Globus Maritime Limited ("Globus," the “Company," “we,” or “our”)

(NASDAQ:GLBS), a dry bulk shipping company, today reported its

unaudited consolidated operating and financial results for the

quarter and year ended December 31, 2017.

- In 12M 2017, Total revenues

increased by about 60% compared to 12M 2016

- In Q4 2017, Total revenues

increased by almost 57% and loss decreased by about 48% compared to

Q4 2016

- In 12M 2017, Debt under

loan agreements was reduced by about 37% compared to 12M

2016

Financial Highlights

|

|

Three months ended |

|

|

Year ended |

|

|

December 31, |

|

|

December 31, |

| (Expressed

in thousands of U.S dollars except for daily rates and per share

data) |

2017 |

|

2016 |

|

|

|

2017 |

|

2016 |

|

| Total

revenues |

4,111 |

|

2,618 |

|

|

|

14,423 |

|

9,018 |

|

| Adjusted

(LBITDA)/EBITDA (1) |

902 |

|

(594 |

) |

|

|

1,701 |

|

(3,466 |

) |

| Total

comprehensive (loss)/income |

(1,277 |

) |

(2,450 |

) |

|

|

(6,475 |

) |

(9,825 |

) |

| Basic

(loss)/earnings per share(2) |

(0.04 |

) |

(0.93 |

) |

|

|

(0.25 |

) |

(3.77 |

) |

| Time

charter equivalent rate (TCE)(3) |

8,112 |

|

4,793 |

|

|

|

6,993 |

|

3,962 |

|

| Average

operating expenses per vessel per day |

5,267 |

|

5,088 |

|

|

|

5,005 |

|

4,553 |

|

| Average

number of vessels |

5.0 |

|

5.0 |

|

|

|

5.0 |

|

5.2 |

|

(1) Adjusted (LBITDA)/EBITDA is a measure not in accordance with

generally accepted accounting principles (“GAAP”). See a later

section of this press release for a reconciliation of

(LBITDA)/EBITDA to total comprehensive (loss) and net cash (used

in)/ generated from operating activities, which are the most

directly comparable financial measures calculated and presented in

accordance with the GAAP measures.

(2) The weighted average number of shares for the year ended

December 31, 2017 was 25,749,951 compared to 2,603,835 shares for

the year ended December 31, 2016. The weighted average number of

shares for the three month period ended December 31, 2017 was

30,503,159 compared to 2,627,674 shares for the three month period

ended December 31, 2016. The actual number of shares outstanding as

of December 31, 2017 was 31,630,419 and the basic loss per share

outstanding as of December 31, 2017 for the year ended December 31,

2017 was $0.20.

(3) Daily Time charter equivalent rate (TCE) is a measure not in

accordance with generally accepted accounting principles (“GAAP”).

See a later section of this press release for a reconciliation of

Daily TCE to Voyage revenues.

Current Fleet ProfileAs of the

date of this press release, Globus’ subsidiaries own and operate

five dry bulk carriers, consisting of four Supramax and one

Panamax.

|

Vessel |

YearBuilt |

Yard |

Type |

Month/YearDelivered |

DWT |

|

|

Flag |

|

Moon Globe |

2005 |

Hudong-Zhonghua |

Panamax |

June 2011 |

74,432 |

|

|

Marshall Is. |

|

Sun Globe |

2007 |

Tsuneishi Cebu |

Supramax |

Sept 2011 |

58,790 |

|

|

Malta |

|

River Globe |

2007 |

Yangzhou Dayang |

Supramax |

Dec 2007 |

53,627 |

|

|

Marshall Is. |

|

Sky Globe |

2009 |

Taizhou Kouan |

Supramax |

May 2010 |

56,855 |

|

|

Marshall Is. |

|

Star Globe |

2010 |

Taizhou Kouan |

Supramax |

May 2010 |

56,867 |

|

|

Marshall Is. |

| Weighted Average Age: 9.8 Years as of

December 31, 2017 |

|

300,571 |

|

|

|

| |

|

|

|

|

|

Current Fleet Deployment

All our vessels are currently operating on short

term time charters (“on spot”).

Management Commentary

Athanasios Feidakis, President, Chief Executive

Officer and Chief Financial Officer of Globus Maritime Limited,

stated:

“We are happy to return to a positive EBITDA

territory in 2017! The market has been very challenging in the past

few years but finally there is a glimpse of hope. In 2017 we

took significant steps to reduce our debt and improve the quality

of our operations with satisfactory results.

“The general market opinion is positive and we

are pleased that it is moving out of the twilight zone.

