Glencore to Resume Payments to Israeli Billionaire Gertler Despite U.S. Sanctions -- Update

June 15 2018 - 5:13AM

Dow Jones News

By Scott Patterson

Swiss mining giant Glencore PLC said it would resume

multimillion-dollar payments to a former business partner

sanctioned by the U.S. Treasury Department for alleged corruption

in the Democratic Republic of Congo, resolving a thorny legal

dispute that threatened to disrupt its operations.

Glencore stopped paying royalties to Israeli billionaire Dan

Gertler in December after the sanctions were imposed. On Friday, it

said resuming the payments was the only viable option to avoid the

risk of losing its assets.

Mr. Gertler in April launched a legal action against Glencore in

a Congolese court seeking $3 billion in damages in response to the

company's decision to halt payments. Mr. Gertler had also obtained

high court injunctions which, if they had become final, would have

enabled him to permanently seize assets at Glencore's mines,

causing severe disruption, the company said.

The Treasury Department's sanctions prohibit U.S. firms from

working with Mr. Gertler and several companies associated with him.

That presented a challenge to Glencore, which, while a Swiss

company, has extensive operations in the U.S. and whose business is

tightly linked to the U.S. financial system.

Glencore said it would pay Mr. Gertler in euros, rather than

dollars, and that no Americans would be connected to the payments,

an arrangement it believes "would appropriately address all

applicable sanctions obligations." As a result of the agreement,

Glencore said its subsidiaries and affiliate companies of Mr.

Gertler agreed to withdraw all pending and threatened litigation

between them.

The payments to Mr. Gertler have been a long-running headache

for Glencore. Canadian regulator, the Ontario Securities

Commission, or OSC, launched an investigation into the payments,

which had originally been designated for Congo's state-run mining

company, Gecamines, but instead were diverted to Mr. Gertler, The

Wall Street Journal reported in July. Glencore said the shift in

payments was done at the request of Gecamines.

Glencore in November disclosed that the OSC had launched a probe

into financial statements and disclosures related to international

bribery and anticorruption laws by Glencore's Toronto-listed

Katanga Mining subsidiary. Three Katanga directors stepped down

from its board following an internal review that found weaknesses

in the company's controls over financial reporting.

Then came the U.S. Treasury Department's December allegations

that Mr. Gertler had amassed a fortune through "opaque and corrupt

mining and oil deals." Mr. Gertler's main company working in Congo,

Fleurette Group, has vigorously denied corruption charges.

Mr. Gertler is a friend of Congolese President Joseph Kabila,

according to the Treasury Department. He was also a close partner

with Glencore as it built a dominant position in copper and cobalt

in a country where few Western mining firms choose to work.

Glencore said it expects to start paying Mr. Gertler's company,

Ventora Development, in July at a rate of about EUR10.5 million, or

$12.2 million, a quarter, from its Mutanda Mining SARL operation.

It will also make a "true-up" royalty payment of EUR4.6 million, or

$5.3 million, when the settlement is signed.

Payments from Glencore's other copper and cobalt mine in Congo,

Katanga Mining's Kamoto Copper Co. unit, estimated to be about

EUR16.5 million a quarter, or $19.1 million, will begin in

2019.

Totally royalties paid to Mr. Gertler from both mine will amount

to about $130 million a year, according to an estimate by Goldman

Sachs, an amount it says "is not material" to Glencore.

Mr. Gertler was a central figure in a $412 million settlement in

September 2016 between the Justice Department and the Securities

and Exchange Commission with New York hedge fund Och-Ziff Capital

Management Group LLC.

The Justice Department alleged in a criminal case that Och-Ziff

went into business with Mr. Gertler despite a consultant's warning

that he used political connections to benefit himself and his

associates.

Mr. Gertler hasn't been charged in the case and his spokesman

has denied the allegations. Daniel Och, chairman and chief

executive of Och-Ziff, said the firm's conduct scrutinized by the

Justice Department was "inconsistent with our core values."

Following the allegations against Mr. Gertler, Glencore

purchased Mr. Gertler's stakes in its two Congo copper projects for

$534 million in cash.

Write to Scott Patterson at scott.patterson@wsj.com

(END) Dow Jones Newswires

June 15, 2018 04:58 ET (08:58 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

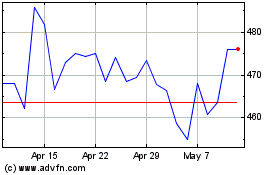

Glencore (LSE:GLEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

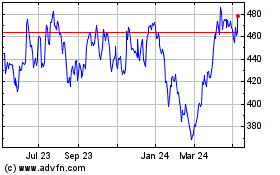

Glencore (LSE:GLEN)

Historical Stock Chart

From Apr 2023 to Apr 2024