TIDMFPO

RNS Number : 2913X

First Property Group PLC

23 November 2017

Date: 23 November 2017

On behalf First Property Group plc ("First

of: Property" or "the Group")

Embargoed: 0700hrs

First Property Group plc

Interim Results for the six months to 30 September 2017

First Property Group plc (AIM: FPO), the award winning property

fund manager and investor with operations in the United Kingdom and

Central Europe, today announces its interim results for the six

months to 30 September 2017.

Financial Highlights:

-- Profit before tax up 11% to GBP4.98 million (2016: GBP4.47 million);

-- Contribution to profit by Group Properties was GBP6.08

million (2016: GBP5.84 million) prior to deduction of unallocated

central overheads and tax;

-- Fund management fee revenue up 63% to GBP1.49 million (2016: GBP0.92 million);

-- Cash reduced to GBP10.00 million (2016: GBP14.12 million) due

to investments and capital expenditure of GBP5.14 million;

-- Interim dividend up 5% to 0.42 pence per share (2016: 0.40 pence per share);

-- Adjusted NAV per share up 12% to 51.25 pence per share (2016: 45.86 pence per share);

-- Growth in adjusted NAV, together with dividends paid, since

2006 has equated to 26% per annum on an annualised basis.

Operational Highlights:

-- Total assets under management up 37% to GBP554 million (2016: GBP405 million);

-- Third party assets under management up 63% to GBP382 million (2016: GBP235 million);

-- Weighted average unexpired fund management contract term: 6.08 years (2016: 6.42 years);

-- New fund management contract, Fprop Offices LP: GBP182

million in equity (of which GBP51 million has been invested so far)

to be invested in office properties in England.

Financial Summary:

Unaudited Unaudited Percentage Audited

Six months Six months change Year to

to 30 to 31 March

Sept 2017 30 Sept 2017

2016

-------------------------- ------------ ------------ ----------- ----------

Income Statement:

-------------------------- ------------ ------------ ----------- ----------

Revenue GBP12.09m GBP11.12m +8.7% GBP23.66m

Statutory profit GBP4.98m GBP4.47m +11.4% GBP9.14m

before tax

Diluted earnings

per share 2.84p 2.40p +18.3% 6.61p

Dividend per share 0.42p 0.40p +5.0% 1.55p

Average GBP/EUR

rate 0.881 0.822 +7.2% 0.841

-------------------------- ------------ ------------ ----------- ----------

Balance Sheet

at period end:

-------------------------- ------------ ------------ ----------- ----------

Net assets per

share 35.68p 29.50p +21.0% 34.84p

Adjusted net assets

per share (EPRA

basis) 51.25p 45.86p +11.8% 47.64p

Cash Balances GBP10.00m GBP14.12m -29.2% GBP15.95m

Period end GBP/EUR

rate 0.881 0.865 +1.8% 0.855

-------------------------- ------------ ------------ ----------- ----------

Group Property

portfolio at period

end:

-------------------------- ------------ ------------ ----------- ----------

Group Properties GBP146.3m GBP144.3m +1.4% GBP143.5m

at book value

Group Properties GBP171.9m GBP170.3m +0.9% GBP164.5m

at market value

Gross Debt (non-recourse GBP117.8m GBP122.0m -3.4% GBP117.5m

to the Group)

LTV% 68.6% 71.6% 71.5%

-------------------------- ------------ ------------ ----------- ----------

Total assets under GBP554m GBP405m +36.8% GBP477m

management:

-------------------------- ------------ ------------ ----------- ----------

Poland 40.8% 48.6% 45.4%

United Kingdom 57.0% 46.6% 51.4%

Romania 2.2% 4.8% 3.2%

Commenting on the results, Ben Habib, Chief Executive of First

Property Group, said:

"This has been another excellent six months for First

Property.

"All our funds under management and the properties we own are

performing well and third party assets under management have

increased by 63% since last year.

"Our prospects are excellent, underpinned by our bedrock of

recurring income streams and the opportunities open to us in the

various markets in which we operate.

"We look forward to delivering continued growth and increasing

levels of profitability for our clients and shareholders."

A briefing for analysts will be held at 10:30hrs today at the

headquarters of First Property Group plc, 32 St James's Street,

London, SW1A 1HD. Participants can also attend by telephone on +44

330 336 9104, passcode 787807. A copy of the accompanying investor

presentation can be accessed simultaneously at

http://www.fprop.com/media-news/presentations/. An audio recording

of the call will subsequently be posted on the company website,

www.fprop.com/audio/.

For further information please contact:

First Property Group plc Tel: 020 7340

0270

Ben Habib (Chief Executive www.fprop.com

& Chief Investment Officer)

George Digby (Group Finance

Director)

Jeremy Barkes (Director,

Business Development)

Arden Partners Tel: 020 7614

5900

Chris Hardie/ Ben Cryer

Redleaf Communications Tel: 020 7382

4747

Robin Tozer/ Elisabeth Cowell firstproperty@redleafpr.com

Notes to Investors and Editors:

First Property Group plc is an award winning property fund

manager and investor with operations in the United Kingdom and

Central Europe. Around one third of the shares in the Company are

owned by management and their families.

Its focus is on higher yielding commercial property with

sustainable cash flows. The company is flexible and takes an active

approach to asset management. Its earnings are derived from:

-- Fund management - via its FCA regulated and AIFMD approved

subsidiary, First Property Asset Management Ltd (FPAM), which earns

fees from investing for third parties in property. FPAM currently

manages twelve funds which are invested across the United Kingdom,

Poland and Romania.

-- Group Properties - principal investments by the Group, to

earn a return on its own capital, usually in partnership with third

parties. Investments include ten directly held properties in Poland

and Romania (including five held by Fprop Opportunities plc [FOP],

in which the Group is currently the majority shareholder), and

non-controlling interests in nine other funds managed by FPAM.

Listed on AIM the Company has offices in London, Warsaw and

Bucharest. Further information about the Company and its products

can be found at: www.fprop.com.

CHIEF EXECUTIVE'S STATEMENT

Performance:

I am pleased to report interim results for the six months ended

30 September 2017.

Revenue earned by the Group amounted to GBP12.09 million (2016:

GBP11.12 million) yielding a profit before tax of GBP4.98 million

(2016: GBP4.47 million). Diluted earnings per share were 2.84 pence

(2016: 2.40 pence).