“Current Charter rates are healthy and the

futures/FFA curves suggest further strengthening. Since we maintain

a versatile approach on the employment of our vessels, it is easy

for us to focus on taking advantage of the improved rate

market.

“We are optimistic in the continuous strength of

the world economy as well as the restrain in newbuilding orders,

and we consider both good omens for the medium term.

“Our strategy going forward is to employ

our ships on short-medium term contracts and enjoy rates above cash

breakeven.

“As the market returns to healthier levels we

will then start looking at fleet renewals within 2018.”

Management Discussion and Analysis of the

Results of Operations

Fourth quarter of the year 2017 compared

to the fourth quarter of the year 2016

Total comprehensive loss for the fourth quarter

of the year 2017 amounted to $1.3 million or $0.04 basic loss per

share based on 30,503,159 weighted average number of shares,

compared to total comprehensive loss of $2.5 million for the same

period last year or $0.93 basic loss per share based on 2,627,674

weighted average number of shares.

The following table corresponds to the breakdown

of the factors that led to the increase of total comprehensive loss

during the fourth quarter of 2017 compared to the corresponding

quarter in 2016 (expressed in $000’s):

4th Quarter of 2017 vs 4th Quarter of

2016

|

Net loss for the 4th

quarter of 2016 |

(2,450 |

) |

| Increase

in Voyage revenues |

1,680 |

|

| Decrease

in Management fee income |

(187 |

) |

| Increase

in Voyage expenses |

(165 |

) |

| Increase

in Vessels operating expenses |

(83 |

) |

| Decrease

in Depreciation |

40 |

|

| Increase

in Depreciation of dry docking costs |

(59 |

) |

| Decrease

in Total administrative expenses |

259 |

|

| Increase

in Other expenses, net |

(11 |

) |

| Increase

in Interest expense and finance costs net, |

(124 |

) |

| Increase

in Foreign exchange losses |

(177 |

) |

|

Net loss for the 4th

quarter of 2017 |

(1,277 |

) |

|

|

|

|

Voyage revenuesDuring the

three-month period ended December 31, 2017 and 2016, our revenue

reached $4.1 million and $2.4 million respectively. The 71%

increase in Voyage revenues was mainly attributed to the increase

in the average time charter rates achieved by our vessels during

the fourth quarter of 2017 compared to the same period in 2016.

Time Charter Equivalent rate (TCE) for the fourth quarter of 2017

amounted to $8,112 per vessel per day against $4,793 per vessel per

day during the same period in 2016 corresponding to an increase of

69%.

Vessel operating expensesVessel

operating expenses, which include crew costs, provisions, deck and

engine stores, lubricating oils, insurance, maintenance, and

repairs, reached $2.4 million and $2.3 million during the three

month period ended December 31, 2017 and 2016, respectively. The

breakdown of our operating expenses for the quarters ended December

31, 2017 and 2016 was as follows:

|

|

2017 |

|

|

|

2016 |

|

|

| Crew

expenses |

48% |

|

|

|

50% |

|

|

| Repairs

and spares |

26% |

|

|

|

27% |

|

|

|

Insurance |

10% |

|

|

|

7% |

|

|

|

Stores |

10% |

|

|

|

8% |

|

|

|

Lubricants |

5% |

|

|

|

5% |

|

|

|

Other |

1% |

|

|

|

3% |

|

|

|

|

|

|

|

|

|

|

|

Average daily operating expenses during the

three-month periods ended December 31, 2017 and 2016 were $5,267

per vessel per day and $5,088 per vessel per day respectively,

corresponding to an increase of 4%.

Total administrative

expensesTotal administrative expenses decreased by $0.2

million or 47% to $0.3 million during the three month period ended

December 31, 2017 compared to $0.5 million during the same period

in 2016. The increased figure during the fourth quarter of 2016 is

mainly attributed to consulting and legal fees of the Company.

Year ended December 31, 2017 compared to

the year ended December 31, 2016

Total comprehensive loss for the year ended

December 31, 2017 amounted to $6.5 million or $0.25 basic loss per

share based on 25,749,951 weighted average number of shares,

compared to total comprehensive loss of $9.8 million for the same

period last year or $3.77 basic loss per share based on 2,603,835

weighted average number of shares.

