Initial Statement of Beneficial Ownership (3)

January 09 2018 - 8:37AM

Edgar (US Regulatory)

|

FORM 3

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

INITIAL STATEMENT OF BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0104

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Vollet Scott

|

2. Date of Event Requiring Statement (MM/DD/YYYY)

1/1/2018

|

3. Issuer Name

and

Ticker or Trading Symbol

TEMPUR SEALY INTERNATIONAL, INC. [TPX]

|

|

(Last)

(First)

(Middle)

C/O TEMPUR SEALY INTERNATIONAL, INC., 1000 TEMPUR WAY

|

4. Relationship of Reporting Person(s) to Issuer (Check all applicable)

_____ Director

_____ 10% Owner

___

X

___ Officer (give title below)

_____ Other (specify below)

EVP, Global Operations /

|

|

(Street)

LEXINGTON, KY 40511

(City)

(State)

(Zip)

|

5. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_

X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Beneficially Owned

|

1.Title of Security

(Instr. 4)

|

2. Amount of Securities Beneficially Owned

(Instr. 4)

|

3. Ownership Form: Direct (D) or Indirect (I)

(Instr. 5)

|

4. Nature of Indirect Beneficial Ownership

(Instr. 5)

|

|

Common Stock

|

13908

|

D

|

|

Table II - Derivative Securities Beneficially Owned (

e.g.

, puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 4)

|

2. Date Exercisable and Expiration Date

(MM/DD/YYYY)

|

3. Title and Amount of Securities Underlying Derivative Security

(Instr. 4)

|

4. Conversion or Exercise Price of Derivative Security

|

5. Ownership Form of Derivative Security: Direct (D) or Indirect (I)

(Instr. 5)

|

6. Nature of Indirect Beneficial Ownership

(Instr. 5)

|

|

Date Exercisable

|

Expiration Date

|

Title

|

Amount or Number of Shares

|

|

Stock Options (right to buy)

|

(1)

|

2/22/2020

|

Common Stock

|

1153.0

|

$28.39

|

D

|

|

|

Stock Options (right to buy)

|

(2)

|

2/21/2021

|

Common Stock

|

1109.0

|

$46.68

|

D

|

|

|

Stock Options (right to buy)

|

(3)

|

2/8/2022

|

Common Stock

|

899.0

|

$71.5

|

D

|

|

|

Stock Options (right to buy)

|

(4)

|

2/22/2023

|

Common Stock

|

3647.0

|

$37.05

|

D

|

|

|

Stock Options (right to buy)

|

(5)

|

2/28/2024

|

Common Stock

|

1611.0

|

$51.87

|

D

|

|

|

Stock Options (right to buy)

|

(6)

|

2/26/2025

|

Common Stock

|

3573.0

|

$57.51

|

D

|

|

|

Performance Restricted Stock Units

|

(7)

|

(7)

|

Common Stock

|

2171.0

|

$0.0

|

D

|

|

|

Performance Restricted Stock Units

|

(8)

|

(8)

|

Common Stock

|

4482.0

|

$0.0

|

D

|

|

|

Stock Options (right to buy)

|

(9)

|

1/4/2027

|

Common Stock

|

24248.0

|

$69.5

|

D

|

|

|

Restricted Stock Units

|

(10)

|

(10)

|

Common Stock

|

2365.0

|

$0.0

|

D

|

|

|

Stock Options (right to buy)

|

(11)

|

1/4/2028

|

Common Stock

|

18812.0

|

$62.45

|

D

|

|

|

Restricted Stock Units

|

(12)

|

(12)

|

Common Stock

|

15612.0

|

$0.0

|

D

|

|

|

Explanation of Responses:

|

|

(1)

|

These options became exercisable in three annual installments. The first installment became exercisable on February 22, 2011, and the next two installments became exercisable on February 22, 2012 and February 22, 2013.

|

|

(2)

|

These options became exercisable in three annual installments. The first installment became exercisable on February 22, 2012, and the next two installments became exercisable on February 22, 2013 and February 22, 2014.

|

|

(3)

|

These options became exercisable in three annual installments. The first installment became exercisable on February 9, 2013, and the next two installments became exercisable on February 9, 2014 and February 9, 2015.

|

|

(4)

|

These options became exercisable in two annual installments. The first installment became exercisable on February 22, 2014, and the second installment became exercisable on February 22, 2015.