The Euro was on average 7.2% stronger versus Sterling during the

period at an average rate of GBP0.881 (2016: GBP0.822). This

resulted in Group profit before tax being GBP392,000 higher than it

would have been on a constant currency basis.

The Group ended the period with reported net assets of GBP44.91

million (2016: GBP36.43 million). It is the accounting policy of

the Group to carry its properties and interests in associates at

the lower of cost or market value. The net assets of the Group when

adjusted to their market value less any deferred tax liabilities,

stood at GBP60.84 million (2016: GBP54.43 million). The growth in

adjusted net assets, together with dividends paid, since 2006 has

equated to 26% per annum on an annualised basis.

Group cash balances stood at GBP10.00 million (2016: GBP14.12

million) at the period end. The reduction in cash balances was

primarily attributable to investments of GBP3.48 million and

capital expenditure of GBP1.66 million. Of the cash held, GBP2.83

million (2016: GBP5.34 million) was held by FOP (67.3% owned by the

Group) and GBP750,000 was held by Corp Sp. z o.o. (90% owned by the

Group), the property management company for Blue Tower in

Warsaw.

Dividend:

The Directors have resolved to increase the interim dividend by

5% to 0.42 pence per share (2016: 0.40 pence per share) which will

be paid on 30 December 2017 to shareholders on the register at 2

December 2017, with an ex-dividend date of 1 December 2017.

Review of Operations:

PROPERTY FUND MANAGEMENT - (First Property Asset Management Ltd

or FPAM)

As at 30 September 2017 aggregate assets under management,

calculated by reference to independent third party property

valuations, stood at GBP554 million (2016: GBP405 million),

including some GBP172 million (2016: GBP170 million) of properties

held by the Group and FOP. Of these 57% were located in the UK, 41%

in Poland, and 2% in Romania.

Fund management fees are generally levied monthly by FPAM by

reference to the value of properties under management. In the case

of Fprop Offices LP the Group does not receive any fees but instead

shares in the profits earned by the fund.

Revenue earned from fund management amounted to GBP1.49 million

(2016: GBP0.92 million), resulting in a profit before unallocated

central overheads and tax of GBP804,000 (2016: GBP273,000). This

represents 11.7% (2016: 4.5%) of Group profit before unallocated

central overheads and tax.

At the period end FPAM's fund management fee income, excluding

performance fees, was being earned at an annualised rate of GBP2.64

million (2016: GBP1.90 million), a year on year increase of

38.9%.

FPAM's weighted average unexpired fund management contract term

at the period end was 6.08 years (2016: 6.42 years).

Third party funds under management grew by some 22% since 31

March 2017 to GBP382 million, and by some 63% since 30 September

2016.

During the period we were awarded a new fund management contract

by Fprop Offices LP, to invest in office properties in England. The

fund received equity commitments of GBP182 million and is entitled

to borrow up to a further GBP80 million enabling it to invest up to

GBP262 million in property. Of this amount we have thus far

invested GBP51 million, leaving a further GBP211 million to be

invested.

The reconciliation of movement in funds under management during

the period is shown below:

Funds managed Group Totals

for third parties Properties

(including funds (including

in which the Group FOP)

is a minority

shareholder)

---------------- ----------------------------------- ----------------- -----------------

UK CEE Total No. All No. AUM No.

GBPm. GBPm. GBPm. of CEE of GBPm. of

prop's GBPm. prop's prop's

---------------- ------- ------- ------- -------- ------- -------- ------- --------

As at 1

April 2017 245.3 67.7 313.0 63 164.5 10 477.5 73

---------------- ------- ------- ------- -------- ------- -------- ------- --------

Purchases 15.4 - 15.4 3 - - 15.4 3

New fund

mandates 51.1 - 51.1 3 - - 51.1 3

Property

sales - (3.7) (3.7) (3) - - (3.7) (3)

Capital

expenditure - - - - 1.8 - 1.8 -

Property

depreciation - - - - (1.1) - (1.1) -

Property

revaluation 4.1 - 4.1 - 1.6 - 5.7 -

FX revaluation - 2.0 2.0 - 5.1 - 7.1 -

As at 30

Sept 2017 315.9 66.0 381.9 66 171.9 10 553.8 76

---------------- ------- ------- ------- -------- ------- -------- ------- --------

FPAM now manages twelve (2016: nine) closed-end funds. A brief

synopsis of the value of assets and maturity of each of these

vehicles is set out below:

Fund Country Fund Assets % of Assets

of investment expiry under total under

management assets management

at market under at market

value management value

at at

30 Sept 30 Sept

2017 2016

----------- --------------- -------- ------------- ------------ ------------

SAM & DHOW UK Rolling * * *

RPT Poland Aug GBP7.1m 1.3% GBP7.0m

2020

5PT Poland Dec GBP8.7m 1.6% GBP8.5m

2022

UK PPP UK Feb GBP93.3m 16.9% GBP93.1m

2022

PDR UK May Nil - Nil

2018

SIPS UK Jan GBP156.1m 28.2% GBP95.3m

2025

FRS Romania Sept GBP6.7m 1.2% GBP10.2m

2025

FGC Poland Aug GBP21.2m 3.8% GBP20.4m

2024

FKR Poland Apr GBP22.3m 4.0% -

2024

SPEC OPPS UK Jan GBP15.4m 2.8% -

2027

OFFICES UK Jun GBP51.1m 9.2% -

2024 (Commitment

of GBP182m)

Sub Total GBP381.9m 69.0% GBP234.5m

----------- --------------- -------- ------------- ------------ ------------

FOP Poland Oct GBP73.9m 13.3% GBP67.0m

2025

GRP PROPS Poland n/a GBP98.0m 17.7% GBP103.3m

& Romania

----------- --------------- -------- ------------- ------------ ------------

Sub Total GBP171.9m 31.0% GBP170.3m

----------- --------------- -------- ------------- ------------ ------------

Total GBP553.8m 100% GBP404.8m

----------- --------------- -------- ------------- ------------ ------------

* Not subject to recent revaluation

GROUP PROPERTIES

Group Properties comprises ten commercial properties in Poland

and Romania, five of which are held by FOP (in which the Group is

currently the majority shareholder), and non-controlling interests

in nine of the twelve funds managed by FPAM, as set out in the

tables below.

