Harris Williams Advises Numotion on its Sale to AEA Investors LP

November 13 2018 - 4:44PM

Business Wire

Harris Williams, a preeminent middle market investment bank

focused on the advisory needs of clients worldwide for more than 25

years, announces the sale of Numotion, a portfolio company of Audax

Private Equity and LLR Partners (LLR), to funds sponsored by AEA

Investors LP (AEA). Numotion is a premier provider of Complex

Rehabilitation Technology (CRT) and related mobility solutions. The

transaction, led by Geoff Smith, Cheairs Porter, Paul Hepper, Tyler

Bradshaw, Nathan Robertson and Bill Whitaker of Harris Williams’

Healthcare & Life Sciences (HCLS) Group, extends the firm’s

successful track record in the industry.

“We are delighted and proud to have represented Audax, LLR and

Numotion’s management team on this transaction. Numotion’s vision

and execution under the leadership of CEO Mike Swinford have not

only positioned the company as a market leader in the CRT sector,

but also positioned it as a full global mobility products and

services platform,” said Geoff Smith, a managing director at Harris

Williams.

“The combination of AEA’s long track record of success driving

growth in market leaders, industry expertise and belief in

Numotion’s mission make AEA an ideal partner to continue and

accelerate Numotion’s growth trajectory,” said Cheairs Porter, a

managing director at Harris Williams. “We are incredibly excited to

watch the development of this chapter of Numotion’s story.”

Numotion is a leading provider of CRT, improving the lives of

people with disabilities by enabling them to actively participate

in everyday life. CRT is medically-necessary,

individually-configured mobility products and services, including

manual and power wheelchairs, designed to meet the unique medical

and functional needs of individuals with significant disabilities

and medical conditions to provide them with greater independence.

Based in Brentwood, Tennessee, Numotion has more than 140 locations

across the U.S. and serves more than 250,000 people.

Since its founding in 1999, Audax Private Equity has been

focused on building leading middle market companies. Audax Private

Equity has invested $5 billion in 117 platform and 713 add-on

companies. Through its disciplined Buy & Build approach, Audax

Private Equity seeks to help platform companies execute add-on

acquisitions that fuel revenue growth, optimize operations and

significantly increase equity value. Audax Group is an alternative

asset management firm specializing in investments in middle market

companies. With offices in Boston, New York and San Francisco,

Audax Group has $13 billion in assets under management across its

Private Equity, Mezzanine and Senior Debt businesses.

LLR is a middle market private equity firm committed to creating

long-term value by growing its portfolio companies. LLR invests in

several industries, with a focus on technology, healthcare and

services businesses. Founded in 1999 and with more than $3.5

billion raised across five funds, LLR is a flexible provider of

capital for growth, recapitalizations and buyouts.

AEA was founded in 1968 by the Rockefeller, Mellon and Harriman

family interests and S.G. Warburg & Co. as a private investment

vehicle for a select group of industrial family offices with

substantial assets. AEA’s active individual investors include an

extraordinary network of more than 75 of the world’s leading

industrial families, business executives and former government

leaders. Today, AEA’s approximately 70 investment professionals

operate globally with offices in New York, Connecticut, London,

Munich and Shanghai. The firm manages funds that have approximately

$11 billion of invested and committed capital, which AEA invests

through leveraged buyouts of middle market and small business

companies and through mezzanine and senior debt investments.

Harris Williams (www.harriswilliams.com), a subsidiary of the

PNC Financial Services Group, Inc. (NYSE:PNC), is a preeminent

middle market investment bank focused on the advisory needs of

clients worldwide. The firm has deep industry knowledge, global

transaction expertise and an unwavering commitment to excellence.

Harris Williams provides sell-side and acquisition advisory,

restructuring advisory, board advisory, private placements and

capital markets advisory services.

Harris Williams’ HCLS Group has experience across a broad range

of sectors, including medical devices, products and distribution;

multi-site and retail healthcare providers; alternate site care;

healthcare IT; managed care and cost containment services;

outsourced clinical services; and outsourced pharma services. For

more information on the HCLS Group and other recent transactions,

visit the HCLS Group’s section of the Harris Williams website.

Investment banking services are provided by Harris Williams LLC,

a registered broker-dealer and member of FINRA and SIPC, and Harris

Williams & Co. Ltd, which is a private limited company

incorporated under English law with its registered office at 5th

Floor, 6 St. Andrew Street, London EC4A 3AE, UK, registered with

the Registrar of Companies for England and Wales (registration

number 07078852). Harris Williams & Co. Ltd is authorized and

regulated by the Financial Conduct Authority. Harris Williams is a

trade name under which Harris Williams LLC and Harris Williams

& Co. Ltd conduct business.

For media inquiries, please contact Katie Langemeier, associate

brand manager, at +1 (804) 648-0072.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181113006197/en/

Katie Langemeier, associate brand manager+1 (804) 648-0072

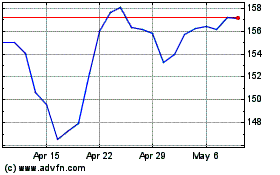

PNC Financial Services (NYSE:PNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

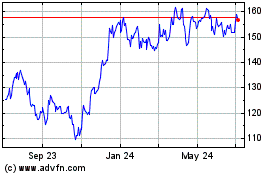

PNC Financial Services (NYSE:PNC)

Historical Stock Chart

From Apr 2023 to Apr 2024