The following table corresponds to the breakdown

of the factors that led to the total comprehensive loss for the

year ended December 31, 2017 compared to the total comprehensive

loss ended December 31, 2016 (expressed in $000’s):

Year end of 2017 vs Year end of

2016

|

Net loss for the year 2016 |

(9,825 |

) |

| Increase

in Voyage revenues |

5,652 |

|

| Decrease

in Management fee income |

(247 |

) |

| Increase

in Voyage expenses |

(621 |

) |

| Increase

in Vessels operating expenses |

(447 |

) |

| Decrease

in Depreciation |

160 |

|

| Decrease

in Depreciation of dry docking costs |

143 |

|

| Decrease

in Total administrative expenses |

717 |

|

| Decrease

in Gain from sale of subsidiary |

(2,257 |

) |

| Decrease

in Other expenses, net |

113 |

|

| Decrease

in interest income |

(2 |

) |

| Decrease

in Interest expense and finance costs |

455 |

|

| Increase

in Foreign exchange losses |

(316 |

) |

|

Net loss for the year 2017 |

(6,475 |

) |

|

|

|

|

Voyage revenuesDuring the year

ended December 31, 2017 and 2016, our Voyage revenue reached $14.4

million and $8.7 million respectively. The 66% increase in revenue

was mainly attributed to the increase in the average time charter

rates achieved by our vessels during the year ended December 31,

2017 compared to the same period in 2016. Time Charter Equivalent

rate (TCE) for the year 2017 amounted to $6,993 per vessel per day

against $3,962 per vessel per day during the year 2016

corresponding to an increase of 77%.

Voyage expenses Voyage expenses

reached $1.9 million during the year ended December 31, 2017

compared to $1.3 million during the year 2016. Voyage expenses

include commissions on revenue, port and other voyage expenses and

bunker expenses. Bunker expenses mainly refer to the cost of

bunkers consumed during periods that our vessels are travelling

seeking employment. Voyage expenses for the year 2017 and 2016 are

analyzed as follows:

| In

$000’s |

2017 |

2016 |

|

Commissions |

781 |

468 |

| Bunkers

expenses |

968 |

593 |

| Other

voyage expenses |

143 |

210 |

|

Total |

1,892 |

1,271 |

|

|

|

|

Vessel operating expensesVessel

operating expenses, which include crew costs, provisions, deck and

engine stores, lubricating oils, insurance, maintenance, and

repairs, reached $9.1 million during the year ended December 31,

2017 compared to $8.7 million during the year 2016. The breakdown

of our operating expenses for the year ended December 31, 2017 and

2016 was as follows:

|

|

2017 |

|

|

2016 |

|

| Crew

expenses |

51% |

|

|

56% |

|

| Repairs

and spares |

24% |

|

|

20% |

|

|

Insurance |

8% |

|

|

9% |

|

|

Stores |

9% |

|

|

7% |

|

|

Lubricants |

5% |

|

|

5% |

|

|

Other |

3% |

|

|

3% |

|

|

|

|

|

|

|

|

Average daily operating expenses during the year

ended December 31, 2017 and 2016 were $5,005 per vessel per day and

$4,553 per vessel per day respectively, corresponding to an

increase of

10%.

Gain from sale of subsidiaryIn March 2016, the

Company entered into an agreement with Commerzbank to sell the

shares of Kelty Marine Ltd., to an unaffiliated third party and

apply the total net proceeds from the sale towards the respective

loan facility. Based on certain financial conditions agreed

to beforehand with the Bank this resulted in the remaining

principal amount of the loan to be written off. The financial

effect from the sale of Kelty Marine Ltd. resulted to a gain of

$2.3 million.

Interest expense and finance

costsInterest expense and finance costs reached $2.2

million during the year ended December 31, 2017 compared to $2.7

million during the year 2016. The decrease is mainly attributed to

the conversion of $20 million of outstanding principal of two loans

to 20 million shares, as described in the Share and Warrant

Purchase Agreement that we entered on February 8, 2017. The

weighted average interest rate on our debt outstanding during the

year ended December 31, 2017 reached 3.8% compared to 3.5% during

the year 2016. Our debt outstanding for the year ended 2017 was

$41.7 million compared to $65.8 million for the year ended 2016.

Interest expense and finance costs for the year 2017 and 2016 are

analyzed as follows:

| In

$000’s |

2017 |

2016 |

| Interest

payable on long-term borrowings |

1,778 |

2,430 |

| Bank

charges |

34 |

33 |

|

Amortization of debt discount |

84 |

128 |

| Other

finance expenses |

325 |

85 |

|

Total |

2,221 |

2,676 |

|

|

|

|

Liquidity and capital

resourcesAs of December 31, 2017 and 2016, our cash and

bank balances and bank deposits were $2.8 million and $0.2 million

respectively.

