Indian Rupee Strengthens From 1-week Low Against US Dollar

June 12 2012 - 7:41AM

RTTF2

The Indian rupee erased some of its early morning losses at the

end of Tuesday's domestic deals as Indian shares rallied on RBI

rate cut hopes following the weaker than expected industrial

production data.

The IIP figures are disappointing and the government would take

steps to give positive signals to the industry and kick-start the

economy, finance minister Pranab Mukherjee said at a conference of

public sector banks in New Delhi.

Government data showed that industrial production rose 0.1

percent from a year earlier in April, reflecting contraction in

capital goods and a dip in manufacturing output. Output fell 3.5

percent in March from a year earlier, according to revised

figures.

Paring early morning losses of over 100 points, the benchmark

BSE Sensex ended the day up 195 points or 1.17 percent at 16,863.

The broader Nifty index rose by 62 points or 1.22 percent to

5,116.

The rupee rose to 55.6550 against the dollar, snapping back from

a weekly low of 56.09 hit in the morning. On the upside, 55.40 is

seen as the next likely target level for the Indian currency.

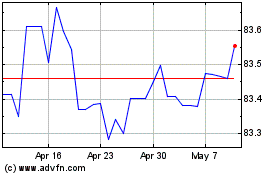

US Dollar vs INR (FX:USDINR)

Forex Chart

From Mar 2024 to Apr 2024

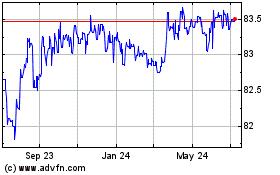

US Dollar vs INR (FX:USDINR)

Forex Chart

From Apr 2023 to Apr 2024