Growing Within Cash Flow: Efficient $100-110

Million Plan Targets 15-20% Production Increase

GeoPark Limited (“GeoPark” or the “Company”) (NYSE: “GPRK”), a

leading independent Latin American oil and gas explorer, operator

and consolidator with operations and growth platforms in Colombia,

Chile, Brazil, Argentina, and Peru, today announced its work

program and investment guidelines for 2018. (All figures are

expressed in US Dollars).

A conference call to discuss Third Quarter 2017 financial

results and the 2018 work program and investment guidelines will be

held on November 16, 2017 at 10:00 a.m. Eastern Standard Time.

2018: Continued production growth fully funded with operating

cash flow

GeoPark has approved a self-funded, risk-balanced work program

for 2018 that will increase production by an estimated 15-20% and

boost operating cash flows. The Company screened over 100 different

projects proposed by its five country business units and selected

the top 50 projects (30+ new wells) based on key technical,

economic and strategic criteria.

The main focus of the work program will be to increase

production and develop the potential of the large Tigana/Jacana oil

play in Colombia with a 20+ well drilling campaign in Llanos 34

block (GeoPark operated, 45% WI). The program includes construction

of a new flowline and facilities to continue reducing operating and

transportation costs. These represent low-cost, low-risk, quick

cash flow generating projects with high expected economic

returns.

Additional exploration drilling will be carried out in Colombia,

Brazil and Argentina during 2018.

James F. Park, Chief Executive Officer of GeoPark, said: “With a

focused and capital-efficient plan, GeoPark - as we are doing in

2017 - will produce, develop, and explore our assets and

meaningfully grow our business in 2018 all funded by our own

generated cashflow; with enough firepower set aside for new

attractive acquisition opportunities. We believe this is the right

formula for an E&P company to achieve enduring success in

today’s world. Our team is ready and excited about our upcoming

work program targeted to extend our 15- year track-record of

production and reserve growth - and adaptable to succeed in

whatever oil price scenarios prevail.”

OUTLOOK

GeoPark’s 2018 work program is described below and underscores

the high quality of the Company’s assets as well as its strong

financial position.

2018 work program ($50-55 Brent): 15-20% production

growth

- Production target: 2018 average

production of 31,500-32,500 boepd representing a 15-20% increase

over 2017 average production, and 2018 exit production targeted at

34,000+ boepd.

- Capital expenditure program:

$100-110 million fully-funded by cash flow from operations, to be

allocated as follows:

- Colombia - $85-90 million:

Focused on continuing the development and appraisal of the

Tigana/Jacana oil play and targeting new exploration prospects in

Llanos 34 block. The work program in Colombia includes:

- 18-19 development and appraisal wells

and 2-3 exploration wells in Llanos 34 block

- 1 exploration well in Tiple Exploration

Acreage (GeoPark operated, 85% WI)

- 2 exploration wells in Llanos 32 block

(GeoPark non-operated, 12.5% WI)

- Construction of a new 30-km flowline

and additional facilities to support production growth and continue

reducing operating and transportation costs

- Argentina - $5-8 million:

Focused on continued exploration drilling in the Neuquen Basin with

one exploration well in CN-V block (GeoPark operated, 50% WI) and

six gross exploration wells in Sierra del Nevado and Puelen blocks

(GeoPark non-operated, 18% WI).

- Peru - $6-9 million: Focused on

environmental impact studies and preliminary engineering works and

facilities in the Morona block (GeoPark operated, 75% WI), with the

goal of putting the field into production by the end of 2019.

- Brazil - $3-4 million: Focused

on exploration drilling in the Reconcavo and Potiguar onshore

blocks (GeoPark operated, 70-100% WI). The work program includes

two shallow exploration wells and seismic studies.

- Chile - $1-2 million: Focused on

continuing business optimization, plus environmental and

unconventional studies in the Fell block (GeoPark operated, 100%

WI).

Adjustments to oil price scenarios

The 2018 work program is fully funded by operational cash flows

and can be adapted to provide production growth under different oil

price scenarios.

- Above $60/bbl Brent oil price:

Capital expenditures can be increased to $120-150 million by adding

incremental projects, targeting production growth of 20-25%.

- Below $50/bbl Brent oil price:

Capital expenditures can be reduced to $50-90 million – focusing on

lowest-risk projects that produce the fastest cash flow, targeting

production growth of 5-10%.

GeoPark currently has commodity risk management contracts in

place covering 35-50% of its production for 1H2018. GeoPark

monitors market conditions on a continuing basis and may enter into

new commodity risk management contracts to secure minimum oil

prices for its 2018 production and beyond.

Estimated operating netbacks

- Consolidated operating netback per

boe: Defined as net revenue minus operating costs, royalties

and selling expenses, is estimated to be approximately $20-24/boe

with a $50-55 Brent oil price, approximately $25-29/boe with a

$60-65 Brent oil price, and approximately $16-20/boe with a $45-50

Brent oil price.

CONFERENCE CALL INFORMATION

GeoPark will host its Third Quarter 2017 Financial Results

conference call and webcast on Thursday, November 16, 2017, at

10:00 a.m. Eastern Standard Time.