Net cash provided by operating

activities for the year ended December 31, 2017 was $0.6

million compared to net cash used in operating activities of $3.6

million during the year 2016. The $4.2 million increase in our cash

from operations was mainly attributed to the $5.2 million increase

in our adjusted EBITDA from $3.5 million adjusted LBITDA during the

year 2016 to adjusted EBITDA of $1.7 million during the year under

consideration.

Net cash generated from/(used in)

financing activities during the three-month and

twelve-month periods ended December 31, 2017 and 2016 were as

follows:

|

|

Three months endedDecember

31, |

|

Year endedDecember 31, |

|

| In

$000’s |

2017 |

|

2016 |

|

|

2017 |

|

2016 |

|

|

|

|

|

|

|

| Proceeds

from issuance of share capital |

3,842 |

|

- |

|

|

9,653 |

|

- |

|

| Net

proceeds/(repayment) from shareholders loan Firment & Silaner

Credit Facilities |

(280 |

) |

647 |

|

|

280 |

|

5,950 |

|

|

Repayment of long term debt |

- |

|

- |

|

|

(4,399 |

) |

(3,100 |

) |

|

Restricted cash |

- |

|

(210 |

) |

|

- |

|

290 |

|

|

Dividends paid on preferred shares |

- |

|

- |

|

|

- |

|

(14 |

) |

| Interest

paid |

(986 |

) |

(514 |

) |

|

(3 ,309 |

) |

(1,730 |

) |

|

Net cash generated from/(used in) financing

activities |

2,576 |

|

(77 |

) |

|

2,225 |

|

1,396 |

|

|

|

|

|

|

|

|

|

|

|

|

As of December 31, 2017, we and our

vessel-owning subsidiaries had outstanding borrowings under our

Loan agreement with DVB Bank SE and HSH Nordbank AG of an aggregate

of $41.7 million compared to $65.8 million as of December 31, 2016,

gross of unamortized debt discount.

Amended agreements with the

banksIn June and July 2017 the Company agreed the

restructure of its loan agreements with DVB Bank SE and HSH

Nordbank AG, respectively. By these agreements the Company was

successful in achieving waivers and relaxations on its loan

covenants as well as deferring instalment loan payments due in

2017.

Share and warrant purchase

agreement As previously reported, the Company on February

8, 2017 entered into a Share and Warrant Purchase Agreement

pursuant to which it sold for $5 million an aggregate of 5 million

of its common shares, par value $0.004 per share and warrants to

purchase 25 million of its common shares at a price of $1.60 per

share to a number of investors in a private placement. These

securities were issued in transactions exempt from registration

under the Securities Act. On February 9, 2017, the Company entered

into a registration rights agreement with those purchasers

providing them with certain rights relating to registration under

the Securities Act of the Shares and the common shares underlying

the Warrants.

In connection with the closing of the February

2017 private placement, the Company also entered into two loan

amendment agreements with existing lenders.

One loan amendment agreement was entered into by

the Company with Firment Trading Limited (“Firment”), an affiliate

of the Company’s chairman, and the lender of the Firment Credit

Facility, which then had an outstanding principal amount of $18.5

million. Firment released an amount equal to $16.9 million (but

left an amount equal to $1.6 million outstanding, which continued

to accrue interest under the Firment Credit Facility as though it

were principal) of the Firment Credit Facility and the Company

issued to Firment Shipping Inc., an affiliate of Firment,

16,885,000 common shares and a warrant to purchase 6,230,580 common

shares at a price of $1.60 per share. Subsequent to the closing of

the February 2017 private placement, Globus repaid the outstanding

amount on the Firment Credit Facility in its entirety. The

Firment Credit Facility expired on April 12, 2017.

The other loan amendment agreement was entered

into by the Company with Silaner Investments Limited (“Silaner”),

an affiliate of the Company’s chairman, and the lender of the

Silaner Credit Facility. Silaner released an amount equal to the

outstanding principal of $3.1 million (but left an amount equal to

$0.1 million outstanding, which continued to accrue interest under

the Silaner Credit Facility as though it were principal) of the

Silaner Credit Facility and the Company issued to Firment Shipping

Inc., an affiliate of Silaner, 3,115,000 common shares and a

warrant to purchase 1,149,437 common shares at a price of $1.60 per

share. Subsequent to the closing of the February 2017 private

placement, Globus repaid the outstanding amount on the Silaner

Credit Facility in its entirety. The Silaner Credit Facility

expired on January 12, 2018.

