INVESTOR ALERT: Kirby McInerney LLP Announces Extended Lead Plaintiff Deadline in the Securities Lawsuit Pending Against A10 ...

July 06 2018 - 4:06PM

Business Wire

The law firm of Kirby McInerney LLP gives notice of the revised

lead plaintiff deadline in the securities lawsuit pending against

A10 Networks, Inc. (NYSE:ATEN) (“A10 Networks” or the “Company”)

and certain of its officers (“Defendants”). The caption for the

action is: Shah v. A10 Networks, Inc. et al., Case No.

3:18-cv-01772-VC, pending in the United States District Court for

the Northern District of California before the Honorable Vince

Chhabria, U.S.D.J.

The operative complaint, filed on March 22, 2018 on behalf of a

proposed class consisting of persons and entities that acquired A10

Networks securities between February 9, 2016 and January 30, 2018,

inclusive, alleges that Defendants violated federal securities

laws. Specifically, the complaint alleges that Defendants made

false and/or misleading statements and/or failed to disclose that:

(1) A10 Networks had issues with its internal controls that

required an Audit Committee investigation; (2) A10 Networks’

revenues since the fourth quarter of 2015 were false due to

improper revenue recognition which prompted an investigation by the

Company’s Audit Committee; and (3) as a result, Defendants’ public

statements were materially false and misleading at all relevant

times. The initial deadline to move for lead plaintiff was May 21,

2018, and on June 29, 2018, the Court denied those motions without

prejudice and reopened the lead plaintiff process, with a revised

lead plaintiff deadline of July 27, 2018.

On January 16, 2018, A10 Networks announced that it expected

fourth quarter 2017 revenue to be between $55.5 million and $56

million, which was below its prior guidance of $64 million to $67

million. Following this news, the stock price of A10 Networks fell

$0.99 per share, or 13.5%, to close at $6.32 on January 17,

2018.

On January 30, 2018, A10 Networks disclosed that the Company’s

Audit Committee was investigating the Company’s revenue recognition

practices from the fourth quarter of 2015 through the fourth

quarter of 2017, inclusive, and that, in the fourth quarter of

2017, the Company determined that a mid-level employee within its

finance department had violated the Company’s Insider Trading

Policy and Code of Conduct. Following these disclosures, the stock

price of A10 Networks fell $0.86 per share, or 12.3%, to close at

$6.13 per share on January 31, 2018.

If you purchased or otherwise acquired A10 securities, have

information, or would like to learn more about these claims, please

contact Thomas W. Elrod of Kirby McInerney LLP at 212-371-6600, by

email at telrod@kmllp.com, or by filling out

this contact form, to discuss your rights or interests with

respect to these matters without any cost to you.

Kirby McInerney LLP is a New York-based plaintiffs’ law firm

concentrating in securities, antitrust, whistleblower, and consumer

litigation. The firm’s efforts on behalf of shareholders in

securities litigation have resulted in recoveries totaling billions

of dollars, and the firm’s achievements and quality of service have

been chronicled in numerous published decisions. Additional

information about the firm can be found at Kirby McInerney LLP’s

website: http://www.kmllp.com.

This press release may be considered Attorney Advertising in

some jurisdictions under the applicable law and ethical rules.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180706005421/en/

Kirby McInerney LLPThomas W. Elrod, Esq.,

212-371-6600telrod@kmllp.comhttps://www.kmllp.com

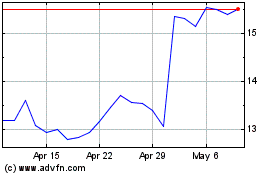

A10 Networks (NYSE:ATEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

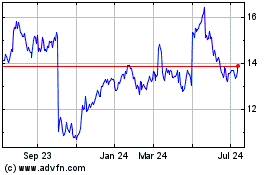

A10 Networks (NYSE:ATEN)

Historical Stock Chart

From Apr 2023 to Apr 2024