Jobs Report, Apple Results Buoy Stocks

November 03 2017 - 9:23AM

Dow Jones News

By David Hodari and Riva Gold

-- US stock futures rise slightly after jobs report

-- Apple jumps in premarket trading

-- Spanish stocks drop on political tensions

U.S. stock futures ticked up slightly after the October jobs

report, even as the pace of hiring proved slower than anticipated

and wages failed to break out.

Futures pointed to a 0.2% rise in the Dow Jones Industrial

Average, up from a 0.1% gain ahead of the report. Nasdaq-100

futures rose 0.6%, as technology companies jumped after Apple

reported better-than-expected results. Apple said late Thursday

that it delivered its best quarterly growth in two years.

Apple shares jumped 4.3% in premarket trading after climbing 45%

so far in 2017, playing a large role in this year's rally in U.S.

stocks.

Global technology shares mostly moved higher in concert, also

supported by upbeat results from Alibaba and other U.S. tech giants

earlier this week. In Europe, shares of chip-gear firm ASML Holding

rose 1.2%, chip maker Infineon Technologies added 1.8% and

semiconductor maker STMicroelectronics climbed 2%. In Taiwan,

shares of Largan Precision were up 3.6% and Hon Hai Precision

Industry gained 0.4%.

In the U.S., attention turned to the U.S. nonfarm payrolls

report, a key indicator of the strength of the economy. The report

showed a gain of 261,000 jobs in October, a pickup from the prior

month, but below the 315,000 jobs expected by economists surveyed

by The Wall Street Journal. The closely watched wage growth figure

showed wages rose 2.4% from a year earlier, a slowdown from the

prior month.

The WSJ Dollar Index, which weighs the U.S. currency against a

basket of 16 others, declined 0.1% following the report. The yield

on the 10-year Treasury note slipped to 2.338%, from 2.347% ahead

of the report. Yields fall as prices rise.

On Friday, investors also continued to parse the details of a

Republican tax bill and the nomination of Fed governor Jerome

Powell to be the next chairman of the central bank.

The Dow industrials fell more than 80 points Thursday after a

detailed summary of the tax plan was reported, but the blue-chip

index climbed later in the session to end higher.

"We think tax reform is more likely than the market thinks it

is," said Jon Adams, investment strategist with BMO Global Asset

Management, noting expectations for a tax cut in 2018 are one of

the reasons for the asset manager's modest preference for equities

over bonds.

Still, "this is a very fluid process and it's likely that there

will be a lot of change to what is currently being proposed," he

added.

In Europe, Spanish bank shares fell, dragging Spain's IBEX 35

down 1.3%. A prosecutor asked a Spanish court on Thursday to issue

an arrest warrant for Carles Puigdemont, the leader of Catalonia's

secessionist movement who fled to Belgium to escape authorities in

Spain.

"I don't think [Catalonia] is played out yet -- the [request

for] arrests have probably inflamed the situation and there's no

doubt going to be a populist response to arrests," said Gautam

Batra, head of investments at Mediolanum Asset Management.

The British pound edged up 0.3% to $1.3101 after its biggest

daily decline since June. The Bank of England on Thursday raised

interest rates for the first time in more than 10 years but

signaled that further increases weren't imminent, causing the pound

to slump 1.4% against the U.S. dollar.

"More important than the decision were the comments during the

press conference and inflation report, which were quite dovish,"

said Markus Stadlmann, chief investment officer at Lloyds Banking

Group. "There are so many moving parts with regards to the economic

situation for the U.K. at the moment that for investors, we have to

take it step by step."

Asia-Pacific equities were little changed ahead

Chinese tech giant Tencent rose 1.7% to a fresh record after

peer Alibaba reported positive quarterly results. The gain helped

Hong Kong's Hang Seng Index -- of which Tencent is the largest

component -- rise 0.3%.

-Corrie Driebusch contributed to this article

Write to David Hodari at David.Hodari@dowjones.com and Riva Gold

at riva.gold@wsj.com

(END) Dow Jones Newswires

November 03, 2017 09:08 ET (13:08 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

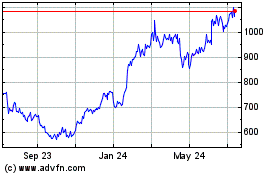

ASML Holding NV (NASDAQ:ASML)

Historical Stock Chart

From Mar 2024 to Apr 2024

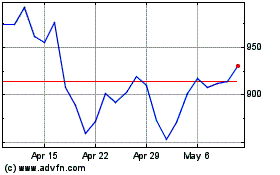

ASML Holding NV (NASDAQ:ASML)

Historical Stock Chart

From Apr 2023 to Apr 2024