- Fourth quarter 2017 reported net

sales of $1.1 billion increased 5% and 3% on an as reported and

constant currency basis, respectively, compared to fourth quarter

2016.

- Fourth quarter 2017 reported EPS of

($0.87) per diluted share compared to $1.16 per diluted share for

the comparable prior year quarter, which includes a provisional

one-time non-cash charge of $153 million, or ($2.01) per

adjusted1 diluted share, as a result of the Tax Cuts

and Jobs Act (the “Tax Act”) that was signed into law on December

22, 2017.

- Adjusted2 earnings per

adjusted1 diluted share of $1.29 increased 29%

compared to $1.00 per diluted share for the comparable prior year

quarter.

- Reiterates FY 2018 volume point

guidance range of 2% to 6% growth as well as reported and

adjusted2 diluted EPS guidance of $3.82 to $4.22 and

$4.60 to $5.00.

- Announces new executive organization

structure.

Herbalife Ltd. (NYSE: HLF) reports results for the fourth

quarter and full year ended December 31, 2017.

“After a year of transition, we returned to net sales growth in

the fourth quarter as expected, and we anticipate stronger net

sales growth for the full year in 2018,” said Rich Goudis, CEO of

Herbalife. “This growth is due to the determination and hard work

of our talented independent distributors and employees around the

globe who are continuously looking for ways to fulfill our purpose

to make the world healthier and happier.”

The Company reported fourth quarter 2017 volume points of 1.3

billion, which represents a decline of 1.8%, compared to the prior

year period, in line with the pre-announcement issued on January 8,

2018. Reported fourth quarter 2017 net sales of $1.1

billion increased 4.6%, while constant currency net sales

increased 3.4%, both compared to the same period in 2016.

On a reported basis, fourth quarter 2017 net loss was $63.4

million, or ($0.87) per diluted share, which includes a provisional

charge of $153.3 million, or ($2.01) per adjusted1 diluted share,

related to the Tax Act, compared to fourth quarter 2016 net income

of $99.4 million, or $1.16 per diluted share. The provisional

charge related to the Tax Act is subject to continued evaluation

and adjustment in future periods as additional information becomes

available and further analysis is completed.

Adjusted2 earnings for the fourth quarter 2017 were $1.29 per

adjusted1 diluted share compared to $1.00 per diluted share for the

fourth quarter of 2016.

Full year 2017 worldwide volume points of 5.4 billion declined

3.6% compared to full year 2016. Reported full year 2017 net sales

of $4.4 billion decreased 1.4%, while constant currency

net sales decreased 1.1%, both compared to full year 2016.

On a reported basis, full year 2017 net income was $213.9

million, or $2.58 per diluted share, compared to net

income of $260.0 million, or $3.02 per diluted

share for 2016.

Adjusted2 earnings for 2017 were $4.86 per

diluted share compared to $4.85 per diluted share for

2016. Due to the negative impact of currency, full year 2017

reported diluted EPS and adjusted2 diluted EPS were each

negatively impacted by $0.23.

Since the approval by the Company’s Board of Directors in

February 2017 of the share repurchase program, a total of

approximately 11.7 million shares were repurchased, including

approximately 400,000 shares repurchased from November 2, 2017

through February 21, 2018.

For the full year 2018, the Company is reiterating its volume

point guidance range of 2% to 6% growth as well as its 2018

reported and adjusted2 diluted EPS guidance of $3.82 to $4.22 and

$4.60 to $5.00.

Furthermore, Herbalife announces, consistent with the Company’s

succession strategy, a new executive organization structure

effective May 1, 2018.

The Company’s president, Des Walsh, will transition to the new

role of executive vice-chairman where his 14 years of experience at

the Company will primarily be used in growing the business and

developing and maintaining strong relationships with the Company’s

distributor leaders around the world.

Concurrently with Mr. Walsh’s transition to his new role, two

Company veterans will each be promoted to serve as co-president of

the Company, each with separate but complementary responsibilities

for leading the Company forward.