It is the Group's policy to carry its properties and interests

in associates at the lower of cost or market value for accounting

purposes, and to recognise dividends when received.

1. Directly held properties (including five held by FOP) held at 30 September 2017:

Country No. Book Market Contribution Contribution

of properties value value to Group to Group

profit profit

before before

tax tax

period period

to to

30 Sept 30 Sept

2017 2016

------------ --------------- ---------- ---------- --------------- ------------------

Poland 3 GBP79.6m GBP92.5m GBP3.46m GBP3.15m

Romania 2 GBP4.2m GBP5.5m GBP0.46m GBP0.58m

FOP (all 5 GBP62.5m GBP73.9m GBP1.90m GBP1.92m

in Poland)

------------ --------------- ---------- ------------ ------------- ------------------

Total 10 GBP146.3m GBP171.9m GBP5.82m GBP5.65m

------------ --------------- ---------- ------------ ------------- ------------------

2. Non-controlling interests in funds and joint ventures managed by FPAM at 30 September 2017:

Fund % owned Book Current Group's Group's

by value market share share

First of First value of pre-tax of pre-tax

Property Property's of holdings profits profits

Group share earned earned

in by fund by fund

fund 30 Sept 30 Sept

2017 2016

----- ---------- ------------- ------------- ------------ ------------

Interest in associates

5PT 37.8% GBP664,000 GBP1,151,000 GBP56,000 GBP61,000

RPT 28.6% GBP218,000 GBP270,000 GBP27,000 GBP26,000

FRS 24.1% GBP649,000 GBP803,000 GBP482,000 GBP83,000

FGC 28.2% GBP1,784,000 GBP1,987,000 GBP134,000 GBP101,000

FKR 18.1% GBP1,160,000 GBP1,598,000 GBP41,000 -

----- ---------- ------------- ------------- ------------ ------------

Sub Total GBP4,475,000 GBP5,809,000 GBP740,000 GBP271,000

----------------- ------------- ------------- ------------ ------------

Investments

UK PPP 0.9% GBP884,000 GBP884,000 GBP33,000 GBP18,000

PDR 5.0% GBP13,000 GBP13,000 - -

SPEC OPPS 4.8% GBP760,000 GBP760,000 - -

OFFICES 1.6% GBP908,000 GBP908,000 - -

OTHER GBP693,000 GBP693,000 - -

----------------- ------------- ------------- ---------- ----------

Sub Total GBP3,258,000 GBP3,258,000 GBP33,000 GBP18,000

----------------- ------------- ------------- ---------- ----------

Total GBP7,733,000 GBP9,067,000 GBP773,000 GBP289,000

------ ------------- ------------- ----------- -----------

Revenue from Group Properties amounted to GBP10.60 million

(2016: GBP10.20 million), generating a profit before unallocated

central overheads and tax of GBP6.08 million (2016: GBP5.84

million) and representing 88.3% (2016: 95.5%) of Group profit

before unallocated central overheads and tax.

The contribution to earnings by the Group's ten properties,

including the five held by FOP (in which the Group held 67.3%), is

detailed below. The table below excludes the Group's

non-controlling interests in funds managed by FPAM. The reduction

in net operating income is very largely as a result of the sale of

a Group property located in Ploiesti, Romania in March 2017.

Six months to Six months

30 Sept 2017 to

30 Sept

2016

EURm. EURm.

--------------------- -------------- -----------

Net operating

income (NOI) 9.41 9.66

Interest expense

on bank loans/

finance leases (1.59) (1.67)

--------------------- -------------- -----------

NOI after interest

expense 7.82 7.99

Current tax (0.71) (0.61)

Debt amortisation (3.66) (3.60)

Capital expenditure (2.10) (0.46)

--------------------- -------------- -----------

Free cash 1.35 3.32

--------------------- -------------- -----------

Market value

of properties EUR195.08 EUR196.87

Average yield

on market value 9.6% 9.8%

Bank loans/ finance

leases outstanding EUR133.74 EUR141.00

Loan to value

(LTV) 68.6% 71.6%

Weighted average 3.13 yrs 3.73 yrs

unexpired lease

term (WAULT)

Vacancy rate 1.5% 1.8%

--------------------- -------------- -----------

The loans secured against these ten properties are each held in

separate non-recourse special purpose vehicles.

In order to mitigate the effects of potential interest rate

rises we have fixed the interest rate on around 40% of the loans. A

one percentage point increase from current market interest rates

would increase the annual interest bill by GBP563,000 per annum

(2016: GBP602,000). The current weighted average borrowing cost is

2.46% (2016: 2.59%) per annum.

Fprop Opportunities plc (FOP):

The contribution by FOP to Group profit before tax amounted to

GBP1.51 million (2016: GBP1.65 million).

Galeria Ostrowiec, FOP's largest asset, was revalued by CBRE at

EUR35.1 million, an uplift of EUR7.1 million (GBP6.26 million) from

its previous appraised value, following the completion of the works

to create some 4,800 m(2) of additional retail space at the centre.

Capital expenditure incurred to date in this development amounted

to GBP3.2 million, all of which has been capitalised. The net

uplift in value is not reflected in the Group's accounts because of

the Group's accounting policy to hold its assets at the lower of

cost or market value. The new tenants are now completing their

respective fit-outs and are expected to commence trading over the

next few months. FOP's net operating income will increase as a

result of this expansion and the new tenancies.

The Group has continued to sell shares held by it in FOP because

it is not the Group's business model to be a controlling

shareholder in funds which it manages and to simplify the Group's

structure. Sales of shares in FOP during the period resulted in a

capital profit for the Group of GBP101,000 (2016: GBP144,000). At

the period end the Group held 67.3% (31 March 2017: 69.2%) of the

issued share capital in FOP.

Associates and Investments:

The Group's non-controlling interests in funds managed by FPAM

contributed GBP740,000 (2016: GBP271,000) to Group profit before

tax prior to the deduction of unallocated central overheads. The

bulk of this increase (GBP397,000) was received from Fprop Romanian

Supermarkets Ltd, which sold three of its nine properties and

distributed the profit to shareholders.

