Filed

Pursuant to

Rule

433

Issuer Free

Writing

Prospectus dated

July

10, 2018

Registration

Statement

No. 333-225147

|

|

|

Corp

o

rate

Over

v

iew

Ju

l

y 20

1

8

|

|

NASDAQ: BIOC

www.biocept.com

|

|

|

Forwar

d

-

Lo

o

ki

n

g

Stateme

n

ts

Th

i

s

p

r

e

s

e

ntation

cont

a

i

n

s

,

and

any

a

cc

o

m

pany

i

n

g

or

a

l

pre

s

e

ntation

wo

u

l

d

no

do

u

bt

c

o

n

ta

i

n

,

f

orward-look

i

ng statement

s

,

with

i

n

the

m

ea

n

ing

o

f

t

he

P

r

i

vate

S

e

c

ur

i

t

i

es

L

i

t

i

g

a

t

i

on

R

e

f

orm

Ac

t

o

f

19

9

5, regard

i

n

g

Bi

ocept,

I

n

c

.

and

our

bu

s

ines

s

.

Forward-

l

o

o

k

ing

s

tatemen

t

s

i

n

cl

u

d

e

a

l

l

s

t

ate

m

ents

th

a

t

are

not

h

is

to

r

i

c

al

f

a

c

ts

a

n

d

gene

r

a

ll

y

c

an

be

i

den

t

i

f

i

e

d

by

ter

m

s

s

u

c

h

as

anti

ci

p

ates,

be

l

ieve

s

,

c

o

u

l

d, e

s

t

i

m

ate

s

,

e

x

pe

c

t

s

,

i

ntend

s

,

m

ay,

p

l

an

s

,

potent

i

a

l

,

pred

ic

t

s

,

pro

j

e

c

t

s

,

s

hou

l

d,

w

ill

,

wou

l

d,

or

the

negat

i

ve

of

tho

s

e

ter

m

s

and

si

m

il

ar

e

x

pre

ssi

on

s

.

Forward-

l

o

o

ki

ng

s

t

ate

m

ents

invo

l

ve

k

nown

and

unknown

r

is

k

s

,

u

n

c

ert

a

i

nties

and

other

fa

c

t

ors

t

hat

m

ay

c

a

u

s

e

our

a

c

tu

a

l

r

e

s

u

l

t

s

,

p

e

r

f

or

m

an

c

e

or

a

c

h

i

eve

m

ents

t

o

b

e

m

ate

r

i

a

ll

y

different

f

rom

any

f

u

t

ure re

s

u

l

t

s

,

per

f

or

m

an

c

e

or

a

c

h

i

eve

m

ents

e

x

pre

ss

ed

or

i

m

p

li

ed

by

the

f

orward-

l

oo

ki

ng

s

tatement

s

.

For

deta

il

s

about

the

s

e

r

isks

,

p

l

ea

s

e

s

ee

our

SE

C

f

ili

ng

s

.

Al

l

forward-

l

o

o

ki

n

g

s

ta

t

e

m

e

n

ts

c

on

t

a

i

n

e

d

i

n

this

pr

e

s

ent

a

t

i

on

s

p

eak

o

n

l

y

as

o

f

the

da

te

here

o

f

,

a

nd

ex

c

ept

a

s

r

e

qu

i

red

by

l

aw,

we

a

s

su

m

e

no

ob

l

igation

to

up

d

ate

th

e

se

f

orwa

r

d-

l

o

o

ki

ng

s

tatemen

t

s whether

as

a re

s

u

l

t

of any new

i

n

f

or

m

at

i

on,

f

uture

e

v

ent

s

,

c

hanged

ci

r

c

u

m

s

tan

c

es

or otherwi

s

e. Th

i

s

p

r

e

s

e

ntation

d

oes

not

con

s

t

i

t

ute

an

o

ffer

to

s

e

l

l

s

e

curit

i

e

s

i

n

cl

u

d

i

ng

but

n

ot

li

m

i

t

ed

to

w

i

t

h

i

n

a

ny

juri

s

d

i

ct

i

on

in

wh

ic

h

the

s

a

l

e

o

f

su

c

h

s

e

curit

i

e

s

wou

l

d

be

u

n

l

a

w

f

u

l

.

T

h

e

i

n

f

or

m

ation

set

f

or

t

h he

r

ein has

not

been

rev

i

ewed,

approved

or

d

is

approved,

nor

has

the

a

cc

ura

c

y

or

adequa

c

y

of

the

i

n

f

or

m

at

i

on

s

et

f

orth

here

i

n

been

pa

ss

ed

upon,

by

the

SE

C

or

any

s

tate

s

e

c

urit

i

es

ad

m

i

n

is

trator.