John DeSimone, currently chief financial officer, will assume

the role of co-president and chief strategic officer where he will

manage the Company’s regional leadership, who have responsibility

for growing the Company’s nutrition business and driving

performance in more than 90 countries around the globe. These will

be new duties for Mr. DeSimone who will continue to manage the

Company’s financial planning and investor relations operations.

Chief health and nutrition officer, Dr. John Agwunobi, will

continue in his role leading the Company’s nutrition and fitness

training and medical and consumer affairs. As co-president and

chief health and nutrition officer, Dr. Agwunobi will expand his

responsibilities to concentrate on enhancing the distributor and

customer experience. This new position will work intimately with

our distributors and customers, ensuring that the Company is

continuously innovating in the areas of corporate sales,

technology, marketing and product development.

As part of this new organization structure, current senior vice

president and principal accounting officer, Bosco Chiu, having

served close to 25 years at the Company, will be promoted to

executive vice president and chief financial officer. In addition,

current acting general counsel Richard Werber will assume the new

role of chief legal officer while current senior vice president,

deputy general counsel and chief compliance officer Henry Wang will

be promoted to executive vice president and general counsel.

Fourth Quarter and Fiscal 2017 Key

Metrics3

Regional Volume Point Metrics

Volume Points (Mil) Volume Points (Mil) Region

4Q '17 Yr/Yr % Chg FY '17 Yr/Yr % Chg North

America 250.8 -7.3% 1,099.0 -12.0% Asia Pacific 273.8

0.2% 1,089.2 1.2% EMEA 271.8 4.5% 1,088.5 3.7% Mexico 207.7 -8.4%

875.4 -4.8% South & Central America 153.0 -6.6% 593.9 -10.4%

China 149.7 9.6% 633.4 1.4% Worldwide

Total 1,306.8 -1.8% 5,379.4 -3.6%

Regional Net Sales and Foreign Exchange

(“FX”) Impact

Reported Net Sales Growth/Decline

Growth/Decline Region 4Q '17 (mil) including FX

excluding FX North America $ 192.2 -4.9% -5.0% Asia Pacific

$ 229.7 1.7% -0.2% EMEA $ 220.3 12.0% 5.4% Mexico $ 108.0 3.1%

-1.3% South & Central America $ 125.2 3.5% 17.0% China $

217.9 11.9% 8.4% Worldwide Total $ 1,093.3

4.6% 3.4% Reported Net Sales

Growth/Decline Growth/Decline Region FY '17 (mil)

including FX excluding FX North America $ 840.2

-12.1% -12.1% Asia Pacific $ 915.9 0.3% -0.9% EMEA $ 868.7 6.5%

4.2% Mexico $ 442.7 -0.9% 0.5% South & Central America $ 474.3

-2.9% 0.4% China $ 885.9 2.0% 4.0% Worldwide

Total $ 4,427.7 -1.4% -1.1%

Outlook

Based on current business trends the Company’s first quarter

2018 and full year 2018 guidance are as follows:

Three Months Ending Twelve Months Ending March 31,

2018 December 31, 2018

Low

High

Low

High

Volume Point Growth vs 2017 (7.0%) (3.0%) 2.0% 6.0% Net Sales

Growth vs 2017 (1.0%) 3.0% 5.5% 9.5% Diluted EPS (a) $0.70 $0.90

$3.82 $4.22 Adjusted Diluted EPS (a) (b) $0.90 $1.10 $4.60 $5.00

Cap Ex ($ millions) $30.0 $40.0 $115.0 $155.0 Effective Tax Rate

(a) 30.0% 35.0% 30.0% 35.0% Adjusted Effective Tax Rate (a) (b)

27.0% 32.0% 27.0% 32.0% (a) Excludes any future potential

ongoing tax effects from the exercise of equity awards that could

impact the Company's tax rate due to the updated stock compensation

accounting standard, any future contingent value rights

revaluation, any impact of potential Venezuela currency

devaluations, benefits from future potential China grants, as well

as any impact of the China Growth and Impact Investment Fund.