Commercial Property Markets Outlook

Poland:

GDP growth in Poland is expected to exceed 4% in 2017 and

continues to exceed that of most other EU nations. Inflation has

picked up but at just over 2% per annum is manageable. Government

debt remains low by international standards at some 54% of GDP.

Investor demand for commercial property remains high. Volumes

are expected to match or exceed that of 2016 (around EUR5 billion),

itself the second highest year on record. Rental growth has been

more elusive, particularly in some sub sectors, such as offices in

Warsaw, where there has been considerable new development in recent

years. Capital values for good secondary property remain

attractive, yielding around one third more than equivalent property

in Western Europe at around 7-9% per annum.

Romania:

The economic outlook for Romania is at its best since before the

credit crunch. GDP growth accelerated to 8.8% year on year in the

third quarter just ended and is comfortably set to exceed 4% for

the year.

Investor demand for commercial property continues to improve but

volumes remain slim. Around EUR1 billion of commercial property is

expected to transact in 2017. The occupier market is picking up

too, as the economy continues to expand but, as in Poland, rental

growth remains elusive given the scale of new development.

Bank lending margins are beginning to reduce, which should boost

investment demand for commercial property.

United Kingdom:

The Bank of England's recent decision to raise interest rates by

0.25% should have little impact on the commercial property market

given the Bank's continued loose monetary policy program, and the

continued limited availability of bank debt.

The buying window for commercial property which we identified

last year following the UK's referendum on its membership of the EU

remains opens for specific kinds of property, in particular the

larger institutional lot sizes.

We therefore remain bullish about the prospects of the UK

commercial property market and particularly Fprop Offices LP which

is currently in the process of investing its capital

commitments.

Current Trading and Prospects

This has been another excellent six months for First

Property.

All our funds under management and the properties we own are

performing well and third party assets under management have

increased by 63% since last year.

Our prospects are excellent, underpinned by our bedrock of

recurring income streams and the opportunities open to us in the

various markets in which we operate.

We look forward to delivering continued growth and increasing

levels of profitability for our clients and shareholders.

Ben Habib

Chief Executive

23 November 2017

CONSOLIDATED INCOME STATEMENT

for the six months to 30 September 2017

Six months Six months Year to

to 30 to

Sept 2017

(unaudited) 30 Sept 31 March

2016 2017

(unaudited) (audited)

-------------------------- --- ------------- ------------- -----------

Total Total Total

results results results

-------------------------- --- ------------- ------------- -----------

GBP'000 GBP'000 GBP'000

Revenue 12,089 11,121 23,663

-------------------------- --- ------------- ------------- -----------

Cost of sales (2,179) (1,893) (5,065)

Gross profit 9,910 9,228 18,598

Profit on sale of

an investment property - - 890

Profit on sale of

FOP shares 101 144 552

Reversal of impairment

loss /(impairment

loss) to

investment properties 6 167 142 (219)

Operating expenses (4,415) (3,897) (8,207)

Operating profit 5,763 5,617 11,614

Share of results in

associates 7 740 271 519

Distribution income 33 18 60

Interest income 3 75 81 135

Interest expense 3 (1,631) (1,514) (3,191)

Profit before tax 4,980 4,473 9,137

Tax charge 4 (1,122) (1,220) (547)

-------------------------- --- ------------- ------------- -----------

Profit for the period 3,858 3,253 8,590

Attributable to:

Owners of the parent 3,364 2,849 7,833

Non-controlling interest 494 404 757

3,858 3,253 8,590

Earnings per share

Basic 5 2.90p 2.46p 6.75p

Diluted 5 2.84p 2.40p 6.61p

-------------------------- --- ------------- ------------- -----------

CONDENSED CONSOLIDATED STATEMENT OF

COMPREHENSIVE INCOME

for the six months to 30 September 2017

Six months Six months Year to

to 30 to 31 March

Sept 2017 30 Sept 2017

2016

(unaudited) (unaudited) (audited)

----------------------------------- ------------ ------------ ----------

GBP'000 GBP'000 GBP'000

----------------------------------- ------------ ------------ ----------

Profit for the period 3,858 3,253 8,590

------------------------------------ ------------ ------------ ----------

Other comprehensive

income

Exchange difference

on retranslation of

foreign subsidiaries (1,245) 286 2,008

Revaluation of available-for-sale

financial assets - - (29)

Taxation - - -

Total comprehensive

income for the period 2,613 3,539 10,569

------------------------------------ ------------ ------------ ----------

Total comprehensive

income for the period:

Owners of the parent 2,306 3,321 9,974

Non-controlling interest 307 218 595

------------------------------------ ------------ ------------ ----------

2,613 3,539 10,569

----------------------------------- ------------ ------------ ----------

All operations are continuing.

CONDENSED CONSOLIDATED BALANCE SHEET

as at 30 September 2017

Notes As at As at As at

30 Sept 30 Sept 31 March

2017 (unaudited) 2016 (unaudited) 2017

(audited)

------------------------------ ------ ------------------ ------------------ -----------

GBP'000 GBP'000 GBP'000

Non-current assets

Goodwill 153 153 153

Investment properties 6 130,892 129,333 128,428

Property, plant and

equipment 78 181 97

Interest in associates 7a 4,475 3,098 4,347

Other financial assets 7b 3,258 918 897

Other receivables 8 1,905 139 2,108

Deferred tax assets 4,213 3,430 4,341

------------------------------ ------ ------------------ ------------------ -----------

Total non-current

assets 144,974 137,252 140,371

Current assets

Inventories - land

and buildings 15,391 14,998 15,115

Current tax assets 78 123 160

Trade and other receivables 8 5,308 5,307 4,890

Cash and cash equivalents 9,998 14,115 15,946

------------------------------ ------ ------------------ ------------------ -----------

Total current assets 30,775 34,543 36,111

Current liabilities

Trade and other payables 9 (7,283) (7,685) (9,848)

Financial liabilities 10a (8,861) (8,383) (19,641)

Current tax liabilities (165) (187) (314)

------------------------------ ------ ------------------ ------------------ -----------

Total current liabilities (16,309) (16,255) (29,803)

------------------------------ ------ ------------------ ------------------ -----------

Net current assets 14,466 18,288 6,308

------------------------------ ------ ------------------ ------------------ -----------

