Grainger Downgraded to Neutral - Analyst Blog

June 05 2012 - 12:06PM

Zacks

We have downgraded our recommendation on W.W. Grainger

Inc. (GWW) from Outperform to Neutral, given the slowdown

in its sales in April and the entry of Amazon.com

Inc. (AMZN) in the maintenance, repair & operations

(MRO) space.

Grainger’s first quarter 2012 earnings increased 19% year over

year to $2.57 per share, while revenues advanced 16% to $2.193

billion. Both outperformed the respective Zacks Consensus

Estimates.

Grainger remains focused on expanding its product offerings and

growing the share of its private label products. The company’s

catalog, issued in February 2012, offers around 410,000 compared

with 350,000 products in the February 2011 issue.

The company has a long-term vision to expand the count to

500,000 products by 2015. It has historically seen approximately 2%

incremental growth per year on sales from products added through

the program.

Currently, 23% of Grainger’s sales are from private label, but

the company expects to increase that to 40% over time. Private

label has been a significant driver of sustainable margin expansion

over the past few years, especially in the globally sourced product

category.

Grainger also focuses on expansion programs to strengthen its

businesses in each of its operating regions, mainly in Asia and

Latin America. Approximately 25% of 2012 sales are expected to come

from outside the U.S compared with 10% in 2002.

The primary areas of focus for international growth are sales

and earnings growth in the existing markets, selective expansion

into new markets in a phased approach and ongoing development of

the global infrastructure.

E-commerce is one of Grainger’s most efficient and profitable

channels as it is reportedly growing twice as fast as other

channels. Grainger continues to invest in e-commerce and expects to

increase the number of customers utilizing this channel, boosting

overall sales.

The e-commerce business currently generates 27% of Grainger’s

revenues and there is scope to drive it up to 50% in the next five

years. This channel also carries higher margins as it requires

lower selling, general and administrative costs.

Grainger’s sound balance sheet, low debt level and cash flow

characteristics allow the company to further invest in growth

opportunities, increase dividends and reinvest capital through

share repurchases. The company has been rewarding shareholders with

an uninterrupted streak of increased dividends for 41 consecutive

years, a record that only 12 companies in the S&P500 can claim.

Going forward, the company will continue to redeploy cash and plans

to repurchase approximately 2% of outstanding shares each year.

On the flipside, we believe margins will be under pressure due

to Grainger’s accelerated growth investments: product line

expansion, sales force expansion, e-commerce, inventory services,

distribution centers and international expansion.

Furthermore, Grainger’s sales growth of 12% in April 2012 was

weaker than expected, as management had hinted in the first quarter

conference call that even though sales growth in April had a slow

start due to the religious holidays, but was expected to be roughly

in line with the 15% growth in March. Sales growth has dipped as

compared with the 17% growth witnessed in January, 18% in February

and 15% in March this year.

Amazon has recently launched www.AmazonSupply.com, a website

offering more than 500,000 parts/supplies to business, industrial,

scientific and commercial customers at competitive prices. Grainger

is presently a dominant player in industrial maintenance, repair

& operations distribution, with a product offering of 413,000.

With the entry of Amazon in this space, we expect pricing

pressure.

We have thus downgraded our recommendation from Outperform to

Neutral on Grainger. The quantitative Zacks #3 Rank (short term

Hold rating) for the company indicates no clear directional

pressure on the stock over the near term.

Illinois-based W.W. Grainger is a leading North American

distributor of material handling equipment including safety and

security supplies, lighting and electrical products, power and hand

tools, pumps and plumbing supplies, etc. The company’s services

comprise inventory management and energy efficiency solutions.

The company competes with Applied Industrial

Technologies Inc. (AIT) and WESCO International

Inc. (WCC).

APPLD INDL TECH (AIT): Free Stock Analysis Report

AMAZON.COM INC (AMZN): Free Stock Analysis Report

GRAINGER W W (GWW): Free Stock Analysis Report

WESCO INTL INC (WCC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Applied Industrial Techn... (NYSE:AIT)

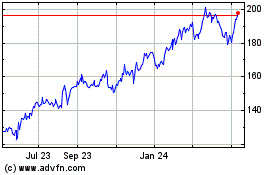

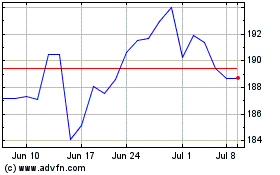

Historical Stock Chart

From Mar 2024 to Apr 2024

Applied Industrial Techn... (NYSE:AIT)

Historical Stock Chart

From Apr 2023 to Apr 2024