The Company has filed a Registration Statement on Form S-1 (File No. 333-225147) (including a preliminary prospectus) with the SEC for the offering for which this presentation relates. The Registration Statement has not yet become effective. Before you invest, you should read the preliminary prospectus contained in the Company’s Registration Statement, any amendments or supplements thereto and other documents the Company has filed with the SEC for more complete information about the Company and this offering. The preliminary prospectus and the Registration Statement, as may be amended or supplemented from time to time, may be accessed through the SEC’s website at www.sec.gov. Alternatively, the Company or any dealer participating in the offering will arrange to send you the preliminary prospectus and any amendments or supplements thereto if you request it through Maxim Group LLC, 405 Lexington Ave, New York, NY 10174, Attn: Syndicate Department or by Tel: (212) 895-3745. This presentation contains statistics and other data that has been obtained from or compiled from information made available by third party service providers. The Company has not independently verified such statistics or data. The information presented in this presentation is as of July 10, 2018 unless indicated otherwise.

|

|

2

|

|

Cor

p

o

r

ate

Prof

i

le

CLIA – CAP accredited laboratory located in San Diego Patented technology used for liquid biopsy in cancer Providing actionable information to help physicians make treatment decisions NASDAQ: BIOC, Listed 2014 Market Cap: +/- $15M Shares Out: 68.5M ADTV: ~1,500K High concordance to tissue biopsy Collaborations and partnerships with renowned institutions Planned development of IVD kits for global distribution and use Biocept Completing the answer

|

|

3

|

|

In

v

e

s

tment

High

l

ig

h

ts

Liquid Biopsy Market Estimated at $10+ Billion

|

|

▪

|

Potential to improve cancer patient outcomes

|

|

|

▪

|

Advantages of a simple blood test vs. tissue biopsy (convenience, repeatability, feasibility

benefits, reduced cost and fewer complications)

|

Test Menu Focused Only on Actionable Information

|

|

▪

|

Unique CTC and ctDNA testing

|

|

|

▪

|

Enables detection and monitoring of clinically-validated biomarkers listed in NCCN Guidelines

|

Industry-Leading Test Performance

|

|

▪

|

Multiple clinical studies, publications, and presentations support Biocept’s proprietary Target

Selector™ platform

|

Opportunities for Value-Creating Strategic Partnerships

|

|

▪

|

Potential for U.S. and Global Transactions

|

|

|

▪

|

Commercial and Technology Partnerships

|

Strong Revenue Growth and Health Plan Reimbursement

|

|

▪

|

4-year Revenue CAGR of 236%*

|

|

|

▪

|

Indicative of platform validation and market potential

|

|

|

▪

|

Cost-effective liquid biopsy testing

|

Evolution Toward Distributed Business Model

|

|

▪

|

Actively growing Pathology Partnership (ie TC-PC) business

|

|

|

▪

|

Target Selector Kits for both CTC and ctDNA platforms

|

*FY2014 through FY2017 and includes conversion to accrual revenue recognition in 1Q 2017

|

|

4

|

|

Anti

c

i

p

at

e

d

Mil

e

s

t

o

n

es

Ne

x

t

1

2

Months

✓

Inc

r

ea

s

e

mar

k

et

pen

e

tration

into

eme

r

ging

liquid biop

s

y

s

e

gment

✓

En

t

er

into

str

a

tegic

c

o

mmer

c

ial

and

tech

n

ology

pa

r

tner

s

h

ips

–

Global

and

U.S.

✓

S

ign addit

i

onal

E

mpower

TC

agreements

with

pathologis

t

s

and

major

hos

p

i

t

als

✓

Validate Oncomine™ NGS Panel; Become Thermo Fisher Liquid Biopsy Center of Excellence

✓

Grow sales of blood collection tubes under VWR marketing and distribution agreement

✓

Sign

new

thir

d

-

pa

r

ty

health

plan ag

r

eemen

t

s

and

expand

r

e

lationship

with

B

CBS

✓

P

ublish clinical ca

s

e

studies

✓

Lau

n

ch

additional

on

c

ology

bioma

r

k

e

r

a

s

s

a

ys

|

|

5

|

|

Patients Diagnosed with Cancer in the US

|

|

»

O

v

er

1.68

m

illi

on

new

c

an

c

er

ca

s

es

i

n

2017

»

Brea

s

t,

l

ung,

and

CRC

a

cc

ount

for >3

6

%

of all

new

c

ases

of

c

ancer

»

More

than

610,000

p

eop

l

e

w

il

l

d

i

e

of

c

an

c

er

i

n

2017

»

Brea

s

t,

l

ung,

and

CRC

a

cc

ount

for >4

1

%

of all

c

ancer

r

elated

deaths

»

S

o

u

rc

e:

A

m

erican

Cancer

S

o

c

i

ety

2

0

17

–

SEE

R

S

ta

ti

s

t

i

c

s

|

Estimated New Cases

Prostate 161,360 19% Breast 252,710 30% Lung & bronchus 116,990 14% Lung & bronchus 105,510 12% Colon & rectum 71,420 9% Colon & rectum 64,010 8% Urinary bladder 60,490 7% Uterine corpus 61,380 7% Melanoma of the skin 52,170 6% Thyroid 42,470 5% Kidney & renal pelvis 40,610 5% Melanoma of the skin 34,940 4% Non-Hodgkin lymphoma 40,080 5% Non-Hodgkin lymphoma 32,160 4% Leukemia 36,290 4% Leukemia 25,840 3% Oral cavity & pharynx 35,720 4% Pancreas 25,700 3% Liver & intrahepatic bile duct 29,200 3% Kidney & renal pelvis 23,380 3%

All Sites 836,150 100% All Sites 852,630 100% Estimated Deaths

Lung & bronchus 84,590 27% Lung & bronchus 71,280 25% Colon & rectum 27,150 9% Breast 40,610 14% Prostate 26,730 8% Colon & rectum 23,110 8% Pancreas 22,300 7% Pancreas 20,790 7% Liver & intrahepatic bile duct 19,610 6% Ovary 14,080 5% Leukemia 14,300 4% Uterine corpus 10,920 4% Esophagus 12,720 4% Leukemia 10,200 4% Urinary bladder 12,240 4% Liver & intrahepatic bile duct 9,310 3% Non-Hodgkin lymphoma 11,450 4% Non-Hodgkin lymphoma 8,690 3% Brain & other nervous system 9,620 3% Brain & other nervous system 7,080 3%

All Sites 318,420 100% All Sites 282,500 100%

|

|

6

|

|

Our Team has a Deep & Successful History of Commercializing Innovation

|

|

Michael Nall

President & CEO

|

|

• 25+ years in healthcare sales, marketing and commercial operations

• 16 years in cancer diagnostics and genomics

• Most recently General Manager N. American Sales and Marketing for Clarient — a GE Healthcare Company

|

|

|

|

|

|

|

|

|

Tim Kennedy

CFO & SVP of Operations

|

|

• 30+ years of financial experience, 25+ years in the clinical diagnostics industry

• Instrumental in 2.1B restructuring of Millennium Health, a privately-held urine drug lab

• Numerous senior management positions – helped transform PLUS Diagnostics into largest independent U.S pathology lab; merged National Health Labs and Roche Biomedical Labs to form LabCorp

|

|

|

|

|

|

|

|

Lyle Arnold, Ph.D.

SVP, R&D & CSO

|

|

• Senior R&D leadership at Gen-Probe, Incyte Genomics, Genta

• Founder/ Co-founder Oasis Biosciences, Molecular Biosystems, Aegea Biotechnologies

• Former faculty member, UCSD School of Medicine and member, UCSD Cancer Center

• 50 issued US and more than 160 issued and pending patents worldwide

|

|

|

|

|

|

|

|

Veena Singh, MD

SVP & Sr. Medical Director

|

|

• Board certified AP/CP and Molecular Pathology, UCSD, Cedars Sinai trained

• Numerous publications, serves on CAP committees

• Most recently Medical Director – bioTheranostics

|

|

|

|

|

|

|

|

Michael Terry

SVP, Commercial Operations

|

|

• 25+ years commercial leadership experience in molecular Dx and med-tech companies

• Former GE Healthcare executive, certified in Six Sigma

• Recent experience in liquid biopsy field; EVP commercial operations at both Sequenom and Trovagene

|

|

|

7

|

|

B

i

oce

p

t

is Guid

e

d

by a

B

o

ard

of

V

is

i

on

a

ries

&

Sc

i

entific

In

f

l

u

enc

e

rs

|

Board of Directors

|

|

|

Clinical Advisory Board

|

|

|

|

David F. Hale

|

|

Bruce E. Gerhardt, CPA

|

|

Lee Schwartzberg, MD

|

|

David Carbone, MD

|

|

|

Chairman

|

|

Director, Member Audit Committee

|

|

Chief, Division of Hematology Oncology;