Total assets less

current liabilities 159,440 155,540 146,679

------------------------------ ------ ------------------ ------------------ -----------

Non-current liabilities

Financial liabilities 10b (111,104) (115,519) (100,043)

Deferred tax liabilities (3,423) (3,593) (3,208)

Net assets 44,913 36,428 43,428

------------------------------ ------ ------------------ ------------------ -----------

Equity

Called up share capital 1,166 1,166 1,166

Share premium 5,785 5,777 5,781

Share-based payment

reserve 203 203 203

Foreign exchange translation

reserve (1,039) (1,679) 19

Investment revaluation

reserve (67) (38) (67)

Retained earnings 35,343 28,789 33,311

------------------------------ ------ ------------------ ------------------ -----------

Equity attributable

to the owners of the

parent 41,391 34,218 40,413

Non-controlling interest 3,522 2,210 3,015

------------------------------ ------ ------------------ ------------------ -----------

Total equity 44,913 36,428 43,428

------------------------------ ------ ------------------ ------------------ -----------

Net assets per share 5 35.68p 29.50p 34.84p

------------------------------ ------ ------------------ ------------------ -----------

CONSOLIDATED STATEMENT OF

CHANGES IN EQUITY

for the six months to 30 September 2017

Share Share Share Foreign Purchase Investment Retained Non-controlling Total

Capital Premium Based Exchange of own Revaluation Earnings Interest

Payment Translation Shares Reserve

Reserve Reserve

-------------------- -------- -------- -------- ------------ --------- ------------ --------- ---------------- --------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------- -------- -------- -------- ------------ --------- ------------ --------- ---------------- --------

At 1 April 2016 1,166 5,773 203 (2,151) (103) (38) 27,334 1,906 34,090

-------------------- -------- -------- -------- ------------ --------- ------------ --------- ---------------- --------

Profit for the

period - - - - - - 3,253 - 3,253

Fair value (or - - - - - - - - -

revaluation) gains

on

available-for-sale

financial assets to

profit or loss

Movement on foreign

exchange - - - 472 - - - (186) 286

Total comprehensive

income - - - 472 - - 3,253 (186) 3,539

Change in

proportion held by

non-controlling

interests - - - - - - - 100 100

Sale of treasury

shares - 4 - - 2 - - - 6

Non-controlling

interest - - - - - - (404) 404 -

Dividends paid - - - - - - (1,293) (14) (1,307)

At 30 Sept 2016 1,166 5,777 203 (1,679) (101) (38) 28,890 2,210 36,428

-------------------- -------- -------- -------- ------------ --------- ------------ --------- ---------------- --------

Profit for the

period - - - - - - 5,337 - 5,337

Fair value (or

revaluation) gains

on

available-for-sale

financial assets

to profit or loss - - - - - (29) - - (29)

Movement on foreign

exchange - - - 1,698 - - - 24 1,722

-------------------- -------- -------- -------- ------------ --------- ------------ --------- ---------------- --------

Total comprehensive

income - - - 1,698 - (29) 5,337 24 7,030

Change in

proportion held by

non-controlling

interests - - - - - - - 456 456

Sale of treasury

shares - 4 - - 2 - - - 6

Non-controlling

interest - - - - - - (353) 353 -

Dividends paid - - - - - - (464) (28) (492)

-------------------- -------- -------- -------- ------------ --------- ------------ --------- ---------------- --------

At 1 April 2017 1,166 5,781 203 19 (99) (67) 33,410 3,015 43,428

-------------------- -------- -------- -------- ------------ --------- ------------ --------- ---------------- --------

Profit for the

period - - - - - - 3,858 - 3,858

Fair value (or - - - - - - - - -

revaluation) gains

on

available-for-sale

financial assets to

profit or loss

Movement on foreign

exchange - - - (1,058) - - - (187) (1,245)

Total comprehensive

income - - - (1,058) - - 3,858 (187) 2,613

Change in

proportion held by

non-controlling

interests - - - - - - - 224 224

Sale of treasury

shares - 4 - - 2 - - - 6

Non-controlling

interest - - - - - - (494) 494 -

Dividends paid - - - - - - (1,334) (24) (1,358)

-------------------- -------- -------- -------- ------------ --------- ------------ --------- ---------------- --------

At 30 Sept 2017 1,166 5,785 203 (1,039) (97) (67) 35,440 3,522 44,913

-------------------- -------- -------- -------- ------------ --------- ------------ --------- ---------------- --------

CONDENSED CONSOLIDATED CASH FLOW STATEMENT

for the six months to 30 September 2017

Six months Six months Year to

to to 30

30 Sept

2016 (unaudited)

30 Sept 31 March

2017 (unaudited) 2017

(audited)

----------------------------------- ------ ------------------- ------------------ ------------

Notes GBP'000 GBP'000 GBP'000

----------------------------------- ------ ------------------- ------------------ ------------

Cash flows from operating

activities

Operating profit 5,763 5,617 11,614

Adjustments for:

Depreciation of investment

property, and property,

plant & equipment 1,138 976 1,960

Profit on the sale of

an investment property - - (890)

Profit on the sale of

FOP shares (101) (144) (552)

(Reversal of impairment

loss)/ impairment loss

to investment properties 6 (167) (142) 219

(Increase)/ decrease

in inventories (149) (135) (130)

(Increase)/ decrease

in trade and other receivables (122) (122) 305

(Decrease)/ increase

in trade and other payables (2,649) (364) 1,637

Other non-cash adjustments 86 (112) 615

Cash generated from

operations 3,799 5,574 14,778

Income taxes paid (727) (667) (1,156)

----------------------------------- ------ ------------------- ------------------ ------------

Net cash flow from operating

activities 3,072 4,907 13,622

----------------------------------- ------ ------------------- ------------------ ------------

Cash flow from investing

activities

Capital expenditure

on investment properties (1,663) (176) (1,990)

Proceeds from partial

disposal of available-for-sale

assets 612 153 239

Purchase of property,

plant and equipment (13) (16) (26)

Consideration from the

sale of FOP shares 326 244 1,108

Purchase of investments (2,361) - -

Investment in shares

of new associates - - (1,119)

Interest received 3 75 81 135

Dividends from associates 7a - 64 96

Distributions received 33 18 64

Net cash flow (used

in)/ from investing

activities (2,991) 368 (1,493)