|

|

(5)

|

These options became exercisable in three annual installments. The first installment became exercisable on February 28, 2015, and the next two installments became exercisable on February 28, 2016 and February 28, 2017.

|

|

(6)

|

Two installments of these options became exercisable in annual installments on February 27, 2016 and February 27, 2017. The third installment will become exercisable on February 27, 2018.

|

|

(7)

|

Matching Performance Restricted Stock Units ("MPRSUs") were granted to the Reporting Person on March 18, 2016 (the "Grant Date"). Each MPRSU represents a contingent right to receive one share of TPX Common Stock for each share purchased by the Reporting Person on or about the Grant Date. On February 24, 2017, the Compensation Committee of the TPX Board of Directors determined that the performance threshold had been satisfied, and the award agreement became subject only to time vesting restrictions. Pursuant to the award agreement, the MPRSUs vest in five annual installments, with 543 units vesting on the first four anniversaries of the Grant Date and 542 units vesting on the fifth anniversary of the Grant Date. Following achievement of the performance threshold, on the first vesting date the first tranche of MPRSUs vested and was released.

|

|

(8)

|

Matching Performance Restricted Stock Units ("MPRSUs") were granted to the Reporting Person on May 6, 2016 (the "Grant Date"). Each MPRSU represents a contingent right to receive one share of TPX Common Stock for each share purchased by the Reporting Person on or about the Grant Date. On February 24, 2017, the Compensation Committee of the TPX Board of Directors determined that the performance threshold had been satisfied, and the award agreement became subject only to time vesting restrictions. Pursuant to the award agreement, the MPRSUs vest in five annual installments, with 1,121 units vesting on the first three anniversaries of the Grant Date and 1,120 units vesting on the fourth and fifth anniversaries of the Grant Date. Following achievement of the performance threshold, on the first vesting date the first tranche of MPRSUs vested and was released.

|

|

(9)

|

These options will become exercisable in four annual installments. The first installment will become exercisable on January 5, 2018, and the next three installments will become exercisable on January 5, 2019, January 5, 2020 and January 5, 2021.

|

|

(10)

|

Restricted stock units ("RSUs") were granted to the Reporting Person on February 11, 2016. Pursuant to the award agreement, one installment of 789 RSUs vested and was distributed to the Reporting Person on February 11, 2017. The second installment of 789 RSUs will vest on February 11, 2018 and the third and fourth installments of 788 RSUs each will vest on February 11, 2019 and February 11, 2020, respectively.

|

|

(11)

|

These options vest in four equal annual installments on the first four anniversaries of the grant date, beginning on January 5, 2019.

|

|

(12)

|

Restricted Stock Units ("RSUs") were granted to the Reporting Person on January 5, 2018. Pursuant to the award agreement, the RSUs will vest in four annual installments beginning January 5, 2019.

|

Remarks:

Ex. 24 Power of Attorney

|

Reporting Owners

|

|

Reporting Owner Name / Address

|

Relationships

|

|

Director

|

10% Owner

|

Officer

|

Other

|

Vollet Scott

C/O TEMPUR SEALY INTERNATIONAL, INC.

1000 TEMPUR WAY

LEXINGTON, KY 40511

|

|

|

EVP, Global Operations

|

|

Signatures

|

|

/s/ William H. Dorton, Attorney-in-Fact

|

|

1/9/2018

|

|

**

Signature of Reporting Person

|

Date

|

|

Reminder: Report on a separate line for each class of securities beneficially owned directly or indirectly.

|

|

*

|

If the form is filed by more than one reporting person,

see

Instruction 5(b)(v).

|

|

**

|

Intentional misstatements or omissions of facts constitute Federal Criminal Violations.

See

18 U.S.C. 1001 and 15 U.S.C. 78ff(a).

|

|

Note:

|

File three copies of this Form, one of which must be manually signed. If space is insufficient,

see

Instruction 6 for procedure.

|

|

Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

|

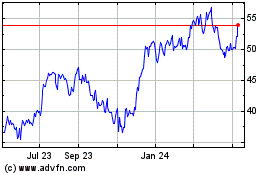

Tempur Sealy (NYSE:TPX)

Historical Stock Chart

From Mar 2024 to Apr 2024

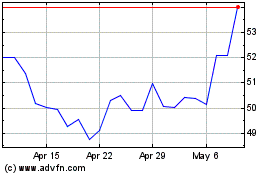

Tempur Sealy (NYSE:TPX)

Historical Stock Chart

From Apr 2023 to Apr 2024