|

|

Director, James Thoracic Center, James

|

|

|

|

|

|

|

Professor of Medicine, University of

|

|

Cancer Hospital and Solove Research

|

|

|

|

|

|

|

Tennessee

|

|

Institute, Ohio State University

|

|

|

M. Faye Wilson, CPA, MBA

|

|

Ivor Royston, MD

|

|

|

|

|

|

|

Lead Independent Director, Chair

|

|

Director, Chair – Science and

|

|

|

|

|

|

|

Audit Committee, Member

|

|

Technology Committee, Member

|

|

Jenny Chang, MD

|

|

Michael Kosty, MD

|

|

|

Compensation Committee, Member

|

|

Nominating and Governance

|

|

Director, Methodist Hospital Cancer

|

|

Scripps Clinic Torrey Pines, San Diego

|

|

|

Nominating and Governance

|

|

Committee

|

|

Center, Houston, Texas

|

|

California

|

|

|

Committee

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Marsha A. Chandler, PhD

|

|

Bruce A. Huebner

|

|

Edgardo Santos, MD

|

|

Melissa Johnson, MD

|

|

|

Director, Chair - Nominating and

|

|

Director, Chair – Compensation

|

|

Medical Director, Lynn Cancer Institute,

|

|

Medical Oncologist, Nashville, Tennessee

|

|

|

Governance Committee, Member

|

|

Committee, Member – Science

|

|

Boca Raton, Florida

|

|

|

|

|

Science and Technology Committee

|

|

and Technology Committee,

|

|

|

|

|

|

|

|

|

Member – Audit Committee

|

|

|

|

|

|

|

|

|

|

|

Fred Hirsch, MD, PhD

|

|

Santosh Kesari, MD, PhD

|

|

|

Michael W. Nall

|

|

|

|

CEO, Int’l Assoc.of Study of Lung Cancer;

|

|

Chair, Dept. of Translational Neuro-oncology

|

|

|

Director, President & CEO

|

|

|

|

Professor of Medicine, University of

|

|

and Neurotherapeutics, John Wayne Cancer

|

|

|

|

|

|

|

Colorado

|

|

Institute, Santa Monica California

|

|

|

|

|

|

|

|

Scientific Advisory Board

|

|

David Berz, MD, PhD

|

|

|

|

|

Beverly Hills Cancer Center

|

|

|

|

|

David Rimm, MD, PhD

|

|

Marileila Garcia, PhD

|

|

Chief Medical Officer – Valkyrie

|

|

|

|

|

Professor of Pathology and Medicine

|

|

Professor, University of Colorado Division

|

|

Pharmacueticals

|

|

|

|

|

(Oncology) Yale University School of

|

|

of Medical Oncology

|

|

Beverly Hills, CA

|

|

|

|

|

Medicine

|

|

|

|

|

|

|

|

|

8

|

|

Pot

e

nt

i

al

L

i

q

u

id

Bio

p

sy

Glo

b

al

Ma

r

k

e

t

Op

p

o

r

tu

n

ity

Liquid Biopsy market segments Today Emerging Future Future Profiling Monitoring Companion Diagnostics Screening including detection of asymptomatic patients ~$9B worldwide market by 2020* ~$2B worldwide market by 2020* ~$5B worldwide market by 2020* ~$7B worldwide market by 2020* “We sized the [global] market opportunity for liquid biopsy as $22B by 2020…” *J.P. Morgan Industry Report - May 27, 2015

|

|

9

|

|

Mole

c

ul

a

r

Profi

l

ing

of

Canc

e

r

Biomar

k

ers

The

Sta

n

d

a

rd

of

C

a

re in P

e

rso

n

a

l

iz

e

d

T

re

a

tme

n

t

Target Selector Biopsy ctDNA CTCs Tissue Biopsy Personalized Molecular Assays Identification of Molecular Biomarkers Required to Qualify Patients for Targeted Therapy

|

|

10

|

|

Per

s

o

n

a

l

i

z

ed

T

r

e

atm

e

nt

Imp

r

o

v

ed

Out

c

om

e

s

Imp

r

o

v

ed

Out

c

om

e

s

5-Year Relative Survival By Year of Diagnosis (All Cancer Sites) 75.0% 70.0% 65.0% 60.0% 55.0% 50.0% 45.0% 40.0% 1975-1977 1978-1980 1981-1983 1987- 1989 1990-1992 1993-1995 1996-1998 1999-2001 2003-2006 2007-2013 2004 2013 the overall cancer death rate in the united stated fell by Evolution of Targeted Therapies for Cancer Treatment NCI Cancer Statistics https://seer.cancer.gov/csr/1975_2014/browse_csr.php?sectionSEL=2&pageSEL=sect_02_table.08.html Herceptin Tarceva Erbitux Zelboraf Xalkori Gilotrif Tagrisso Keytruda Opdivo

|

|

11

|

|

Matching Cancer Patients to Personalized Therapy Remains Challenging

Lives are lost… Cancer proliferates… Time elapses… Treatment effective Treatment not effective Treatment not effective Treatment effective Dollars are wasted… Resources spent… Time elapses…

|

|

12

|

|

Legacy Cancer Diagnostic Tools Do Not Tell The Complete Story

|

|

Advantages

|

Disadvantages

|

Cost

|

|

Traditional Surgical Biopsy

|

▪

Required for diagnosis

▪

Considered standard of care

▪

Source of cancer (histology)

