Haemonetics Remains Neutral - Analyst Blog

May 31 2012 - 11:00AM

Zacks

We reiterate our Neutral

recommendation on Haemonetics (HAE) subsequent to

its fourth quarter fiscal 2012 results. The company’s revenues

during the fourth quarter surpassed the Zacks Consensus Estimate

though earnings per share lagged the forecast.

We are encouraged to note that

Plasma, which accounted for 44% of disposables revenues during the

fiscal year, is now on the path to recovery after a dismal patch.

The upsurge was largely due to the improvement in the plasma

business in Japan after declining in the first half. Besides, the

Japanese Red Cross purchased $1 million of plasma in March, one

month ahead of plan, in anticipation of a planned system

conversion. Additionally, collection volumes in the commercial

plasma business in the US were robust over the last two quarters.

The company also made commendable progress with respect to contract

extensions as 75% of this business is covered through the third

quarter of fiscal 2017 and 98% through the third quarter of fiscal

2015.

With the proposed acquisition of

the transfusion medicine business of Pall

Corporation (PLL) for $551 million, Haemonetics will be

able to enter the $1.2 billion whole blood collection market.

Manual whole blood collection accounts for the vast majority of the

nearly 60 million red blood cells collection procedures performed

annually worldwide. The asset transfer, adding 1,300 employees to

Haemonetics, will involve Pall's manufacturing facilities in

Covina, California; Tijuana, Mexico; Ascoli, Italy and a portion of

Pall's assets in Fajardo, Puerto Rico. The business generated

approximately $210 million in annual revenues spread across

Americas ($136 million), Europe ($52 million) and Asia ($22

million) and commanded 15% of global unit market share.

Haemonetics remains focused on

blood management solutions in order to provide better services to

its customers. The company’s web-based blood management portal,

IMPACT Online, has thereby witnessed greater acceptance among

customers. Revenues from Diagnostics (consisting principally of TEG

Thrombelastograph Hemostasis Analyzer) increased, driven by better

penetration of IMPACT accounts in North America and significant

growth in China. The company installed 230 TEG devices in the

second half of the fiscal year and increased the installed base by

18% in the full year. This trend is expected to continue in the

forthcoming quarters.

Despite the growing top line, the

company’s bottom line was affected by a challenging margin

scenario. Gross margin (adjusted) declined by 70 basis points (bps)

year over year to 50.8% during the quarter. Despite a 12.9% drop in

research and development expenses to $7.7 million, a 24.8% rise in

selling, general and administrative expenses to $60 million led to

a 350 bps decline in the adjusted operating margin to 14.5%.

Margins continued to remain under pressure due to the recall of

OrthoPAT devices and quality issues associated with the HS Core

disposable in Europe.

Our recommendation is backed by a

Zacks #3 Rank (“Hold”) in the short term.

HAEMONETICS CP (HAE): Free Stock Analysis Report

PALL CORP (PLL): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

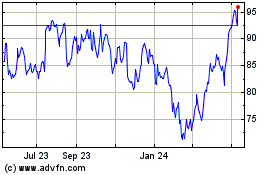

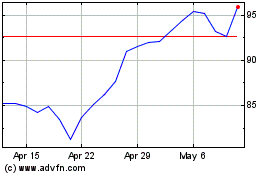

Haemonetics (NYSE:HAE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Haemonetics (NYSE:HAE)

Historical Stock Chart

From Apr 2023 to Apr 2024