(b) Adjusted diluted EPS and adjusted

effective tax rate, for the purposes of guidance, excludes the

impact of non-cash interest costs associated with the company’s

convertible notes, expenses related to regulatory inquiries, and

contingent value rights revaluation, as applicable and detailed in

Schedule A. See Schedule A – “Reconciliation of Non-GAAP Financial

Measures” for a detailed reconciliation of adjusted diluted EPS to

diluted EPS calculated in accordance with GAAP and a discussion of

why the company believes these non-GAAP measures are useful.

With respect to guidance, the Company has included a $200

million impact to its share base from repurchases under its share

repurchase program in 2018.

Any incremental repurchases beyond $200 million that may be made

in 2018 cannot be accurately predicted and are therefore excluded

from the guidance table above.

Guidance is based on the average daily exchange rates during the

first three weeks of January.

Adjusted2 diluted EPS guidance for the first quarter 2018

includes a projected currency benefit of approximately $0.10 per

diluted share versus the first quarter of 2017.

Full year 2018 adjusted2 diluted EPS guidance includes a

projected currency benefit of approximately $0.13 per diluted

share, compared to 2017, which is $0.03 favorable compared to the

$0.10 tailwind included in the initial full year 2018 guidance the

Company provided on November 2, 2017.

_______________

1 See Schedule A - “Reconciliation of Non-GAAP Financial Measures”

for a reconciliation of adjusted diluted share count to reported

diluted share count and a discussion of why the share count has

been adjusted for purposes of calculating adjusted diluted EPS for

the fourth quarter of 2017. 2 Adjusted diluted EPS is a non-GAAP

measure and, for the purpose of guidance, excludes the impact of:

non-cash interest costs associated with the Company’s convertible

notes, expenses related to regulatory inquiries, China grant

income, and contingent value rights revaluation. Adjusted diluted

EPS, for the purpose of reported results, also excludes expenses

relating to challenges to the Company’s business model, expenses

relating to FTC settlement implementation, arbitration award

related to the re-audit, and the impact of the Tax Act as

applicable and detailed in Schedule A. See Schedule A –

“Reconciliation of Non-GAAP Financial Measures” for a detailed

reconciliation of adjusted net income to net income calculated in

accordance with GAAP and a reconciliation of adjusted diluted EPS

to diluted EPS calculated in accordance with GAAP and a discussion

of why we believe these non-GAAP measures are useful.

3 Supplemental tables that include Average

Active Sales Leader and additional business metrics can be found at

http://www.ir.herbalife.com.

Fourth Quarter 2017 Earnings Conference Call

Herbalife senior management will host an investor conference

call to discuss its recent financial results and provide an update

on current business trends on Thursday, February 22, 2018, at 2:30

p.m. PT (5:30 p.m. ET).

The dial-in number for this conference call for domestic callers

is (877) 317-1296, and (262) 320-2006 for international callers

(conference ID 34074913). Live audio of the conference call will be

simultaneously webcast in the investor relations section of the

Company's website at http://ir.herbalife.com.

An audio replay will be available following the completion of

the conference call in MP3 format or by dialing (855) 859-2056 for

domestic callers or (404) 537-3406 for international callers

(conference ID 34074913). The webcast of the teleconference will be

archived and available on Herbalife's website.

About Herbalife Ltd.

Herbalife is a global nutrition company that has been changing

people's lives with great products since 1980. Our

weight-management, targeted nutrition, energy and sports and

fitness and outer nutrition care products are available

exclusively to and through dedicated Herbalife Independent

Members in more than 90 countries. We are committed to fighting the

worldwide problems of poor nutrition and obesity by offering

high-quality products, one-on-one coaching with an Herbalife Member

and a community that inspires customers to live a healthy, active

life.

We support the Herbalife Family Foundation (HFF) and

its Casa Herbalife programs to help bring good nutrition

to children in need. We also sponsor more than 190 world-class

athletes, teams and events around the globe,

including Cristiano Ronaldo, the LA Galaxy and

champions in many other sports.

The Company has over 8,000 employees worldwide, and its shares

are traded on the New York Stock Exchange (NYSE: HLF)

with net sales of approximately $4.4 billion in 2017. To

learn more, visit Herbalife.com or IAmHerbalife.com.