Each of the above mentioned warrants are

exercisable for 24 months after their respective issuance. Under

the terms of the warrants, all warrant holders (other than Firment

Shipping Inc., which has no such restriction in its warrants) may

not exercise their warrants to the extent such exercise would cause

such warrant holder, together with its affiliates and attribution

parties, to beneficially own a number of common shares which would

exceed 4.99% (which may be increased, but not to exceed 9.99%) of

the Company’s then outstanding common shares immediately following

such exercise, excluding for purposes of such determination common

shares issuable upon exercise of the warrants which have not been

exercised. This provision does not limit a warrant holder from

acquiring up to 4.99% of the Company’s common shares, selling all

of their common shares, and re-acquiring up to 4.99% of the

Company’s common shares.

On October 19, 2017, the Company entered into a

Share and Warrant Purchase Agreement (the “October 2017 SPA”)

pursuant to which it sold for $2.5 million an aggregate of 2.5

million of its common shares, par value $0.004 per share and a

warrant (the “October 2017 Warrant”) to purchase 12.5 million of

its common shares at a price of $1.60 per share to an investor in a

private placement (the “October 2017 Private Placement”). These

securities were issued in transactions exempt from registration

under the Securities Act of 1933, as amended. On that day, Company

also entered into a registration rights agreement with the

purchaser providing it with certain rights relating to registration

under the Securities Act of the 2.5 million common shares issued in

connection with the October 2017 Private Placement and the common

shares underlying the October 2017 Warrant.

Under the terms of the October 2017 Warrant, the

purchaser may not exercise its warrant to the extent such exercise

would cause the purchaser, together with its affiliates and

attribution parties, to beneficially own a number of common shares

which would exceed 4.99% (which may be increased upon no less than

61 days’ notice, but not to exceed 9.99%) of Globus’s then

outstanding common shares immediately following such exercise,

excluding for purposes of such determination common shares issuable

upon exercise of the October 2017 Warrant which have not been

exercised. This provision does not limit the purchaser from

acquiring up to 4.99% of our common shares, selling all of its

common shares, and re-acquiring up to 4.99% of our common

shares.

The October 2017 Warrant contains a provision

whereby its holder has the right to a cashless exercise if, six

months after its issuance, a registration statement covering their

resale is not effective. If for any reason the Company is unable to

keep such a registration statement active and its share price is

higher than the $1.60 exercise price, the Company could be required

to issue shares without receiving cash consideration. The October

2017 Warrant is exercisable for 24 months after its issuance. A

registration statement covering this transaction was filed with the

U.S. Securities and Exchange Commission and became effective on

February 8, 2018.

As of December 31, 2017, in connection with the

October 2017 SPA, the October 2017 Warrant was outstanding and

exercisable for an aggregate of 12,500,000 common shares.