----------------------------------- ------ ------------------- ------------------ ------------

Cash flow from financing

activities

Net repayment of shareholder

loans in subsidiaries (158) (75) (227)

Proceeds from bank loan - - -

Repayment of finance

leases/ bank loans (3,243) (2,958) (6,075)

Repayment from the sale

of FOP shareholder loan 131 152 534

Short term loan to an

associate - 5,083 5,083

Sale of shares held

in Treasury 6 6 12

Interest paid (1,486) (1,455) (3,100)

Dividends paid (1,334) (1,293) (1,757)

Dividends paid to non-controlling

interest (24) (14) (42)

----------------------------------- ------ ------------------- ------------------ ------------

Net cash flow (used

in)/ from financing

activities of continuing

operations (6,108) (554) (5,572)

Net (decrease)/ increase

in cash and cash equivalents (6,027) 4,721 6,557

----------------------------------- ------ ------------------- ------------------ ------------

Cash and cash equivalents

at the beginning of

period 15,946 8,975 8,975

----------------------------------- ------ ------------------- ------------------ ------------

Currency translation

gains/ (losses) on cash

and cash equivalents 79 419 414

----------------------------------- ------ ------------------- ------------------ ------------

Cash and cash equivalents

at the end of the period 9,998 14,115 15,946

----------------------------------- ------ ------------------- ------------------ ------------

NOTES TO THE ACCOUNTS

for the six months ended 30 September 2017

1. Basis of Preparation

-- These interim consolidated financial statements for the six

months ended 30 September 2017 have not been audited or reviewed

and do not constitute statutory accounts within the meaning of

section 435 of the Companies Act 2006. They have been prepared in

accordance with the Group's accounting policies as set out in the

Group's latest annual financial statements for the year ended 31

March 2017 and are in compliance with IAS 34 "Interim Financial

Reporting". These accounting policies are drawn up in accordance

with International Accounting Standards (IAS) and International

Financial Reporting Standards (IFRS) as issued by the International

Accounting Standards Board and as adopted by the European Union

(EU).

-- The comparative figures for the financial year ended 31 March

2017 are not the full statutory accounts for the financial year but

are abridged from those accounts prepared under IFRS which have

been reported on by the Group's auditors and delivered to the

Registrar of Companies. The report of the auditors was unqualified,

did not include references to any matter to which the auditors drew

attention by way of emphasis without qualifying their report and

did not contain a statement under section 498 (2) or (3) of the

Companies Act 2006.

-- These interim financial statements were approved by a

committee of the Board on 22 November 2017.

2. Segmental Analysis

Segment reporting six months to 30 September 2017

Head office costs and overheads that are common to all segments

are shown separately under unallocated central costs. The staff

incentive accrual is included under unallocated central costs but

will be reallocated across all segments at the year end.

Fund Management Group Properties Division

Division

--------------------- --------------------- --------------------------------------- --------------------- --------

Property Group properties Group fund Unallocated central TOTAL

fund management properties ("FOP") overheads

--------------------- --------------------- ----------------- -------------------- --------------------- --------

GBP000 GBP000 GBP000 GBP'000 GBP'000

Rental income - 6,262 3,000 - 9,262

Service charge

income - 626 708 - 1,334

Asset management

fees 1,304 - - - 1,304

Performance fees 189 - - - 189

Total Revenue 1,493 6,888 3,708 - 12,089

Depreciation and

amortisation (19) (997) (122) - (1,138)

--------------------- --------------------- ----------------- -------------------- --------------------- --------

Operating profit 804 4,526 2,334 (1,901) 5,763

Share of results in

associates - 740 - - 740

Distribution income - 33 - - 33

Interest income - 21 54 - 75

Interest expense - (749) (882) - (1,631)

--------------------- --------------------- ----------------- -------------------- --------------------- --------

Profit/ (loss)

before tax 804 4,571 1,506 (1,901) 4,980

--------------------- --------------------- ----------------- -------------------- --------------------- --------

Analysed as:

Underlying profit/

(loss) before tax

before adjusting

for the following

items: 615 5,111 1,465 (486) 6,705

Sale of FOP shares - 101 - - 101

FPG's share in an

associates profit

from the sale of

investment

properties - 397 - - 397

Reversal of

impairment loss to

investment

properties - - 167 - 167

Performance and

related fees 189 - - - 189

Depreciation - (870) - - (870)

Staff incentive

accrual - - - (1,256) (1,256)

Realised foreign

currency (losses)/

gains - (168) (126) (159) (453)

Profit/ (loss)

before tax 804 4,571 1,506 (1,901) 4,980

--------------------- --------------------- ----------------- -------------------- --------------------- --------

Revenue for the six months to 30 September 2017 from continuing

operations consists of revenue arising in the United Kingdom 8%

(2016: 6%) and Central and Eastern Europe 92% (2016: 94%) and all

relates solely to the Group's principal activities.

Segment reporting six months to 30 September 2016

Fund Group Properties

Management Division

Division

--------------------- ------------ -------------------------- ------------ --------

Property Group Group Unallocated TOTAL

fund properties fund central

management properties overheads

("FOP")

--------------------- ------------ ------------ ------------ ------------ --------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Rental income - 5,960 2,640 - 8,600

Service charge

income - 840 763 - 1,603

Asset management

fees 918 - - - 918

Performance - - - - -

fees

--------------------- ------------ ------------ ------------ ------------ --------

Total revenue 918 6,800 3,403 - 11,121

--------------------- ------------ ------------ ------------ ------------ --------

Depreciation

and amortisation (17) (864) (95) - (976)

--------------------- ------------ ------------ ------------ ------------ --------

Operating profit 273 4,566 2,427 (1,649) 5,617

Share of results

in associates - 271 - - 271

Distribution

income - 18 - - 18

Interest income - 51 20 10 81

Interest expense - (719) (795) - (1,514)

Profit/ (loss)

before tax 273 4,187 1,652 (1,639) 4,473

--------------------- ------------ ------------ ------------ ------------ --------

Analysed as:

Underlying

profit/ (loss)

before tax

before adjusting

for the following

items: 273 5,091 1,576 (445) 6,495

Reversal of

impairment

loss to investment

properties - - 142 - 142

Sale of FOP

shares - 144 - - 144

Performance - - - - -

and related

fees

Depreciation - (812) - - (812)

