Google to Ban Ads for Cryptocurrencies

March 14 2018 - 12:30AM

Dow Jones News

By Lara O'Reilly and Douglas MacMillan

Google is following Facebook's lead by banning ads for

cryptocurrencies and other "speculative financial products" across

its advertising platforms.

Alphabet Inc.'s Google said the new policy will become effective

in June across ads bought on its search and display-advertising

network, as well as its YouTube unit. The policy also will restrict

ads for nontraditional methods of wagering on the future movements

of stock prices and foreign-exchange, such as binary options and

financial spread-betting, Google said.

Facebook updated its ad policy to ban ads for similar financial

products on Jan. 30.

The rise in popularity and price of Bitcoin and other virtual

currencies has led to scammers using online ads to promote

fraudulent cryptocurrency schemes via online ads.

One new tool in the scammer's arsenal is so-called

crypto-jacking, or putting lines of code in websites or ads to

surreptitiously harness the computing power of the web surfers who

look at them. The power is used to mine cryptocurrency, a digital

form of money that has no government or central-bank printing it or

standing behind it.

Google said last year it removed more than 130 million ads that

were used by hackers to mine for cryptocurrency. That is a very

small percentage of the ads run on Google's ad network.

The company's director of sustainable ads, Scott Spencer,

declined to comment on how much potential ad revenue the company

would be turning away by enacting the new policy, saying the

decision was made to prevent consumer harm.

The company has long banned ads promoting counterfeit goods or

dangerous products, such as weapons or recreational drugs.

Financial regulators are taking a close look at the

multibillion-dollar U.S. market for raising funds in

cryptocurrencies, raising questions about how these assets may be

regulated in the future. The U.S. Securities and Exchange

Commission warned earlier this month that cryptocurrency exchanges

risk being deemed illegal because they don't disclose how they

determine what currencies can be bought and sold on their

sites.

In addition to its cryptocurrency ad-policy announcement, Google

said in a blog post published Wednesday that it took down more than

3.2 billion ads that violated its wider policies in 2017, such as

those that attempted to send people to sites loaded with malware or

phishing scams. The company said it removed 1.7 billion bad ads in

2016.

Some bad ads did get through its defenses -- which comprise a

combination of technology and thousands of human content reviewers

-- but Mr. Spencer said those that slipped through the net can be

measured in the hundreds, as opposed to the billions.

Overall, Google said it removed 320,000 publishers from its ad

network for violating its various publisher policies in 2017, while

about 90,000 websites and 700,000 mobile apps were blacklisted.

(END) Dow Jones Newswires

March 14, 2018 00:15 ET (04:15 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

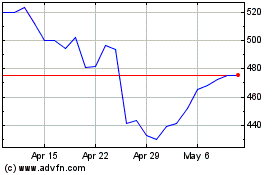

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Mar 2024 to Apr 2024

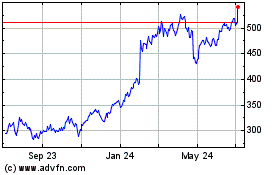

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Apr 2023 to Apr 2024