CONSOLIDATED FINANCIAL & OPERATING

DATA

| |

Three months ended |

|

|

|

Year ended |

|

| |

December 31, |

|

|

|

December31, |

|

|

|

2017 |

|

2016 |

|

|

|

2017 |

|

2016 |

|

| (in

thousands of U.S. dollars, except per share data) |

(unaudited) |

(unaudited) |

|

Statement of comprehensive income data: |

|

|

|

|

|

|

|

|

|

|

| Voyage revenues |

4,111 |

|

2,431 |

|

14,392 |

|

8,740 |

|

| Management fee

income |

- |

|

187 |

|

31 |

|

278 |

|

| Total

Revenues |

4,111 |

|

2,618 |

|

14,423 |

|

9,018 |

|

| |

|

|

|

|

| Voyage expenses |

(501 |

) |

(336 |

) |

(1,892 |

) |

(1,271 |

) |

| Vessel operating

expenses |

(2,423 |

) |

(2,340 |

) |

(9,135 |

) |

(8,688 |

) |

| Depreciation |

(1,195 |

) |

(1,235 |

) |

(4,854 |

) |

(5,014 |

) |

| Depreciation of dry

docking costs |

(280 |

) |

(221 |

) |

(862 |

) |

(1,005 |

) |

| Administrative

expenses |

(80 |

) |

(420 |

) |

(1,224 |

) |

(2,094 |

) |

| Administrative expenses

payable to related parties |

(189 |

) |

(108 |

) |

(514 |

) |

(351 |

) |

| Share-based

payments |

(12 |

) |

(5 |

) |

(40 |

) |

(50 |

) |

| Gain from sale of

subsidiary |

- |

|

- |

|

- |

|

2,257 |

|

| Other expenses,

net |

(7 |

) |

(3 |

) |

83 |

|

(30 |

) |

| Operating loss

before financing activities |

(576 |

) |

(2,050 |

) |

(4,015 |

) |

(7,228 |

) |

| Interest income |

3 |

|

- |

|

3 |

|

5 |

|

| Interest expense and

finance costs |

(636 |

) |

(509 |

) |

(2,221 |

) |

(2,676 |

) |

| Foreign exchange

(losses)/gains, net |

(68 |

) |

109 |

|

(242 |

) |

74 |

|

| Total finance

costs, net |

(701 |

) |

(400 |

) |

(2,460 |

) |

(2,597 |

) |

| Total

comprehensive loss for the period |

(1,277 |

) |

(2,450 |

) |

(6,475 |

) |

(9,825 |

) |

|

|

|

|

|

|

| Basic

& diluted (loss)/earnings per share for the period |

(0.04 |

) |

(0.93 |

) |

(0.25 |

) |

(3.77 |

) |

|

Adjusted (LBITDA)/EBITDA (1) |

902 |

|

(594 |

) |

1,701 |

|

(3,466 |

) |

|

|

|

|

|

|

|

|

|

|

(1) Adjusted (LBITDA)/EBITDA represents net

(loss)/earnings before interest and finance costs net, gains or

losses from the change in fair value of derivative financial

instruments, foreign exchange gains or losses, income taxes,

depreciation, depreciation of dry-docking costs, amortization of

fair value of time charter acquired, impairment and gains or losses

on sale of vessels. Adjusted (LBITDA)/EBITDA does not represent and

should not be considered as an alternative to total comprehensive

income/(loss) or cash generated from operations, as determined by

IFRS, and our calculation of Adjusted (LBITDA)/EBITDA may not be

comparable to that reported by other companies. Adjusted

(LBITDA)/EBITDA is not a recognized measurement under IFRS.

Adjusted (LBITDA)/EBITDA is included herein

because it is a basis upon which we assess our financial

performance and because we believe that it presents useful

information to investors regarding a company’s ability to service

and/or incur indebtedness and it is frequently used by securities

analysts, investors and other interested parties in the evaluation

of companies in our industry.

Adjusted (LBITDA)/EBITDA has limitations as an

analytical tool, and you should not consider it in isolation, or as

a substitute for analysis of our results as reported under IFRS.

Some of these limitations are:

- Adjusted (LBITDA)/EBITDA does not reflect our cash expenditures

or future requirements for capital expenditures or contractual

commitments;

- Adjusted (LBITDA)/EBITDA does not reflect the interest expense

or the cash requirements necessary to service interest or principal

payments on our debt;

- Adjusted (LBITDA)/EBITDA does not reflect changes in or cash

requirements for our working capital needs; and

- Other companies in our industry may calculate Adjusted

(LBITDA)/EBITDA differently than we do, limiting its usefulness as

a comparative measure.

Because of these limitations, Adjusted

(LBITDA)/EBITDA should not be considered a measure of discretionary

cash available to us to invest in the growth of our business.

The following table sets forth a

reconciliation of Adjusted (LBITDA)/EBITDA to total comprehensive

(loss) and net cash (used in)/ generated from operating activities

for the periods presented:

