Investors Punish L Brands After Victoria Secret's Weakness

July 12 2018 - 10:01PM

Dow Jones News

By Micah Maidenberg

Victoria's Secret, the flagship beauty and lingerie line for L

Brands Inc., simply isn't resonating with shoppers.

Revenue from Victoria's Secret products fell 1% for the

five-week period ended July 7, compared with the same period last

year, L Brands Chief Investor Relations Officer Amie Preston said

in an audio message accompanying its latest sales report. Fewer

customers visited stores for Victoria's Secret's semiannual sale,

forcing the company to lengthen it by about two weeks and slash

already reduced prices.

Those moves were meant "to drive traffic and clear inventory,"

Ms. Preston said in the message. As a result, merchandise margins

fell "significantly," compared with last year, she added.

Investors on Thursday punished the Columbus, Ohio-based

retailer's stock following the news. Shares in L Brands fell 12% to

close at $32.34. The stock has fallen 46% since the start of the

year.

Victoria's Secret "is broken," Randy Konik, managing director at

Jefferies LLC, said in a research note.

"Consumers are going somewhere else," Mr. Konik added in an

interview. "At any price, the consumer doesn't want their products

anymore."

The brand's struggles come amid shifting cultural mores and

consumer behavior. Some observers believe Victoria's Secret's

emphasis on skinny, supermodel imagery to promote its merchandise

is out of touch and that the company hasn't responded to demand for

different kinds of underwear.

"Victoria's Secret just didn't get the memo that we're talking

about bodies of all sizes and inclusiveness," said Jane Hali, chief

executive of Jane Hali & Associates LLC, an investment research

firm in Boca Raton, Fla. "Sexy isn't in. Comfort is in."

Competitors like Triumph, Adore Me and Calvin Klein are doing a

better job at reaching consumers, according to analysts. American

Eagle Outfitters Inc.'s Aerie brand just launched an ad campaign

that features women with disabilities.

A spokeswoman for L Brands didn't respond to requests for

comment. Led by CEO Leslie Wexner, L Brands has bucked trends in

the retail business by adding stores, betting that female shoppers

will still visit physical shops to try on products like underwear

and beauty items.

For the five-week period ended July 7, L Brands reported $1.3

billion in sales, up 6% from the year-earlier period. The company

booked $4.8 billion in sales for the 22-week period, up 8%. Despite

Victoria's Secret's weak performance, L Brands' Bath & Body

Works performed well, with sales up 10% for the five-week

period.

Investors are looking for signs that L Brands can turn around

Victoria's Secret.

"You can't have them missing margin plans. You can't have them

missing sales plans on one of the biggest events of the year," said

Ike Boruchow, a managing director at Wells Fargo Securities LLC who

follows L Brands. "You need to see stability in the numbers."

Other retailers also struggled this week after their sales

reports for the five-week period ended July 7 were released.

Cato Corp., based in Charlotte, N.C., reported same-store sales

for the period were flat compared with last year, and its shares

fell 13.5%. Lynnwood, Wash.-based Zumiez Inc.'s stock dropped 10%

after it reported slower comparable sales growth. Buckle Inc.'s

comparable sales slipped 1.2% for the period. Shares in the

Kearney, Neb.-based company were down 7.7%.

Write to Micah Maidenberg at micah.maidenberg@wsj.com

(END) Dow Jones Newswires

July 12, 2018 21:46 ET (01:46 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

L Brands (NYSE:LB)

Historical Stock Chart

From Mar 2024 to Apr 2024

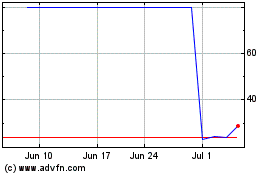

L Brands (NYSE:LB)

Historical Stock Chart

From Apr 2023 to Apr 2024