▪

Results for all known oncogenic alterations

▪

Analysis of whole cells

|

▪

Invasive – not appropriate for monitoring

▪

Risk of adverse events

▪

Expensive

▪

Often inadequate for complete molecular

profiling

▪

Only 57% of tissue biopsies have sufficient

tissue for analysis

▪

Can take as much as 30 days for results

▪

Heterogeneity of tumor can lead to false

negatives

▪

Does not account for evolving cancer over time

– snapshot view

|

$15,000 to $45,000

|

|

NGS Based Liquid Biopsy Panels

|

▪

Real time

▪

Non-invasive – appropriate for profiling

▪

Faster availability of results

|

▪

Cannot deliver information on all biomarkers

▪

Varying sensitivity and specificity by biomarker

▪

Expensive

▪

Non-clinically actionable information

▪

One size fits all approach – not individualized

▪

Based solely on DNA fragments – ctDNA

▪

Target market – medical oncology only

|

$6,800

|

|

|

13

|

|

Bio

c

e

p

t

So

l

v

e

s

the

Pro

b

l

e

m

by

Com

b

i

n

i

n

g

the

Be

s

t

of

B

oth

W

o

r

l

d

s

Target Selector Biopsy – Completing the Answer

TM

|

|

The Biocept Advantage

|

|

|

|

✓

Combined results from whole cells (CTCs) and ctDNA from a single blood sample

|

|

|

|

|

|

|

|

|

|

|

|

|

|

✓

Enables results for all types of oncogenic alterations including SNVs, Indels, Fusions, CNVs, and Protein Expression

|

|

|

|

|

|

|

|

|

|

|

|

✓

Turnaround in 7 days or less enabling targeted therapy to move into frontline

|

|

✓

Cost = $1,200

|

|

|

|

|

|

|

|

|

✓

Individually validated all alterations – delivers high concordance with tissue

|

|

|

|

|

|

|

|

|

|

|

✓

Marketed as single tests or profiles enables personalized results for each patient

|

|

|

|

|

|

|

|

|

|

|

|

✓

Value – pay for individual and/or actionable alterations only

|

|

|

|

|

|

|

|

|

|

|

|

✓

Reimbursement advantages

|

|

|

|

|

|

|

|

|

|

|

|

✓

Addresses challenges of tumor heterogeneity

|

|

|

|

|

|

|

|

|

|

|

|

✓

Real time results versus static snapshots

|

|

|

|

|

|

|

|

|

|

|

|

✓

Non-invasive - appropriate for both profiling and monitoring

|

|

|

|

|

|

14

|

|

Patient Case Study – Biocept’s Testing Provides “The Gift of Time”

Biocept’s Target Selector Enables Personalized Treatment for Non-Small Cell Lung Cancer (NSCLC) Patient After Tissue Biopsy Proves Inadequate

Biopsy yields insufficient tissue for biomarker testing Jan 2014 Disease progression confirmed biopsy tissue insufficient for biomarker testing Nov 2014 Biocept’s liquid biopsy detects ALK Translocation Dec 1, 2014 Patient progresses liquid biopsy ordered Biocept liquid biopsy ordered again ALK not detected June 2016 3 cycle of chemo plus cyberKnife therapy completed May 2014 Crizotinib Nivolumab Female patient with history of cancer Jan 2014 Physician orders biocept EGFR and ALK liquid biopsy tests Nov 21, 2014 18months progression free survival on crizotinib June 2016 Patient continues to thrive after several rounds of personalized treatment

|

|

15

|

|

Hig

h

ly

Rel

e

v

a

nt

T

e

s

t

M

e

n

u

:

In

d

ustry

L

e

a

d

i

n

g

Ass

a

y

s

T

rust

e

d

by C

l

i

n

ic

i

a

n

s,

P

a

tie

n

ts,

a

n

d

P

a

y

ers

15 Actionable Biomarkers Found in the Guidelines

|

|

|

|

|

Cancer

|

Target Selector CTC

|

Target Selector ctDNA

|

|

Breast

|

HER2*, ER*, FGFR1, AR, PDL1, PR*

|

ESR1 mutations

|

|

Gastric

|

HER2*, FGFR1

|

|

|

Lung

|

ALK*, ROS1*, MET*, FGFR1, PDL1*, RET

|

EGFR*, KRAS*, BRAF* mutations,

ALK mutations

|

|

Colon

|

EGFR amplification

|

KRAS*, BRAF*, NRAS* mutations

|

|

Prostate

|

AR

, ARv7

|

|

|

Melanoma

|

|

BRAF*, NRAS* mutations

|

* In NCCN guidelines

|

|

|

|

•

|

Biomarkers currently available for clinical use

|

|

•

|

Biomarkers under development

|

|

|

16

|

|

Industry-Leading Assay

Performance

Controlled Validation Concordance (standard criteria) – 99.3%

|

|

|

|

CTC Biomarkers + ctDNA Analytical Validation

|

CTC Biomarkers + ctDNA Analytical Combined

|

|

Data Size (N)

|

4641

|

|

Accuracy

|

4610/4641 (99.3%)

|

|

Sensitivity

|

99.2%

|

|

Specificity

|

99.6%

|

Concordance to Tissue (real-world experience) - 87%

|

|

|

|

CTC Biomarkers + ctDNA Clinical Validation

|

CTC Biomarkers + ctDNA Clinical Combined

|

|

Data Size (N)

