Lloyds 1Q Pretax Profit Rises 23%; PPI Provision Falls to GBP90 Million

April 25 2018 - 2:59AM

Dow Jones News

By Adam Clark

Lloyds Banking Group PLC (LLOY.LN) said Wednesday that pretax

profit rose 23% in the first quarter of 2018, as the U.K. lender

benefited from lower exceptional charges and rising net income.

Pretax profit for the three months to March 31 increased to 1.60

billion pounds ($2.23 billion), from GBP1.30 billion the prior

year.

The profit increase included a boost from lower provisions for

claims of historic misselling of payment protection insurance, down

to GBP90 million for the quarter from GBP350 million the year

before. PPI claims have cost the lender a total of nearly GBP19

billion, as the August 2019 deadline for new complaints nears.

Lloyds also booked GBP258 million in impairment costs for the

period, more than double a year earlier.

The bank said it hasn't seen any deterioration of asset quality,

and the U.K. economy continues to be resilient.

Lloyds' underlying profit rose 6% to GBP2.00 billion, as total

income rose 4% to GBP4.58 billion.

Net income was up 4% to GBP4.33 billion, as Lloyds improved its

net interest margin, a key measure of banking profit, to 2.93%.

This compares with 2.80% in the same period the prior year, and

2.90% in the prior quarter. Lloyds said it benefited from lower

deposit and wholesale funding costs, as well as its acquisition of

the MBNA credit card business in 2017.

Lloyds ended the quarter with a Common Equity Tier One ratio, a

key measure of capital strength, of 14.1%, improved from 13.9% at

the beginning of 2018. The company said there has been no change to

its financial targets for 2018.

Write to Adam Clark at adam.clark@dowjones.com;

@AdamDowJones

(END) Dow Jones Newswires

April 25, 2018 02:44 ET (06:44 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

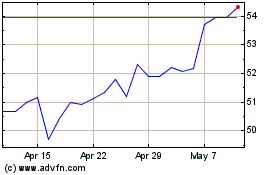

Lloyds Banking (LSE:LLOY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lloyds Banking (LSE:LLOY)

Historical Stock Chart

From Apr 2023 to Apr 2024