Honeywell Rides Sales Momentum -- WSJ

July 21 2018 - 3:02AM

Dow Jones News

By Allison Prang

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (July 21, 2018).

Honeywell International Inc. raised its financial guidance for

the year as sales rose in its second quarter, showing the

industrial conglomerate continues to benefit from strong demand

from customers in aviation, defense and other segments.

Executives also played down any impact from tariffs and trade

concerns in the company's earnings call Friday morning, noting

Honeywell could have a leg up against competitors given its sources

outside of China.

Net sales at the New Jersey-based Honeywell rose 8.3% to $10.92

billion in the second quarter from the year-ago period. Honeywell

reported sales increases in all of its segments -- aerospace, home

and building technologies, performance materials and technologies

and safety and productivity solutions. Analysts polled by Thomson

Reuters were expecting net sales of $10.8 billion.

The company now expects annual organic sales growth of between

5% and 6%, up from its previous expectations of between 3% and 5%.

The latest period also marked Honeywell's sixth consecutive quarter

with year-over-year organic sales growth.

On an adjusted basis, Honeywell now expects to earn between

$8.05 and $8.15 a share for the year, up from its prior forecast of

between $7.85 and $8.05 a share. Free cash flow is expected to be

between $5.6 billion and $6.2 billion for the year, up from the

company's old guidance of between $5.3 billion and $5.9

billion.

"This is just a continuation of a very high quality story," said

Deane Dray, a managing director at RBC Capital Markets.

Mr. Dray said there is a lot of excitement around the company's

warehouse automation business, Honeywell Intelligrated. That

business -- which falls in the company's safety and productivity

solutions segment, where revenue rose 13% -- is working on a

warehouse for Amazon in Canada.

"You can't just casually mention Amazon," Mr. Dray said. "They

must have a really good relationship."

Shares of Honeywell rose nearly 4% in late-afternoon

trading.

Honeywell is also working to divest itself of some of its

businesses. The company expects to complete the spinoff of both its

home and transportation businesses by the end of the year.

Honeywell reported a second-quarter profit of $1.27 billion, or

$1.68 a share, down from the $1.39 billion, or $1.80 a share, in

the year-earlier period. Tax expenses rose 90% to $719 million,

which included some separation costs.

On an adjusted basis, which omits the $346 million in separation

costs, Honeywell reported earnings of $2.12 a share, up from $1.80

a share a year ago. Analysts polled by FactSet expected $2.01 a

share.

Even as Honeywell works to rid itself of some operations, Chief

Executive Darius Adamczyk, who has been CEO since 2017, in the past

has made known his interest in doing acquisitions. On the company's

call Friday, Chief Financial Officer Tom Szlosek said deals are how

the company would want to use its capital, but Honeywell will

continue doing share buybacks "in the absence of immediate

opportunities." Honeywell has repurchased about $1.7 billion of its

shares in the first half of this year.

Honeywell also on Friday addressed general tariff concerns, an

issue investors have had to parse through in recent weeks.

Executives were somewhat optimistic on Friday's call, with Greg

Lewis, the company's incoming CFO, saying Honeywell could have a

leg up because of where it sources its products.

"This is literally a weekly activity for us and probably the

single most important thing that we talk about in making sure that

we're proactive," Mr. Adamczyk said in response to an analyst's

question about pricing as it relates to tariff inflation.

Write to Allison Prang at allison.prang@wsj.com

(END) Dow Jones Newswires

July 21, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

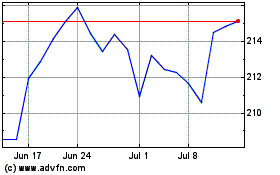

Honeywell (NASDAQ:HON)

Historical Stock Chart

From Mar 2024 to Apr 2024

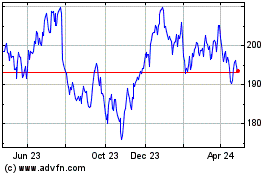

Honeywell (NASDAQ:HON)

Historical Stock Chart

From Apr 2023 to Apr 2024