|

407

|

|

Accuracy

|

354/407 (87%)

|

|

Sensitivity

|

74%

|

|

Specificity

|

94.6%

|

|

|

17

|

|

Premier Commercial Platform

Completing the answer Biocept 26 issued patents Comprehensive high- performance NCCN Test offering Evolution to Distributed Kit Model EmpowerTC tm Pathology partner ship Strong Growth Driven By Effective Commerical Team Increasing Reimbursement Opportunity for cost leadership

|

|

18

|

|

Differentiated Product Offerings

|

Company

|

CTCs / Whole Cells

|

ctDNA / DNA

Fragments

|

Proprietary

Collection Tube

|

Pathology

Partnership Strategy

|

|

Genomic Health

(GHDX)

|

|

|

|

|

|

Epic Sciences

(private)

|

|

|

|

|

|

Foundation

Medicine (FMI)

|

|

|

|

|

|

Guardant Health

(private)

|

|

|

|

|

|

Biocept (BIOC)

|

|

|

|

|

Biocept Advantage

|

|

▪

|

Leading company commercializing both CTCs and ctDNA from a single blood sample

|

|

|

▪

|

Demonstrated high concordance with tissue

|

|

|

▪

|

Assays for most appropriate tumor target from blood for each biomarker

|

|

|

▪

|

Blood more likely to contain intact cells and is less fragmented than other fluids such as urine

|

|

|

▪

|

Broad, international patent coverage

|

|

|

▪

|

Cost and reimbursement advantages

|

|

|

19

|

|

Biocept

IP Portfolio

|

|

Family 1

|

|

|

|

|

|

MicroChannel for CTC Capture

|

|

1) Issued in US with 11 international counterparts

|

|

|

•

Patent 1 – Recovery of rare cells using microchannel

|

|

•

China – Korea – China - France – Germany – Great Britain

|

|

|

•

Patent 2 – Device for Cell Separation

|

|

Italy – Spain – Hong Kong – Japan – pending Aus. – Can.

|

|

|

|

|

2) Issued in US

|

|

|

|

|

|

|

|

|

Family 2

|

|

|

|

|

|

CTC Capture With Antibody Cocktail

|

|

1) Issued in US with 8 international counterparts

|

|

|

•

Patent 1 – Devices & Methods of Cell Capture

|

|

•

Aus. – France – Germany – Great Britain – Spain – Italy – Hong

|

|

|

Analysis

|

|

Kong - Japan – pending in Can - China

|

|

|

•

Patent 2 – Method and Reagents for Signal

|

|

2) Issued in US, Japan, and China - 4 international cases

|

|

|

Amplification

|

|

pending

|

|

|

|

|

•

Canada – Europe - Hong Kong –Korea

|

|

|

|

|

|

|

|

|

Family 3

|

|

|

|

|

|

Collection Tube

|

|

1) Issued in US

|

|

|

Patent 1 – Use of DU for Anti-Clumping of Biological

|

|

|

|

|

Sample

|

|

|

|

|

|

|

|

|

|

|

Family 4

|

|

|

|

|

|

Switch Blockers for ctDNA Analysis

|

|

1) Issued in US, Australia, and China with 4 international

|

|

|

Patent 1 – Methods for Detecting Nucleic Acid

|

|

counterparts

|

|

|

Sequence Variants

|

|

Europe – Japan – Hong Kong – Korea – Brazil

|

Extensive IP portfolio expected to allow Biocept to monetize IP through out-

licensing and moving to distributed model based on developing diagnostic kits

|

|

20

|

|

Market Development

|

|

|

|

|

Customer Focus

▪

Target select cancer center regions

▪

Focus on community oncologists (80% of cancer care)

▪

Partner with integrated delivery networks and local pathologists

Commercial team

▪

Experienced leadership

▪

Regionally based team with significant oncology sales experience

▪

Managed care expertise

|

Current Salesforce Coverage Sales Mgt. Sales Exec 14 NCCN Center direct sales representatives in the field

|

|

21

|

|

Commercial Adoption

|

|

|

|

|

▪

Executing on strategy to contract with major cancer treatment institutions, GPOs, and distributors

|

|

|

▪

Increasing patient access

|

|

▪

Accelerating adoption of liquid biopsy

|

|

|

▪

Leveraging sales and marketing resources by increasing awareness of Biocept’s liquid biopsy platform within large health systems

|

|

|

▪

Roll out new tests and service offerings including molecular pathology partnering model (ie ―TC-PC‖)

|

|

|

22

|

|

“AND” Campaign Debut at ASCO 2017

Biocept Completing the Answer Target Selector

TM

Liquid Biopsy Increasing Targeted Therapies via Liquid Biopsy eating cancer patients, it’s no longer an either/or world. At Biocept, we’re all about the AND… It’s time to consider molecular information from both tissue AND blood. Biocept is the industry’s first to offer cancer biomarker testing using both ctDNA AND CTCs. Focused on approved NCCN biomarkers, Biocept’s tests include targeted therapy AND immunotherapy markers. Visit Booth #25160 to learn about Biocept’s Liquid Biopsy Technology. www.biocept.com