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three months

ended |

|

|

Year ended |

|

| |

December

31, |

|

|

December 31, |

|

|

(Expressed in thousands of U.S. dollars) |

2017 |

|

|

2016 |

|

|

2017 |

|

2016 |

|

| |

(Unaudited) |

|

|

(Unaudited) |

|

| |

|

|

|

|

|

|

|

|

|

|

| Total

comprehensive (loss)/income for the period |

(1,277 |

) |

|

(2,450 |

) |

|

(6,475 |

) |

(9,825 |

) |

| Interest and finance

costs, net |

636 |

|

|

509 |

|

|

2,218 |

|

2,671 |

|

| Foreign exchange gains

net, |

71 |

|

|

(109 |

) |

|

242 |

|

(74 |

) |

| Depreciation |

1,195 |

|

|

1,235 |

|

|

4,854 |

|

5,014 |

|

| Depreciation of dry

docking costs |

280 |

|

|

221 |

|

|

862 |

|

1,005 |

|

| Gain from sale of

subsidiary |

- |

|

|

- |

|

|

- |

|

(2,257 |

) |

| Adjusted

(LBITDA)/EBITDA |

902 |

|

|

(594 |

) |

|

1,701 |

|

(3,466 |

) |

| Share-based

payments |

2 |

|

|

5 |

|

|

30 |

|

50 |

|

| Payment of deferred dry

docking costs |

273 |

|

|

(482 |

) |

|

(412 |

) |

(478 |

) |

| Net (increase)/decrease

in operating assets |

199 |

|

|

(133 |

) |

|

512 |

|

(663 |

) |

| Net (decrease)/increase

in operating liabilities |

(1,851 |

) |

|

1,013 |

|

|

(1,143 |

) |

936 |

|

| Provision for staff

retirement indemnities |

1 |

|

|

- |

|

|

4 |

|

5 |

|

| Foreign exchange gains

net, not attributed to cash & cash equivalents |

470 |

|

|

144 |

|

|

(61 |

) |

16 |

|

| Net cash (used

in)/ generated from operating

activities |

(4 |

) |

|

(47 |

) |

|

631 |

|

(3,600 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three months ended |

|

|

Year ended |

|

| |

December

31, |

|

|

December

31, |

|

| (Expressed in thousands

of U.S. dollars) |

2017 |

|

|

2016 |

|

|

2017 |

|

2016 |

|

| |

(Unaudited) |

|

|

(Unaudited) |

|

| Statement of

cash flow data: |

|

|

|

|

|

|

|

|

|

|

| Net cash (used

in)/generated from operating activities |

(4 |

) |

|

(47 |

) |

|

631 |

|

(3,600 |

) |

| Net cash (used

in)/generated from investing activities |

(36 |

) |

|

(6 |

) |

|

(263 |

) |

362 |

|

| Net cash generated

from/(used in) financing activities |

2,576 |

|

|

(77 |

) |

|

2,225 |

|

1,396 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

As of December 31, |

|

|

As of December 31, |

|

(Expressed in thousands of U.S. Dollars) |

2017 |

|

|

2016 |

|

|

(Unaudited) |

|

Consolidated condensed statement of financial

position: |

|

|

|

|

|

Vessels, net |

87,320 |

|

|

91,792 |

| Other

non-current assets |

53 |

|

|

55 |

|

Total non-current assets |

87,373 |

|

|

91,847 |

| Cash

and bank balances and bank deposits |

2,756 |

|

|

163 |

| Other

current assets |

1,474 |

|

|

1,986 |

|

Total current assets |

4,230 |

|

|

2,149 |

|

Total assets |

91,603 |

|

|

93,996 |

|

Total equity |

43,968 |

|

|

20,760 |

| Total

debt net of unamortized debt discount |

41,538 |

|

|

65,572 |

| Other

liabilities |

6,097 |

|

|

7,664 |

|

Total

liabilities |

47,635 |

|

|

73,236 |

|

Total equity and liabilities |

91,603 |

|

|

93,996 |

|

|

|

|

|

|

|

Consolidated statement of changes in equity: |

|

|

|

|

|

|

|

(Expressed in thousands of U.S. Dollars) |

Issued share |

Share |

(Accumulated |

|

Total |

|

|

|

Capital |

Premium |

Deficit) |

|

Equity |

|

|

As at December 31, 2016 |

10 |

110,004 |

(89,254 |

) |

20,760 |

|

| Loss

for the period |

- |

- |

(6,475 |

) |

(6,475 |

) |

|

Issuance of common stock (1) |

110 |

27,172 |

- |

|

27,282 |

|

|

Issuance of common stock due to exercise of warrants (2) |

6 |

2,365 |

- |

|

2,371 |

|

|

Share-based payments |

- |

30 |

- |

|

30 |

|

|

As at December 31,

2017 |

126 |

139,571 |

(95,729 |

) |

43,968 |

|

(1) For more details see section titled “Share

and warrant purchase agreement”.(2) Pursuant to the “Share and

warrant purchase agreement”, warrants to buy 1,481,808 common

shares were exercised during 2017.

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months endedDecember 31, |

|

Year endedDecember 31, |

|

|

|

2017 |

|

2016 |

|

|

2017 |

|

2016 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Ownership days (1) |

460 |

|

460 |

|

|

1,825 |

|

1,908 |

|

|

Available days (2) |

445 |

|

437 |

|

|

1,787 |

|

1,885 |

|

|

Operating days (3) |

435 |

|

426 |

|

|

1,745 |

|

1,830 |

|

| Fleet

utilization (4) |

97.8 |

% |

97.5 |

% |

|

97.6 |

% |

97.1 |

% |

|

Average number of vessels (5) |

5.0 |

|

5.0 |

|

|

5.0 |

|

5.2 |

|

| Daily

time charter equivalent (TCE) rate (6) |

8,112 |

|

4,793 |

|

|

6,993 |

|

3,962 |

|

| Daily

operating expenses (7) |

5,267 |

|

5,088 |

|

|

5,005 |

|

4,553 |

|

Notes:

