Gentiva Health Services Inc. (GTIV) reported

first-quarter 2012 operating net earnings of 27 cents per share, at

par with the Zacks Consensus Estimate, but lower than the year-ago

quarter level of 57 cents per share. Operating net income of $9.1

million also compares unfavorably with $19.1 million in the

year-ago quarter.

Operating earnings in the reported quarter exclude the impact of

amendment fees and other related expenses incurred in connection

with the amendment of Gentiva’s credit agreement, write-off of debt

issuance costs in connection with the reduction of the company’s

revolving credit facility, costs related to restructuring, legal

settlements, acquisition and integration and various other one-time

charges. However, the prior-year quarter excludes costs related to

legal settlement, restructuring, acquisition and integration as

well as refinancing related charges.

Including all one-time charges and income from discontinued

operations, Gentiva posted net income of $4.8 million or 16 cents

per share, declining substantially from the prior-year income of

$13.5 million or 44 cents per share.

Gentiva’s net revenues declined 3.0% year over year to $435.7

million, marginally lagging the Zacks Consensus Estimate of $438.0

million. The year-over-year decline was largely due to the sale and

closure of some branches coupled with a 4% decline in the Home

Health Episodic segment revenue to $210.6 million, arising from

reduced Medicare reimbursement rates. However, the Hospice segment

revenue remained almost flat year over year at $195.7 million.

Adjusted earnings before interest, taxes, depreciation and

amortization (EBITDA) attributable to continuing operations

decreased 27% to $43.1 million from $59.0 million in the prior-year

quarter. Adjusted EBITDA also excludes all the one-time charges

that are excluded from adjusted operating income.

Financial Update

Gentiva exited the quarter with cash and cash equivalents of

approximately $72.8 million compared with $164.9 million as of

December 31, 2012 and outstanding debt of $938.1 million, down from

$988.1 million at 2011 end. During the reported quarter, the

company repaid $50 million on term loans. The company has repaid

$166.9 million on its revolving credit facility and term loans

since the completion of the Odyssey acquisition.

During the reported quarter, net cash used in operating

activities was $34.7 million versus $2.7 million in the prior-year

period, mainly due to higher DSO levels and a $25 million

settlement payment pertaining to an investigation into the

provision of continuous care services of its subsidiary, Odyssey

HealthCare Inc. Free cash flow also deteriorated considerably to a

negative $38.5 million from a negative $0.6 million in the

first-quarter of 2011.

As of March 31, 2011, Gentiva had total assets of $1.46 billion

and shareholders’ equity of $209.7 million, as compared with $1.53

billion and $202.5 million, respectively, as of December 31,

2011.

Stock Repurchase Update

On March 12, 2012, Gentiva announced a stock repurchase plan

under Rule 10b5-1 of the U.S. Securities and Exchange Commission.

The rule allows the company to override restrictions on buybacks

imposed due to access to substantial non-public information or

self-imposed trading black out periods.

Consequently, since March 31, 2012, the company repurchased 0.61

million shares for $5.0 million.

Other Highlights

On March 6, 2012, Gentiva announced an amendment to its senior

secured credit agreement to make the financial covenants more

flexible for the remaining period of the credit facility. The

amendment consists of alteration of the definition of consolidated

EBITDA (earnings before interest, taxes, depreciation and

amortization) in the credit agreement.

Consequently, all expenses related to Gentiva’s cost realignment

initiative, certain non-recurring cash charges and legal

settlements will be added back during the calculation of

consolidated EBITDA. Additionally, the maximum limit for the

consolidated leverage ratio has been raised to 6.25:1.00 for the

period starting January 1, 2012 to September 30, 2014 and 5.75:1.00

subsequently. The previous limit was 4.50:1.00 till September 30,

2012, 3.75:1.00 from October 1, 2012 to September 30, 2013 and

3.00:1.00 beyond that.

Further, the minimum interest coverage ratio requirement has

been relaxed to 2.00:1.00 for the period from January 1, 2012 to

June 30, 2013, 1.75:1.00 from July 1, 2013 to June 30, 2014 and

2.00:1.00 from July 1, 2014 onwards. Moreover, the definition of

consolidated interest charges has been modified to exclude non-cash

interest charges, which were previously included.

The amendment also hiked the interest rates on the term loans

taken under the credit facility by 1.75% per annum. Thus, the new

rates applicable on the Eurodollar term loans A and B are 6.25% and

6.50%, respectively.

Additionally, Gentiva is now allowed to make discounted

prepayments of outstanding term loans through a Dutch auction

process. Gentiva also repaid $50 million of its principal

outstanding under term loans A and B on a pro rata basis and

downsized its revolving credit facility to $110 million from $125

million.

Outlook for Fiscal 2012

Gentiva affirmed its net revenue guidance at $1.70–1.76 billion

and adjusted income from continuing operations guidance at

$1.00–1.20 per share. The adjusted income from continuing

operations guidance excludes expenses associated with acquisitions,

restructuring, integration activities, legal settlements and other

special items but includes the impact of increased interest rates

due to the amendment of its credit agreement.

Gentiva’s competitor, Amedisys Inc. (AMED) is

expected to release its first-quarter 2012 earnings before the

market opens on May 8, 2012.

Gentiva carries a Zacks #3 Rank, which translates into a

short-term Hold rating.

AMEDISYS INC (AMED): Free Stock Analysis Report

GENTIVA HEALTH (GTIV): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

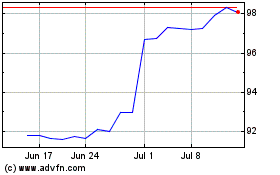

Amedisys (NASDAQ:AMED)

Historical Stock Chart

From Mar 2024 to Apr 2024

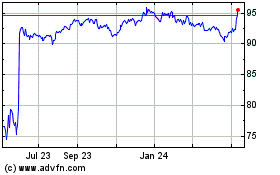

Amedisys (NASDAQ:AMED)

Historical Stock Chart

From Apr 2023 to Apr 2024