By Douglas MacMillan and Liza Lin

In February, a Google executive appeared at a tech conference in

Barcelona touting a new, low-cost smartphone outfitted with a

custom version of its popular mobile operating system.

Less than two months later, that phone's future is in doubt. The

U.S. has barred the device's manufacturer, Chinese firm ZTE Corp.,

from working with American companies, meaning the specially made

Android software that powers the phone is off limits.

The government intervention highlights an unforeseen challenge

for Google in a bid to get its mobile software in the hands of

wider swaths of users. Google, a unit of Alphabet Inc., is relying

on several Chinese companies to distribute its Android apps to

millions of less-affluent smartphone users, even as rising trade

tensions between China and the U.S. are making those partnerships

more risky.

Spokespeople for Google and ZTE declined to comment.

Partners like ZTE are increasingly important to Google as it

competes with Apple Inc. and Samsung Electronics Co. for users of

mobile services. Google's Android operating system runs on more

than 80% of smartphones world-wide, but the company doesn't charge

anything for the operating system. Instead, it makes money from

licensing fees and ads running on Android apps and sales from its

app store, while collecting valuable user data.

Google struggles to reach users of Apple phones, which run the

iOS operating system and come preloaded with apps, and faces more

competition from Samsung, the world's largest seller of Android

devices, which equips phones with its own versions of communication

and productivity apps.

Google also derives little value from Android phones in China,

despite representing 86% of smartphones shipped there last year,

according to researcher Canalys. Google's services have been banned

in the country since the search giant exited China over concerns of

censorship in 2010; phone makers there run apps made by Chinese

tech giants Baidu Inc. and Tencent Holdings Ltd.

But elsewhere, where Google's apps aren't banned, Android is

essential to the internet giant, especially on lower-cost phones.

In the U.S., about one-quarter of U.S. customers pay less than $100

for smartphones, according to Neil Shah, an analyst with research

firm Counterpoint.

Morgan Stanley estimates Alphabet's revenue from mobile-search

ads and a cut of sales from apps sold in the Google Play store was

about $33.8 billion last year, or about 30% of the company's

overall revenue.

ZTE was the first company to carry the "Android Go" operating

system on a phone built for the U.S. market. The $80 Tempo Go,

released on March 30, features new versions of popular mobile apps,

like Google Maps and Gmail, designed to load faster and take up

less space on cheaper phone models.

Phones bundled with Android Go are offered outside of the U.S.

by Chinese phone makers TCL Corp. and Transsion Holdings Ltd. as

well as Finland's Nokia Corp. and India's Lava International Ltd.

The operating system and suite of Google apps takes up 50% less

space than the regular version of Android.

Huawei Technologies Co., a Chinese hardware manufacturer labeled

as a national-security threat by the U.S. government, announced it

would start selling a phone with Android Go in the near future.

ZTE, the fourth-largest seller of smartphones in the U.S.,

looked like an inroad to more potential users of Google's mobile

services. Remarkably, the Shenzhen-based company almost doubled its

share of the U.S. market last year to 11.2%, according to Canalys,

by nurturing relationships with mobile carriers, opening five

research and development centers in the country and upping its

spending on Washington lobbying.

Because Tempo Go has only a fraction of the computing power of a

standard smartphone, Google's apps will generally work much better

on it than those made other companies. "It gives Google complete

control over the phone," Mr. Shah said.

In a statement on Friday, ZTE called the Commerce Department

order "unacceptable," saying it will "not only severely impact the

survival and development of ZTE, but will also cause damages to all

partners of ZTE, including a large number of U.S. companies."

It remains unclear whether the company will continue selling the

Tempo Go and other phones featuring Android apps. The U.S. is by

far its biggest market, with nearly half of its phones shipped

there last year, according to Canalys. It sells other phones

outside of China with its MiFavor interface that is powered by

Android and uses Google apps.

Analysts say while ZTE may be able to use some version of the

Android operating system due to exemptions for open-source

software, the company can't include any Google apps on its phones.

It would also prevent users from downloading Android software

updates, which could put users' privacy and safety at risk,

analysts said.

The clash between U.S. and Chinese trade officials could have a

grander effect on Google, which shut down its search engine there

over the country's censorship rules. Google could have a hard time

returning back to the country, said Mo Jia, Shanghai-based research

analyst at Canalys.

"Google has always wanted to come back to the Chinese market,"

he said. "If the trade war continues, both the Chinese technology

companies and the American technology companies are at risk."

Write to Douglas MacMillan at douglas.macmillan@wsj.com and Liza

Lin at Liza.Lin@wsj.com

(END) Dow Jones Newswires

April 22, 2018 08:14 ET (12:14 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

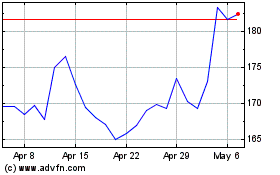

Apple (NASDAQ:AAPL)

Historical Stock Chart

From Mar 2024 to Apr 2024

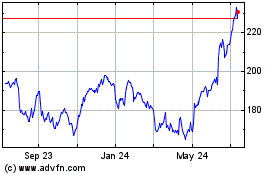

Apple (NASDAQ:AAPL)

Historical Stock Chart

From Apr 2023 to Apr 2024