Provision - - - - -

Staff incentive

accrual - - - (1,113) (1,113)

Realised foreign

currency gains/

(losses) - (236) (66) (81) (383)

Profit/ (loss)

before tax 273 4,187 1,652 (1,639) 4,473

--------------------- ------------ ------------ ------------ ------------ --------

Segment reporting year to 31 March 2017

Fund Group Properties

Management Division

Division

----------------------- ------------ -------------------------- ------------ ----------

Property Group Group Unallocated TOTAL

fund properties fund central

management properties overheads

("FOP")

----------------------- ------------ ------------ ------------ ------------ ----------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Rental income - 12,165 5,229 - 17,394

Service charge

income - 2,464 1,759 - 4,223

Asset management

fees 2,046 - - - 2,046

Performance - - - - -

fees

----------------------- ------------ ------------ ------------ ------------ ----------

Total revenue 2,046 14,629 6,988 - 23,663

----------------------- ------------ ------------ ------------ ------------ ----------

Depreciation

and amortisation (41) (1,786) (133) - (1,960)

----------------------- ------------ ------------ ------------ ------------ ----------

Operating profit 404 10,192 3,866 (2,848) 11,614

Share of results

in associates - 519 - - 519

Distribution

income - 60 - - 60

Interest income - 37 48 50 135

Interest expense - (1,535) (1,656) - (3,191)

Profit/ (loss)

before tax 404 9,273 2,258 (2,798) 9,137

----------------------- ------------ ------------ ------------ ------------ ----------

Analysed as:

Underlying

profit/ (loss)

before tax

before adjusting

for the following

items: 907 9,993 2,791 (857) 12,834

Impairment

loss to investment

properties - - (219) - (219)

Sale of FOP

shares - 552 - - 552

Sale of property - 890 - - 890

Performance - - - - -

and related

fees

Depreciation - (1,662) - - (1,662)

Provision - - - (44) (44)

Staff incentive

accrual (503) (172) (173) (1,922) (2,770)

Realised foreign

currency gain/

(loss) - (328) (141) 25 (444)

Profit/ (loss)

before tax 404 9,273 2,258 (2,798) 9,137

----------------------- ------------ ------------ ------------ ------------ ----------

Assets - Group 792 95,923 67,026 8,394 172,135

Share of net

assets of associates - 4,655 - (308) 4,347

Liabilities (189) (79,817) (50,652) (2,396) (133,054)

----------------------- ------------ ------------ ------------ ------------ ----------

Net assets 603 20,761 16,374 5,690 43,428

----------------------- ------------ ------------ ------------ ------------ ----------

3. Interest Income/ (Expense)

Six months Six months Year

ended ended ended

30 Sept 30 Sept 31 March

2017 2016 2017

----------------------- ----------- ----------- ----------

GBP'000 GBP'000 GBP'000

Interest income -

bank deposits 14 18 35

Interest income -

other 61 63 100

Total interest income 75 81 135

----------------------- ----------- ----------- ----------

Six months Six months Year

ended ended ended

30 Sept 30 Sept 31 March

2017 2016 2017

------------------------ ----------- ----------- ----------

GBP'000 GBP'000 GBP'000

Interest expense -

property loans (1,049) (982) (2,192)

Interest expense -

bank and other (87) (100) (160)

Finance charges on

finance leases (495) (432) (839)

------------------------ ----------- ----------- ----------

Total interest expense (1,631) (1,514) (3,191)

------------------------ ----------- ----------- ----------

4. Tax Expense

The tax charge is based on a combination of actual current and

deferred tax charged at an effective rate that is expected to apply

to the profits for the full year.

Six months Six months Year

ended ended ended

30 Sept 30 Sept 31 March

2017 2016 2017

-------------- ----------- ----------- ----------

GBP'000 GBP'000 GBP'000

Current tax (687) (575) (1,155)

Deferred tax (435) (645) 608

-------------- ----------- ----------- ----------

Total (1,122) (1,220) (547)

-------------- ----------- ----------- ----------

5. Earnings/ NAV Per Share

The basic earnings per ordinary share is calculated on the

profit on ordinary activities after taxation and after

non-controlling interests on the weighted average number of

ordinary shares in issue, during the period.

Figures in the table below have been used in the

calculations.

Six months Six months Year

ended ended ended

30 Sept 30 Sept 31 March

2017 2016 2017

--------------------------- ------------ ------------ ------------

Basic - pence per

share 2.90p 2.46p 6.75p

Diluted - pence per

share 2.84p 2.40p 6.61p

--------------------------- ------------ ------------ ------------

Number Number Number

--------------------------- ------------ ------------ ------------

Weighted average number

of ordinary shares

in issue for basic 115,992,763 115,967,888 115,975,959

Share options 2,700,000 2,700,000 2,700,000

--------------------------- ------------ ------------ ------------

Total for diluted 118,692,763 118,667,888 118,675,959

--------------------------- ------------ ------------ ------------

GBP'000 GBP'000 GBP'000

--------------------------- ------------ ------------ ------------

Basic earnings 3,364 2,849 7,833

--------------------------- ------------ ------------ ------------

Notional interest

on share options assumed

to be exercised 4 4 8

Diluted earnings 3,368 2,853 7,841

--------------------------- ------------ ------------ ------------

Six months Six months Year

ended ended ended

30 Sept 30 Sept 31 March

2017 2016 2017

---------------------- ----------- ----------- ----------

Net assets per share 35.68p 29.50p 34.84p

Adjusted net assets

per share 51.25p 45.86p 47.64p

---------------------- ----------- ----------- ----------

The following numbers have been used to calculate both the net

assets and adjusted net assets per share.