The Herbalife Investor Relations website at

http://ir.herbalife.com contains a significant amount of financial

and other information about the Company. The Company encourages

investors to visit its website from time to time, as information is

updated and new information is posted.

FORWARD-LOOKING STATEMENTS

This release contains “forward-looking statements” within the

meaning of the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. Although we believe that the

expectations reflected in any of our forward-looking statements are

reasonable, actual results could differ materially from those

projected or assumed in any of our forward-looking statements. Our

future financial condition and results of operations, as well as

any forward-looking statements, are subject to change and to

inherent risks and uncertainties, such as those disclosed or

incorporated by reference in our filings with the Securities and

Exchange Commission. Important factors that could cause our actual

results, performance and achievements, or industry results to

differ materially from estimates or projections contained in our

forward-looking statements include, among others, the

following:

- our relationship with, and our ability

to influence the actions of, our Members;

- improper action by our employees or

Members in violation of applicable law;

- adverse publicity associated with our

products or network marketing organization, including our ability

to comfort the marketplace and regulators regarding our compliance

with applicable laws;

- changing consumer preferences and

demands;

- the competitive nature of our

business;

- regulatory matters governing our

products, including potential governmental or regulatory actions

concerning the safety or efficacy of our products and network

marketing program, including the direct selling markets in which we

operate;

- legal challenges to our network

marketing program;

- the consent order entered into with the

FTC, the effects thereof and any failure to comply therewith;

- risks associated with operating

internationally and the effect of economic factors, including

foreign exchange, inflation, disruptions or conflicts with our

third party importers, pricing and currency devaluation risks,

especially in countries such as Venezuela;

- uncertainties relating to

interpretation and enforcement of legislation in China governing

direct selling and anti-pyramiding;

- our inability to obtain the necessary

licenses to expand our direct selling business in China;

- adverse changes in the Chinese

economy;

- our dependence on increased penetration

of existing markets;

- any material disruption to our business

caused by natural disasters, other catastrophic events, acts of war

or terrorism, or cyber-security incidents;

- contractual limitations on our ability

to expand our business;

- our reliance on our information

technology infrastructure and outside manufacturers;

- the sufficiency of our trademarks and

other intellectual property rights;

- product concentration;

- our reliance upon, or the loss or

departure of any member of, our senior management team which could

negatively impact our Member relations and operating results;

- U.S. and foreign laws and regulations

applicable to our international operations;

- uncertainties relating to the United

Kingdom’s vote to exit from the European Union;

- restrictions imposed by covenants in

our credit facility;

- risks related to the convertible

notes;

- uncertainties relating to the

application of transfer pricing, duties, value added taxes, and

other tax regulations, and changes thereto;

- changes in tax laws, treaties or

regulations, or their interpretation;

- taxation relating to our Members;

- product liability claims;

- our incorporation under the laws of the

Cayman Islands;

- whether we will purchase any of our

shares in the open markets or otherwise; and

- share price volatility related to,

among other things, speculative trading and certain traders

shorting our common shares.

We do not undertake any obligation to update or release any

revisions to any forward-looking statement or to report any events

or circumstances after the date hereof or to reflect the occurrence

of unanticipated events, except as required by law.

RESULTS OF OPERATIONS:

Herbalife Ltd. and Subsidiaries Condensed Consolidated

Statements of Income (In millions, except per share amounts)

Three Months Ended Twelve Months Ended

12/31/2017

12/31/2016

12/31/2017

12/31/2016

(Unaudited)

North America $ 192.2 $ 202.2 $ 840.2 $ 955.7 Mexico 108.0

104.8 442.7 446.6 South and Central America 125.2 120.8 474.3 488.7

EMEA 220.3 196.6 868.7 815.6 Asia Pacific 229.7 225.9 915.9 913.0

China 217.9 194.7 885.9

868.8 Worldwide Net Sales 1,093.3 1,045.0 4,427.7

4,488.4 Cost of Sales 209.8 196.1

848.6 854.6 Gross Profit 883.5 848.9

3,579.1 3,633.8 Royalty Overrides 310.1 303.7 1,254.2 1,272.6

Selling, General and Administrative Expenses (1) 431.6 421.7

1,758.6 1,966.9

Other Operating Income (2)

