Gen-Probe's EPS and Sales Beat - Analyst Blog

May 02 2012 - 8:15AM

Zacks

Gen-Probe

Inc. (GPRO), a leading diagnostic devices company,

reported its first quarter fiscal 2012 adjusted (excluding one-time

expenses) earnings of 55 cents a share, beating both the Zacks

Consensus Estimate and the year-ego earnings of 51 cents and 54

cents, respectively. In the reported quarter, profit slipped 3.5%

to $22.5 million (or 49 cents per share).

Gen-Probe recently

announced that women’s healthcare major, Hologic

Inc. (HOLX) will takeover the company for $3,700 million

(or $82.75 a share).

Revenue

Revenues rose 7% year

over year to $153.4 million beating the Zacks Consensus Estimate of

$151 million. Product sales increased 9% to $150.1 million as

healthy sales across Blood Screening and Clinical Diagnostics

franchises was partially offset by lower revenues from the Research

Products and Services and Collaborative Research

businesses.

Revenues from Clinical

Diagnostics segment grew 7% (up 8% in constant currency) year over

year to $94.9 million, led by strong sales of APTIMA Combo 2,

APTIMA HPV and APTIMA Trichomonas assays. Foreign exchange swings

negated revenues by approximately $0.5 million.

Blood Screening sales

rose 12% (up 13% in constant currency) to $52.5 million, driven by

higher shipping of TIGRIS devices to its partner

Novartis (NVS). Foreign exchange swings reduced

sales by roughly $0.1 million.

Research Products and

Services sales dropped 13% to $2.7 million in the quarter. Revenues

from Collaborative Research plunged 61% to $1.4 million, hurt by

lower funding from Novartis for the development of the PANTHER

system for blood screening.

Gen-Probe expects to

launch the PANTHER system in international blood screening markets

in 2012. Royalty and license revenues increased 36% to $1.9

million.

Margins

Product sales gross

margin was 65.1% versus 69.6% in the year-ago quarter, resulting

from unfavorable product mix. Operating margin decreased to 20.6%

from 24.2% due to higher sales and marketing expenses along with

poor product mix.

Marketing and sales

expenses climbed 15% to $19 million due to expansion in the

operations of women’s healthcare. General and administrative

expenses rose 4% to $19 million as a result of continuing

litigation.Research and development expenses dipped 1% year over

year to $28.6 million.

Balance

Sheet

Gen-Probe exited first

quarter 2012 with cash and cash equivalents and marketable

securities of $401.3 million (down 18.3%) and short-term debt of

$248 million, flat year over year. The company produced $31.7

million in cash flows from operations during the quarter and

invested $9.3 million in capital expenditure, resulting in a free

cash flow of $22.4 million.

Guidance

Gen-Probe expects

somewhat higher sequential revenue for the second quarter 2012 and

adjusted earnings in the band of 55 cents and 58 cents a share. On

a reported basis, the company forecasts earnings to remain in the

range of 51 cents to 54 cents per share. Fiscal earnings and

revenues forecast remain unchanged.

Currently, we have a

long-term Neutral recommendation on Gen-Probe, which is in tandem

with a short-term Zacks #3 Rank (Hold).

GEN-PROBE INC (GPRO): Free Stock Analysis Report

HOLOGIC INC (HOLX): Free Stock Analysis Report

NOVARTIS AG-ADR (NVS): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

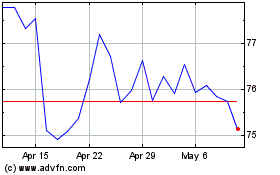

Hologic (NASDAQ:HOLX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hologic (NASDAQ:HOLX)

Historical Stock Chart

From Apr 2023 to Apr 2024