(1) Ownership days are the aggregate number of days in a period

during which each vessel in our fleet has been owned by us.(2)

Available days are the number of ownership days less the aggregate

number of days that our vessels are off-hire due to scheduled

repairs or repairs under guarantee, vessel upgrades or special

surveys.(3) Operating days are the number of available days less

the aggregate number of days that the vessels are off-hire due to

any reason, including unforeseen circumstances but excluding days

during which vessels are seeking employment.(4) We calculate fleet

utilization by dividing the number of operating days during a

period by the number of available days during the period.(5)

Average number of vessels is measured by the sum of the number of

days each vessel was part of our fleet during a relevant period

divided by the number of calendar days in such period.(6) TCE rates

are our voyage revenues less net revenues from our bareboat

charters less voyage expenses during a period divided by the number

of our available days during the period excluding bareboat charter

days, which is consistent with industry standards. TCE is a measure

not in accordance with GAAP.(7) We calculate daily vessel operating

expenses by dividing vessel operating expenses by ownership days

for the relevant time period excluding bareboat charter

days.

Voyage Revenues to Daily Time Charter

Equivalent (“TCE”) Reconciliation

| |

|

|

|

|

| |

Three months endedDecember 31, |

Year endedDecember 31, |

| |

2017 |

2016 |

2017 |

2016 |

|

|

(Unaudited) |

(Unaudited) |

| |

|

|

|

|

| Voyage revenues |

4,111 |

2,431 |

14,392 |

8,740 |

| Less: Voyage

expenses |

501 |

336 |

1,892 |

1,271 |

| Net revenue excluding

bareboat charter revenue |

3,610 |

2,095 |

12,500 |

7,469 |

| Available days net of

bareboat charter days |

445 |

437 |

1,787 |

1,885 |

| Daily TCE rate |

8,112 |

4,793 |

6,993 |

3,962 |

| |

|

|

|

|

About Globus Maritime

LimitedGlobus is an integrated dry bulk shipping company

that provides marine transportation services worldwide and

presently owns, operates and manages a fleet of five dry bulk

vessels that transport iron ore, coal, grain, steel products,

cement, alumina and other dry bulk cargoes internationally. Globus’

subsidiaries own and operate seven vessels with a total carrying

capacity of 300,571 Dwt and a weighted average age of 9.8 years as

of December 31, 2017.

Safe Harbor StatementThis

communication contains “forward-looking statements” as defined

under U.S. federal securities laws. Forward-looking statements

provide the Company’s current expectations or forecasts of future

events. Forward-looking statements include statements about the

Company’s expectations, beliefs, plans, objectives, intentions,

assumptions and other statements that are not historical facts or

that are not present facts or conditions. Words or phrases such as

“anticipate,” “believe,” “continue,” “estimate,” “expect,”

“intend,” “may,” “ongoing,” “plan,” “potential,” “predict,”

“project,” “will” or similar words or phrases, or the negatives of

those words or phrases, may identify forward-looking statements,

but the absence of these words does not necessarily mean that a

statement is not forward-looking. Forward-looking statements are

subject to known and unknown risks and uncertainties and are based

on potentially inaccurate assumptions that could cause actual

results to differ materially from those expected or implied by the

forward-looking statements. The Company’s actual results could

differ materially from those anticipated in forward-looking

statements for many reasons specifically as described in the

Company’s filings with the Securities and Exchange Commission.

Accordingly, you should not unduly rely on these forward-looking

statements, which speak only as of the date of this communication.

Globus undertakes no obligation to publicly revise any

forward-looking statement to reflect circumstances or events after

the date of this communication or to reflect the occurrence of

unanticipated events. You should, however, review the factors and

risks Globus describes in the reports it will file from time to

time with the Securities and Exchange Commission after the date of

this communication.

For further information please

contact:

| Globus Maritime

Limited |

|

|

|

|

+30 210 960 8300 |

| Athanasios Feidakis,

CEO |

|

|

|

|

a.g.feidakis@globusmaritime.gr |

| |

|

|

|

|

|

| Capital Link – New

York |

|

|

|

|

+1 212 661 7566 |

| Nicolas Bornozis |

|

|

|

|

globus@capitallink.com |

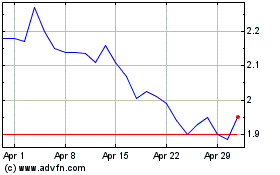

Globus Maritime (NASDAQ:GLBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Globus Maritime (NASDAQ:GLBS)

Historical Stock Chart

From Apr 2023 to Apr 2024