(7.3 ) (34.7 ) (50.8 ) (63.8 )

Operating Income 149.1 158.2 617.1 458.1 Interest Expense, net 39.8

23.3 146.3 93.4

Other (Income) Expense, net (3)

(0.4 ) - (0.4 ) - Income

Before Income Taxes 109.7 134.9 471.2 364.7 Income Taxes (4)

173.1 35.5 257.3 104.7

Net (Loss) Income $ (63.4 ) $ 99.4 $ 213.9 $

260.0 Weighted Average Shares Outstanding: Basic 72.9

83.2 79.2 83.0 Diluted 72.9 86.0 82.9 86.1 (Loss) Earnings

Per Share: Basic $ (0.87 ) $ 1.19 $ 2.70 $ 3.13

Diluted $ (0.87 ) $ 1.16 $ 2.58 $ 3.02

(1) Selling, General and Administrative

Expenses includes $203 million related to regulatory settlements

for the twelve months ended December 31, 2016.

(2) Other Operating Income for FY 2017

relates to certain China grant income and for FY16 relates to

certain China grant income and KPMG arbitration award

(3) Other (Income) Expense relates to the

revaluation of the Contingent Value Rights

(4) Includes the impact of excess tax

benefit recognized under ASU 2016-09 of $4.7 million and $31.1

million for the three months and twelve months ended December 31,

2017, respectively.

Herbalife Ltd. and Subsidiaries Condensed Consolidated

Balance Sheets (In millions) Dec 31, Dec 31,

2017

2016

ASSETS Current Assets: Cash and cash equivalents $ 1,278.8 $

844.0 Receivables, net 93.3 70.3 Inventories 341.2 371.3 Prepaid

expenses and other current assets 147.0 176.9

Total Current Assets 1,860.3 1,462.5 Property, plant

and equipment, net 377.5 378.0 Marketing related intangibles and

other intangible assets, net 310.1 310.1 Goodwill 96.9 89.9 Other

assets 250.3 324.9 Total Assets $

2,895.1 $ 2,565.4 LIABILITIES AND

SHAREHOLDERS' (DEFICIT) EQUITY Current Liabilities: Accounts

payable $ 67.8 $ 66.0 Royalty overrides 277.7 261.2 Current portion

of long-term debt 102.4 9.5 Other current liabilities 458.9

454.8 Total Current Liabilities 906.8 791.5

Non-current liabilities Long-term debt, net of current

portion 2,165.7 1,438.4 Other non-current liabilities 157.3

139.2 Total Liabilities 3,229.8 2,369.1

Contingencies Shareholders' equity: Common shares 0.1 0.1

Paid-in capital in excess of par value 407.3 467.6 Accumulated

other comprehensive loss (165.4 ) (205.1 ) Accumulated deficit

(248.1 ) (66.3 ) Treasury stock (328.6 ) -

Total Shareholders' (Deficit) Equity (334.7 ) 196.3

Total Liabilities and Shareholders' (Deficit)

Equity $ 2,895.1 $ 2,565.4 Herbalife

Ltd. and Subsidiaries Condensed Consolidated Statements of Cash

Flows (In millions) Twelve Months Ended

12/31/2017

12/31/2016

CASH FLOWS FROM OPERATING ACTIVITIES Net income $ 213.9 $ 260.0

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization 99.8 98.3 Share-based compensation