Chief Executive Officer, James F. Park, Chief Financial Officer,

Andres Ocampo, and Chief Operating Officer, Augusto Zubillaga will

discuss GeoPark's financial results for 3Q2017 and work program and

investment guidelines for 2018, with a question and answer session

immediately following.

Interested parties may participate in the conference call by

dialing the numbers provided below:

United States Participants:

866-547-1509International Participants: +1 920-663-6208Passcode:

99494005

Please allow extra time prior to the call to visit the website

and download any streaming media software that might be required to

listen to the webcast.

An archive of the webcast replay will be made available in the

Investor Support section of the Company’s website at

www.geo-park.com after the conclusion of the live call.

GeoPark can be visited online at www.geo-park.com.

GLOSSARY

Adjusted EBITDA Adjusted EBITDA is defined as

profit for the period before net finance costs, income tax,

depreciation, amortization, certain non-cash items such as

impairments and write-offs of unsuccessful efforts, accrual of

share-based payments, unrealized results on commodity risk

management contracts and other non-recurring events

Adjusted EBITDA per boe Adjusted EBITDA divided by total boe

sales volumes

Bbl Barrel

Boe Barrels of

oil equivalent

Boepd Barrels of oil equivalent per

day

Bopd Barrels of oil per day

CEOP

Contrato Especial de Operacion Petrolera (Special Petroleum

Operation Contract)

D&M DeGolyer and MacNaughton

F&D costs Finding and development costs,

calculated as capital expenditures divided by the applicable net

reserves additions before changes in Future Development Capital

“High price” royalty An additional royalty incurred

in Colombia when each oil field exceeds 5 mmbbl of cumulative

production and is determined by a combination of API gravity and

WTI oil prices

Mboe Thousand barrels of oil

equivalent

Mmbo Million barrels of oil

Mmboe Million barrels of oil equivalent

Mcfpd

Thousand cubic feet per day

Mmcfpd Million cubic feet

per day

Mm3/day Thousand cubic meters

per day

NPV10 Present value of estimated future oil

and gas revenues, net of estimated direct expenses, discounted at

an annual rate of 10%

Operating netback per boe

Revenue, less production and operating costs (net of depreciation

charges and accrual of stock options and stock awards) and selling

expenses, divided by total boe sales volumes. Operating netback is

equivalent to adjusted EBITDA net of cash expenses included in

Administrative, Geological and Geophysical and Other operating

costs

PRMS Petroleum Resources Management System

SPE Society of Petroleum Engineers

NOTICE

Additional information about GeoPark can be found in the

“Investor Support” section on the website at www.geo-park.com.

Rounding amounts and percentages: Certain amounts and

percentages included in this press release have been rounded for

ease of presentation. Percentage figures included in this press

release have not in all cases been calculated on the basis of such

rounded figures, but on the basis of such amounts prior to

rounding. For this reason, certain percentage amounts in this press

release may vary from those obtained by performing the same

calculations using the figures in the financial statements. In

addition, certain other amounts that appear in this press release

may not sum due to rounding.

CAUTIONARY STATEMENTS RELEVANT TO FORWARD-LOOKING

INFORMATION

This press release contains statements that constitute

forward-looking statements. Many of the forward-looking statements

contained in this press release can be identified by the use of

forward-looking words such as ‘‘anticipate,’’ ‘‘believe,’’

‘‘could,’’ ‘‘expect,’’ ‘‘should,’’ ‘‘plan,’’ ‘‘intend,’’ ‘‘will,’’

‘‘estimate’’ and ‘‘potential,’’ among others.

Forward-looking statements that appear in a number of places in

this press release include, but are not limited to, statements

regarding the intent, belief or current expectations, regarding

various matters, including expected 2017 and/or 2018 production

growth and capital expenditures plan. Forward-looking statements

are based on management’s beliefs and assumptions, and on

information currently available to the management. Such statements

are subject to risks and uncertainties, and actual results may

differ materially from those expressed or implied in the

forward-looking statements due to various factors.

Forward-looking statements speak only as of the date they are

made, and the Company does not undertake any obligation to update

them in light of new information or future developments or to

release publicly any revisions to these statements in order to

reflect later events or circumstances, or to reflect the occurrence

of unanticipated events. For a discussion of the risks facing the

Company which could affect whether these forward-looking statements

are realized, see filings with the U.S. Securities and Exchange

Commission.

Oil and gas production figures included in this release are

stated before the effect of royalties paid in kind, consumption and

losses.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171115006535/en/

For further information, please

contact:INVESTORS:Stacy Steimel – Shareholder Value

Directorssteimel@geo-park.comSantiago, ChileorMEDIA:Jared

Levy – Sard Verbinnen & CoNew York, USAT: +1 (212)

687-8080jlevy@sardverb.comorKelsey Markovich – Sard Verbinnen &

CoNew York, USAT: +1 (212) 687-8080kmarkovich@sardverb.com

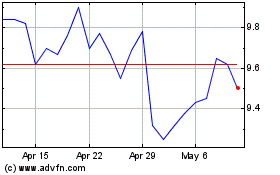

GeoPark (NYSE:GPRK)

Historical Stock Chart

From Mar 2024 to Apr 2024

GeoPark (NYSE:GPRK)

Historical Stock Chart

From Apr 2023 to Apr 2024