Lloyds Banking Group Launches GBP1 Billion Share Buyback -- Update

February 21 2018 - 4:22AM

Dow Jones News

By Max Colchester

Lloyds Banking Group PLC (LLOY.LN) said Wednesday it was

launching a 1 billion pound ($1.4 billion) share buyback alongside

a new strategy aimed at making it one of the most cost-efficient

banks in Europe.

The British retail bank said that its full-year net profit rose

50% to GBP3 billion, as revenues rose 6% to GBP18.5 billion amid a

solid U.K. economy. The results, which set a record for the group,

missed analyst estimates.

The bank also presented a new three-year GBP3 billion investment

plan to further digitalize the group and cut costs. Lloyds Chief

Executive Antonio Horta-Osorio said the "massive undertaking" would

help bolster long-term profitability and dividends.

Following its privatization last year, Lloyds has focused on

diversifying its business away from mortgages while slashing costs.

Like other lenders, it is wrestling with low interest rates and the

rise of online competitors. In 2016 Lloyds bolstered its share of

the British credit-card market by buying MBNA Ltd from Bank of

America Corp. (BAC), while earlier this month it ended a GBP100

billion asset-management mandate with Standard Life Aberdeen as

part of its plan to bulk up its asset-management business.

Write to Max Colchester at max.colchester@wsj.com

(END) Dow Jones Newswires

February 21, 2018 04:07 ET (09:07 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

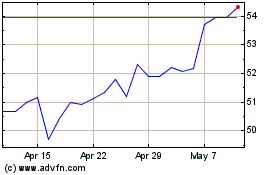

Lloyds Banking (LSE:LLOY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lloyds Banking (LSE:LLOY)

Historical Stock Chart

From Apr 2023 to Apr 2024