expenses 42.1 40.2 Non-cash interest expense 60.2 55.7 Deferred

income taxes 97.8 (36.4 ) Inventory write-downs 20.7 15.8 Foreign

exchange transaction loss 2.4 3.7 Other 1.9 (11.7 ) Changes in

operating assets and liabilities: Receivables (22.2 ) - Inventories

37.9 (71.6 ) Prepaid expenses and other current assets 38.3 0.8

Accounts payable (5.0 ) (1.3 ) Royalty overrides 6.0 20.9 Other

current liabilities (17.1 ) 12.4 Other 14.1

(19.5 ) NET CASH PROVIDED BY OPERATING ACTIVITIES 590.8

367.3 CASH FLOWS FROM INVESTING ACTIVITIES

Purchases of property, plant and equipment (95.5 ) (143.4 ) Other

(2.3 ) 2.1 NET CASH USED IN INVESTING

ACTIVITIES (97.8 ) (141.3 ) CASH FLOWS FROM FINANCING

ACTIVITIES Borrowings from senior secured credit facility, net of

discount 1,274.0 200.0 Principal payments on senior secured credit

facility and other debt (494.5 ) (438.8 ) Debt issuance costs (22.6

) - Share repurchases (844.2 ) (13.2 ) Other 2.1

(0.3 ) NET CASH USED IN FINANCING ACTIVITIES (85.2 )

(252.3 ) EFFECT OF EXCHANGE RATE CHANGES ON CASH 27.0

(19.5 ) NET CHANGE IN CASH AND CASH EQUIVALENTS 434.8

(45.8 ) CASH AND CASH EQUIVALENTS, BEGINNING OF PERIOD 844.0

889.8 CASH AND CASH EQUIVALENTS, END OF PERIOD

$ 1,278.8 $ 844.0 CASH PAID DURING THE YEAR

Interest paid $ 100.7 $ 45.4 Income taxes paid $

158.8 $ 162.9

SUPPLEMENTAL INFORMATION

SCHEDULE A: RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

(Unaudited and unreviewed), (All tables provide Dollars in

millions, except per Share Data)

In addition to its reported results and guidance calculated in

accordance with GAAP, the Company has included in this release

adjusted net income and adjusted diluted EPS, performance measures

that the Securities and Exchange Commission defines as “non-GAAP

financial measures.” Management believes that such non-GAAP

financial measures, when read in conjunction with the Company’s

reported or forecasted results, in each case calculated in

accordance with GAAP, can provide useful supplemental information

for investors because they facilitate a period to period

comparative assessment of the Company’s operating performance

relative to its performance based on reported or forecasted results

under GAAP, while isolating the effects of some items that vary

from period to period without any correlation to core operating

performance and eliminate certain charges that management believes

do not reflect the Company’s operations and underlying operational

performance. The Company’s definition of adjusted net income and

adjusted diluted earnings per share may not be comparable to

similarly titled measures used by other companies because other

companies may not calculate them in the same manner as the Company

does and should not be viewed in isolation from nor as alternatives

to net income or diluted EPS calculated in accordance with

GAAP.

The following is a reconciliation of net

income, presented and reported in accordance with U.S. generally

accepted accounting principles, to net income adjusted for certain

items:

Three Months Ended Twelve Months Ended

12/31/2017 12/31/2016 12/31/2017

12/31/2016 (in millions) Net

(loss) income, as reported $ (63.4 ) $ 99.4 $ 213.9 $ 260.0

Expenses incurred responding to attacks on the company's business

model (1) (2) 0.8 1.4 5.0 12.1 Expenses related to regulatory

inquiries (1) (2) 3.7 2.4 13.7 16.3 Expenses incurred for the

recovery of re-audit expenses (1) (2) - 0.1 - 3.6 Non-cash interest

expense and amortization of non-cash issuance costs (1) (2) (3)

12.2 11.5 47.7 45.1 China grant income (1) (2) (7.3 ) (5.1 ) (50.8

) (34.2 ) FTC Consent Order implementation (1) (2) (4) 1.0 5.4 17.7

10.7 Regulatory settlements (1) (2) - - - 203.0

Arbitration award related to the re-audit

(1) (2)

- (29.7 ) - (29.7 )

Contingent value rights revaluation (1)

(2)

(0.4 ) - (0.4 ) -

Income tax adjustments for above items (1)

(2)

(1.2 ) 0.5 2.6 (69.4 ) Provisional Tax Act impact (5) 153.3

- 153.3 -

Net income, as adjusted (6)

