certainly a slowdown in its strength and some relief from all this

trade talk and this conflict with Turkey," he said.

Arone said he thinks the Trump administration will be looking

for a trade "win" before midterm elections in November. That could

come in the form of an agreement on a renegotiated North American

Free Trade Agreement, or Nafta, with Canada and Mexico.

Meanwhile, Arone said investors should avoid the more defensive

sectors of the market despite their recent strength, instead

favoring stocks that offer strong revenue and earnings-per-share

growth, including the tech and consumer discretionary sector. That

should be balanced by stocks that will benefit from rising input

costs and building inflationary pressures in a late cycle

environment, he said, including energy, materials and industrials

sectors.

With the Federal Reserve on track to deliver up to two more rate

increases before the end of the year, Arone expects defensive,

income-oriented sectors of the market, including utilities,

consumer staples, telecoms and real-estate investment trusts to run

into headwinds.

Meanwhile, minutes of the Fed's last policy meeting are due on

Wednesday, but are expected to deliver little new information,

wrote analysts at RBC Capital Markets.

"The most interesting part of the minutes will be about the

balance sheet outlook. Unfortunately, recent speeches by [Federal

Open Market Committee] members suggest that there is not yet a

strong consensus, so we think that at most we will see the various

options being laid out," they said.

The bigger event will be the Kansas City Fed's annual symposium

for global central bankers in Jackson Hole, Wyo. Fed Chairman

Jerome Powell is set to deliver a Friday speech on "monetary policy

in a changing economy."

See:Fed's Powell may use Jackson Hole speech to discuss

potential trouble ahead

(http://www.marketwatch.com/story/feds-powell-may-use-jackson-hole-speech-to-discuss-potential-trouble-ahead-2018-08-17)

And the rising dollar may be on the agenda, said Michael Hewson,

chief market analyst at CMC Markets UK, arguing that the currency's

strength is likely to pose "significant challenges" to U.S. policy

makers in the months ahead.

"With this being Jerome Powell's first symposium as Federal

Reserve chief, markets will be looking for clues as to whether the

recent currency crisis in emerging markets, and notably Turkey, is

causing anxiety amongst U.S. policy makers, at a time when they

want to continue to normalize rates further," he said.

(END) Dow Jones Newswires

August 18, 2018 08:02 ET (12:02 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

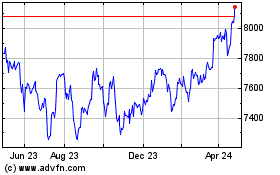

FTSE 100

Index Chart

From Mar 2024 to Apr 2024

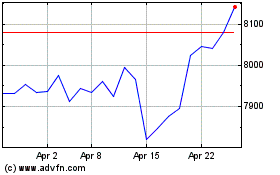

FTSE 100

Index Chart

From Apr 2023 to Apr 2024