HSBC CEO Says Overhaul Strategy 'Is Working'

April 20 2018 - 12:45PM

Dow Jones News

By Margot Patrick

HSBC Holdings PLC Chief Executive John Flint spent the past

seven years watching the bank undergo a radical overhaul under

former boss Stuart Gulliver. On Friday, he signaled much of the

heavy lifting is done and that his leadership will be a period of

evolution not revolution.

"The strategy we have is working," Mr. Flint told shareholders

at an annual meeting in London. "But we now need to keep evolving

it and to deliver at pace."

Mr. Flint started as CEO in February after holding an array of

top posts in 29 years at HSBC. He took over a bank in pared-down

shape after exiting from dozens of businesses in the past several

years and withdrawing from countries where it lacked scale or

profitability.

On the sidelines of the shareholder meeting, Mr. Flint said he

is still working on a strategy update to present to investors this

summer. Analysts expect the plans to include more exits from

certain retail markets and a possible merger or acquisitions for

HSBC's asset-management arm, among other moves.

Mr. Flint played down any potential announcements about leaving

countries, saying it is unfair to employees and could diminish

returns from any sale.

"We just have to figure out what our priorities are going to be

and what our targets are going to be," he said. "We will

communicate as much as we reasonably can but it won't have a

forward looking list of everything we're going to do in the next

three years."

Mr. Flint said the bank can't realistically set any aggressive

new targets until it meets current ones such as reaching a 10%

return on equity. In 2017, the return was 5.9%.

"We've got to get to 10 first. Do I think the organization's got

the potential for more than that? Look at our business in Asia,

look at our business in the Middle East. The organization's got

potential for more, but you've got to be credible in getting to the

current target," he said.

The restructuring overseen by Mr. Gulliver marked a reckoning

for a bank that had grown far from its 1860s roots as a Hong Kong

trade bank into one of the largest in the world. Weakened both

financially and reputationally by a disastrous, pre-financial

crisis foray into U.S. consumer finance, and a $1.9 billion

settlement over inadequate anti-money-laundering controls, HSBC

renewed its focus on Asia and fast-growing parts of China.

Earlier this month, Mr. Flint took analysts on a tour of some of

the bank's businesses in China, and has indicated the country will

remain a key plank of growth plans.

Write to Margot Patrick at margot.patrick@wsj.com

(END) Dow Jones Newswires

April 20, 2018 12:30 ET (16:30 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

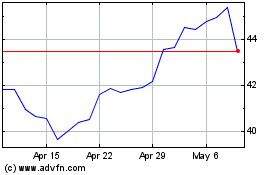

HSBC (NYSE:HSBC)

Historical Stock Chart

From Mar 2024 to Apr 2024

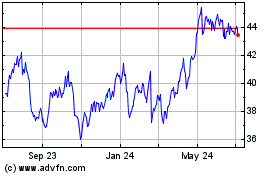

HSBC (NYSE:HSBC)

Historical Stock Chart

From Apr 2023 to Apr 2024