$ 98.6 $ 85.9 $ 402.6 $ 417.4

The following table is a reconciliation of

diluted shares outstanding, presented and reported in accordance

with GAAP, to diluted shares outstanding, adjusted for the impact

of outstanding equity awards. Outstanding equity awards were

excluded from the number of reported diluted outstanding shares for

the fourth quarter of 2017 because the Company reported a net loss

for the fourth quarter of 2017 and their inclusion would be

anti-dilutive. However, because the company’s adjusted net income

for the fourth quarter of 2017, as calculated in the table above,

was positive, inclusion of outstanding equity awards would not be

anti-dilutive. Therefore, the company has adjusted the diluted

shares outstanding for the fourth quarter of 2017 to include equity

awards as set forth below so the calculation of adjusted diluted

EPS is not overstated for the fourth quarter of 2017 and such

number is comparable to adjusted diluted EPS for the prior year

period.

Three Months Ended 12/31/2017 12/31/2016 (in

millions) Diluted shares outstanding, as reported 72.9 86.0

Potential dilutive effect of outstanding equity grants 3.4 -

Diluted shares outstanding, as adjusted 76.3 86.0

The following is a reconciliation of

diluted earnings per share, presented and reported in accordance

with U.S. generally accepted accounting principles, to diluted

earnings per share adjusted for certain items.

Three Months Ended Twelve Months Ended

12/31/2017 12/31/2016 12/31/2017

12/31/2016 (per share) Diluted

(loss) earnings per share, as reported $ (0.87 ) $ 1.16 $ 2.58 $

3.02 Impact of adjusted shares outstanding 0.04

- - - Diluted (loss)

earnings per share using adjusted diluted shares outstanding $

(0.83 ) $ 1.16 $ 2.58 $ 3.02 Expenses incurred responding to

attacks on the company's business model (1) (2) 0.01 0.02 0.06 0.14

Expenses related to regulatory inquiries (1) (2) 0.05 0.03 0.17

0.19 Expenses incurred for the recovery of re-audit expenses (1)

(2) - - - 0.04 Non-cash interest expense and amortization of

non-cash issuance costs (1) (2) (3) 0.16 0.13 0.58 0.52 China grant

income (1) (2) (0.10 ) (0.06 ) (0.61 ) (0.40 ) FTC Consent Order

implementation (1) (2) (4) 0.01 0.06 0.21 0.12 Regulatory

settlements (1) (2) - - - 2.36

Arbitration award related to the re-audit

(1) (2)

- (0.35 ) - (0.34 )

Contingent value rights revaluation (1)

(2)

(0.01 ) - - -

Income tax adjustments for above items (1)

(2)

(0.02 ) 0.01 0.03 (0.80 ) Provisional Tax Act Impact (5)

2.01 - 1.85 -

Diluted earnings per share, as adjusted (6) $ 1.29 $ 1.00

$ 4.86 $ 4.85

(1) Based on interim income tax reporting

rules, these expenses are not considered discrete items. As a

result, the Company's full year effective tax rate is impacted by

these items. When applying the full year effective tax rate to

year-to-date income, the Company's year-to-date tax provision

recorded with respect to these non-GAAP adjustments is different

from the forecasted full-year tax provision impact of these items.

As a consequence, adjustments to the year-to-date and quarterly tax

impacts will be recorded as the adjusted full year effective tax

rate is applied to income in subsequent periods. Additionally,

adjustments to items unrelated to these non-GAAP adjustments may

have an effect on the income tax impact of these non-GAAP

adjustments in subsequent periods.