|

|

23

|

|

EmpowerTC™ Launch at CAP 2017

Biocept Compelting the Answer

TM

Empower TC

TM

Tech-Only Liquid Biopsy Empowering Local Pathologists With World-Class Diagnostics the first in the industry to offer cancer biomarker testing using both ctDNA AND CTCs. Biocept offers specialized tests for approved nccn biomarkers, including targeted therapy and immunotherapy markes. Ctdna braf egfr kras nras ctc alk ar er fgfr1 her2 met pd l1 pr ret ros1 ctc count Our World-Class Lab. Your Expertise. Partner with Biocept for Tech-Only Services that combine our leading CTC Testing Technology with Your Local Knowledge. ALK Gene Rearrangement by FISH:DETECTED (1CTC/16 ml) Case Study:Biocept's liquid Biopsy Enables Personalized Treatment for Non-Small Cell Lung Cancer (NSCLC) Patient After Tissue Biopsy Proves Inadequate. Customer Service 888-332-7729 • FAX 877-300-1761 Biocept,Inc. 5810 Nancy Ridge Drive,San Diego, CA 92121 www.biocept.com C) 2017 Biocept.lnc.. All rights reserved. Target Selector is a trademark of Biocept,Inc. NCCN Guidelines is registered trademark of National Comprehensive Cancer Network, Inc... mktg-0036-02

|

|

24

|

|

Collaboration with Thermo Fisher Scientific

|

|

|

▪

Seek to Validate Thermo Fisher Oncomine™ NGS Panel in Biocept’s CLIA-certified laboratory

▪

Once validated, Biocept to be designated as Thermo Fisher Liquid Biopsy ―Center of Excellence‖ for oncology-focused liquid biopsy initiatives with the companies jointly pursuing various commercial opportunities

▪

Initially target the pharmaceutical industry to provide diagnostic testing services for drug development, clinical trial support, and companion diagnostics (CDx)

▪

Collaboration also intends to evaluate the feasibility of developing best-in-class products based on the integration of Biocept’s Target Selector™ technology with Thermo Fisher’s Ion Torrent™ NGS platform and Oncomine™ liquid biopsy-based NGS panels.

|

Thermo Fisher scientific Agreement in Place for Technology & Commercial Collaboration biocept completing the answer

|

|

25

|

|

Health

Plan Access Continues to Expand with Third Party Contracts

|

|

|

▪

Managed

Care

agreements

i

n

p

l

a

c

e

c

o

v

ering

>

200

m

i

lli

on

liv

es

▪

Ded

ic

ated

managed

c

are

l

eadersh

i

p

w

i

th

y

ears

of

e

x

perien

c

e

from

G

E, LabCorp

and

Quest

▪

Pa

y

o

r

s

have

po

si

t

iv

e

c

overage

for biomarkers listed in guidelines

▪

Aligns with goals of healthcare reform

▪

Improved outcomes while reducing costs

▪

Utilize established CPT codes

|

Multiplan imagine more… acpn America's Choice Provider Network fedmed bluecross blueshield

stratose TM people analytics results

medincrease health plans

tm

scripps

three rivers trpn provider network galaxy health network fortified provider network biocept completing the answer

|

|

26

|

|

Deploying Capital To Fuel Accelerated Gro

wth

Annual Revenue Development Commercial$5.5 $5.0 $4.5 $4.0 $3.5 $3.0 $2.5 $2.0 $1.5 $1.0 $0.5 $0.0 FY 2014 $0.1 FY 2015 $0.6 FY 2016 $3.2 FY 2017 $5.1 Annual Patient Samples 5,500 5,000 4,500 4,000 3,500 3,000 2,500 2,000 1,500 1,000 500 0 FY 2014 661 FY 2015 2,030 FY 2016 4,540 FY 2017 5,051 Commercial Development Research/Evals Note: FY 2017 includes $1.2M related to revenues recognized upon the receipt of payment. Biocept completing the answer

|

|

27

|

|

Biocept – Execution of Value Creation Strategy

|

▪

Investment in technology development of over $100M resulting in full commercialization

▪

Liquid Biopsy moving from early adopter orders to mainstream clinician orders for profiling.

▪

First liquid biopsy (plasma based EGFR testing) now in NCCN guidelines – will increase routine adoption (―AND‖ campaign)

▪

Early adopters now using for monitoring for response or progression indicating that the broader group will follow over coming year

|

▪

14 sales representatives in the field – driving deeper market penetration

▪

Only liquid biopsy company to market to oncologist and pathologist by providing value to both, with a goal of standardization at the institutional level

▪

Paid today by payors as coverage policies exist for Biocept menu, therefore generating revenue – per accession revenue of approx $1000 - $1200.