(2) Excludes tax (benefit)/expense as follows: Three

Months Ended Twelve Months Ended 12/31/2017

12/31/2016 12/31/2017

12/31/2016 (in millions) Expenses incurred

responding to attacks on the company's business model (0.3 ) $ (0.1

) $ (1.2 ) $ (3.0 ) Expenses related to regulatory inquiries (1.3 )

(0.2 ) (4.7 ) (5.5 ) Expenses incurred for the recovery of re-audit

expenses - - (1.0 ) Non-cash interest expense and amortization of

non-cash issuance costs (1.1 ) (1.8 ) - - China grant income 2.0

1.4 14.6 9.8 FTC Consent Order Implementation (0.4 ) (1.4 ) (6.0 )

(3.6 ) Regulatory settlements - (1.3 ) - (70.0 ) Arbitration award

related to the re-audit - 3.9 - 3.9 Contingent Value Rights

revaluation - - -

Total income tax adjustments (6) $ (1.2 ) $ 0.5 $ 2.6

$ (69.4 ) Three Months Ended Twelve Months Ended

12/31/2017 12/31/2016 12/31/2017

12/31/2016 (per share) Expenses

incurred responding to attacks on the company's business model $ -

$ - $ (0.01 ) $ (0.03 ) Expenses related to regulatory inquiries

(0.02 ) - (0.06 ) (0.06 ) Expenses incurred for the recovery of

re-audit expenses - - - (0.01 ) Non-cash interest expense and

amortization of non-cash issuance costs (0.01 ) (0.02 ) - - China

grant income 0.03 0.02 0.18 0.11 FTC Consent Order Implementation

(0.01 ) (0.02 ) (0.07 ) (0.04 ) Regulatory settlements - (0.02 ) -

(0.81 ) Arbitration award related to the re-audit -

0.05 - 0.05 Total income

tax adjustments (6) $ (0.02 ) $ 0.01 $ 0.03 $ (0.80 )

(3) Relates to non-cash expense on our convertible

notes and prepaid forward share repurchase contract. (4) Includes

$3.0 million of product discounts related to preferred member

conversions for the twelve months ended December 31, 2017.

(5) Relates to the estimated income tax

effect of the Tax Cuts and Jobs Act on the Company’s Consolidated

Financial Statements as of December 31, 2017 as discussed in Note

12, Income Taxes, to the Consolidated Financial Statements included

in the annual report on form 10-K for the year ended December 31,

2017.

(6) Amounts may not total due to rounding.

The following is a reconciliation of

diluted earnings per share guidance, presented in accordance with

U.S. generally accepted accounting principles, to adjusted diluted

earnings per share guidance for certain items.

Three Months Ending Twelve Months Ending March 31,

2018 December 31, 2018 Diluted EPS Guidance (1) $0.70

- $0.90 $3.82 - $4.22 Non-cash interest expense and amortization of

non-cash issuance costs (2) 0.17 0.66 Expenses related to

regulatory inquiries (3) 0.04 0.16 Income tax adjustments for above

items (4) (0.01) (0.04) Adjusted diluted EPS guidance (5) $0.90 -

$1.10 $4.60 - $5.00

(1) Excludes any future potential ongoing

tax effects from the exercise of equity awards that could impact

the Company's tax rate due to the updated stock compensation

accounting standard, any future contingent value rights

revaluation, any impact of potential Venezuela currency

devaluations, benefits from future potential China grants, as well

as any impact of the China Growth and Impact Investment Fund.

(2) Relates to non-cash expense on our

convertible notes and prepaid forward share repurchase

contract.

(3) Excludes tax impact of $0.9 million

and $3.4 million for the three months ending March 31, 2018 and the

twelve months ending December 31, 2018, respectively.

(4) The individual tax impact of footnote 3. (5) Amounts may not

total due to rounding.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180222006383/en/

Herbalife Ltd.Media Contact:Jennifer ButlerVP, Media

Relations213.745.0420orInvestor Contact:Eric MonroeDirector,

Investor Relations213.745.0449

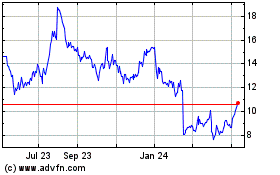

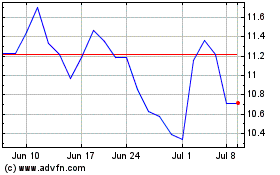

Herbalife (NYSE:HLF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Herbalife (NYSE:HLF)

Historical Stock Chart

From Apr 2023 to Apr 2024