▪

At beginning of 2016, approx 5% of the cash needs provided by operations, 2017 approx 17%

|

Today Central Lab Collection Tube Commercialization Pathology Partnership 2018 IVD Kit Development 2019 Distributed IVD Kit Platform biocept completing the answer

|

|

28

|

|

|

|

29

|

|

Patented Tar

get Selector™ Platform Enables

both CTC and ctDNA Analysis

|

|

|

Benefits:

▪

CTCs obtained through our platform can be used to molecularly characterize tumor cells and evaluate changes in protein expression with the same techniques done in tissue.

▪

The same specimen can be microscopically analyzed for DNA and protein targets.

▪

All CTC tests are enumerated and can be used in monitoring applications.

|

Antibody Cocktail CTC Isolation CEE-Sure™ Blood Collection Tube for CTCs and ctDNA Patented Microfluidic Channel Detection, Enumeration and Biomarker Analysis all in the Channel FISH for Rearrangements Copy Number Variations ICC for Proteins Buffy Coat CTCS Plasma ctDNA Red Blood Cells

|

|

30

|

|

Patented Target Selector™ Platform Enables both CT

C and ctDNA Analysis

|

|

|

|

Benefits:

|

|

|

▪

Performing PCR upfront and then sequencing delivers added confidence to final result.

|

|

▪

Switch-Blocker technology enriches oncogene mutations and suppresses wild type DNA resulting in ultra-high sensitivity and specificity.

|

|

▪

All ctDNA tests are quantitative and can be used to monitor mutation load.

|

|

▪

NGS technology allows multiplexing capabilities and future panel development.

|

Palsma ctdna buffy coat ctcs red blood cells

DNA Isolation Patented Switch- Blocker Technology Multiplex Selector Enrichment PCR NGS Sanger Sequencing CEE-Sure™Blood Collection Tube for CTCs and ctDNA qPCR Mutation Detection

|

|

31

|

|

Biocept Publications, Posters, and Abstracts

|

|

|

|

|

|

|

|

42 Scientific/Clinical Presentations

▪

9 Peer-Reviewed Journal Publications and 3 Published Case Reports

|

|

▪

23 Poster Presentations at Leading Scientific/Clinical Meetings

|

|

▪

1 Technology Description

|

|

▪

6 Abstracts: Scientific/Clinical Meetings

|

|

|

|

|

|

32

|

|

Partners in Establishing Clinical Utility

|

|

|

|

|

▪

Collaborations with major cancer centers

|

|

|

▪

Participating in medical meetings and symposia

|

|

▪

Engaging KOL Advisors

|

|

▪

Building relationships with patient advocacy groups

|

|

▪

Expanding strategic partnerships with pharma and biotech for personalized diagnostics

|

|

|

|

|

|

33

|

|

Landmark Clinical Trial for Liquid Biopsy

The Addario Lung Cancer Medical Institute

(ALCMI) is an international research consortium driving clinical research via a world-class team of investigators from 25 member institutions in the U.S. UK, and Europe. It is supported by a dedicated centralized research infrastructure including standardized biorepositories and data systems.

|

|

|

|

|

▪

400 Lung Cancer Patients

|

|

▪

25 Treatment Sites (U.S. and International)

|

|

▪

1 Year Study Duration Evaluating Clinical Utility of Biocept Liquid Biopsy Testing

|

|

▪

Up to 2,400 Liquid Biopsy Data Points

|

|

▪

Key Endpoints:

|

|

▪

Demonstrate Concordance vs. Tissue

|

|

▪

Evaluate Response To Drug Therapy

|

|

▪

Identify Resistance Mechanisms

|

|

▪

Predict Treatment Failure Early

|

|

|

34

|

|

Achievements Since Going Public

|

|

|

|

Now

|

At IPO

|

|

✓

Revenue of $5.1M in FY 2017

|

$0 Revenue

|

|

✓

In-house billing and collections

|

Outsourced

|

|

✓

26 Issued Patents

|

1

|

|

✓

16 Members on Commercial Team (14 sales reps)

|

None

|

|

✓

Multiple health plan agreements signed including BCBS plans covering over 200M lives

|

None

|

|

✓

4 Pharma Agreements

|

None

|

|

✓

Nearly 30 ongoing clinical studies & numerous published papers and presentations at medical and scientific conferences

|

Less than 6

|

|

✓

Multitudes of patients helped

|

Minimal

|

|

|

35

|

|

|

Contact: David Moskowitz, Investor Relations

Email: dmoskowitz@biocept.com; Phone: 858-320-8244

|

36

|

|

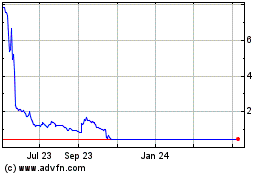

Biocept (NASDAQ:BIOC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Biocept (NASDAQ:BIOC)

Historical Stock Chart

From Apr 2023 to Apr 2024