Number Number Number

--------------------------- ------------ ------------ ------------

Number of shares in

issue at period end 116,004,464 115,980,040 115,992,699

--------------------------- ------------ ------------ ------------

GBP'000 GBP'000 GBP'000

--------------------------- ------------ ------------ ------------

Net assets excluding

non-controlling interest 41,391 34,218 40,413

Adjusted net assets Number Number Number

per share

--------------------------- ------------ ------------ ------------

Number of shares in

issue at period end 116,004,464 115,980,040 115,992,699

Number of share options

assumed to be exercised 2,700,000 2,700,000 2,700,000

--------------------------- ------------ ------------ ------------

Total 118,704,464 118,680,040 118,692,699

--------------------------- ------------ ------------ ------------

Adjusted net assets GBP'000 GBP'000 GBP'000

per share

--------------------------- ------------ ------------ ------------

Net assets excluding

non-controlling interest 41,391 34,218 40,413

Investment properties

at fair value net

of deferred taxes 13,315 17,350 10,740

Inventories at fair

value net of deferred

taxes 4,409 2,009 4,128

Other adjustments 1,726 850 1,267

--------------------------- ------------ ------------ ------------

Total 60,841 54,427 56,548

--------------------------- ------------ ------------ ------------

6. Investment Properties

Six months Six months Year

ended ended ended

30 Sept 30 Sept 31 March

2017 2016 2017

------------------------------ ----------- ----------- ----------

GBP'000 GBP'000 GBP'000

------------------------------ ----------- ----------- ----------

1 April 128,428 120,718 120,718

Capital expenditure 1,663 176 1,990

Disposals - - (1,711)

Depreciation (1,105) (947) (1,891)

Fair value adjustment 167 142 (219)

Foreign exchange translation 1,739 9,244 9,541

End of period 130,892 129,333 128,428

------------------------------ ----------- ----------- ----------

Investment properties owned by the Group, and indirectly via FOP

are stated at cost less depreciation and accumulated impairment

losses.

7. Interest in Associates and Other Financial Assets

Six months Six months Year

ended ended ended

30 Sept 30 Sept 31 March

2017 2016 2017

----------------------------- ----------- ----------- ----------

a) Associated undertakings GBP'000 GBP'000 GBP'000

Cost of investment

at beginning of period 4,347 3,044 3,044

Additions - - 1,119

Disposals (612) (153) (239)

Share of associates

profit after tax 740 271 519

Dividends received - (64) (96)

Cost of investment

at end of period 4,475 3,098 4,347

----------------------------- ----------- ----------- ----------

Investments in associated

undertakings

----------------------------- ----------- ----------- ----------

5(th) Property Trading

Ltd 972 868 916

Regional Property

Trading Ltd 218 185 192

Fprop Romanian Supermarkets

Ltd 649 766 750

Fprop Galeria Corso

Ltd 1,784 1,587 1,678

Fprop Krakow Ltd 1,160 - 1,119

----------------------------- ----------- ----------- ----------

4,783 3,406 4,655

Less: Group share

of profit after tax

withheld on sale of

property to an associate

in 2007 (308) (308) (308)

----------------------------- ----------- ----------- ----------

Cost of investment

at end of period 4,475 3,098 4,347

----------------------------- ----------- ----------- ----------

The withheld profit figure of GBP308,000 represents

the removal of the percentage of intercompany

profit resulting from the sale of the property

in 2007 to 5(th) Property Trading Ltd (an

associate). The figure will reduce when there

is a reduction in First Property Group's stake

in 5(th) Property Trading Ltd.

-------------------------------------------------------------------

b) Other financial

assets and investments

----------------------------- ----------- ----------- ----------

Cost of investment

at beginning of period 897 914 914

Additions 2,361 4 12

Disposal - - -

(Decrease)/increase

in fair value during

the period - - (29)

----------------------------- ----------- ----------- ----------

Cost of investment

at end of period 3,258 918 897

----------------------------- ----------- ----------- ----------

8. Trade and Other Receivables

Six months Six months Year

ended ended ended

30 Sept 30 Sept 31 March

2017 2016 2017

---------------------------- ----------- ----------- ----------

GBP'000 GBP'000 GBP'000

Current assets

Trade receivables 2,514 2,392 2,003

Less provision for

impairment of receivables (490) (634) (626)

---------------------------- ----------- ----------- ----------

Trade receivables

net 2,024 1,758 1,377

Other receivables 2,426 3,159 2,435

Prepayments and accrued

income 858 390 1,078

5,308 5,307 4,890

---------------------------- ----------- ----------- ----------

Non-current assets 1,905 139 2,108

---------------------------- ----------- ----------- ----------

Other receivables include a balance of GBP1.88 million relating

to the deferred consideration from the sale of an investment

property located in Romania, which is receivable after one year.

This has been discounted to reflect its current value.

9. Trade and Other Payables

Six months Six months Year

ended ended ended

30 Sept 30 Sept 31 March

2017 2016 2017

-------------------- ----------- ----------- ----------

GBP'000 GBP'000 GBP'000

Trade payables 3,457 2,787 2,941

Other taxation and

social security 891 673 799

Other payables and

accruals 2,272 4,214 5,275

Deferred income 663 11 833

7,283 7,685 9,848

-------------------- ----------- ----------- ----------

10. Financial Liabilities

Six months Six months Year

ended ended ended

30 Sept 30 Sept 31 March

2017 2016 2017

---------------------------- ----------- ----------- ----------

GBP'000 GBP'000 GBP'000

a) Current liabilities

Loans repayable by

subsidiary (FOP) to

third party shareholders 2,121 1,918 2,148

Bank loans 3,470 3,340 3,180

Finance leases 3,270 3,125 14,313

8,861 8,383 19,641

---------------------------- ----------- ----------- ----------

b) Non-current liabilities

---------------------------- ----------- ----------- ----------

Bank loans 63,757 66,022 63,850

Finance leases 47,347 49,497 36,193

---------------------------- ----------- ----------- ----------

111,104 115,519 100,043

---------------------------- ----------- ----------- ----------

c) Total obligations under financial liabilities

Repayable within one

year 8,861 8,383 19,642

Repayable within one

and five years 78,099 99,041 65,725

Repayable after five

years 33,005 16,478 34,317

---------------------------- ----------- ----------- ----------

119,965 123,902 119,684

---------------------------- ----------- ----------- ----------

Loans repayable by Fprop Opportunities plc (FOP) to third party

shareholders are unsecured and repayable on demand.

Eight bank loans and three finance leases (all denominated in

Euros) totalling GBP117.84 million (31 March 2017: GBP117.54

million) included within financial liabilities are secured against

investment properties owned by the Group and Fprop Opportunities

plc (FOP), and one property owned by the Group shown under

inventories. These bank loans and finance leases are otherwise

non-recourse to the Group's assets.

The interim results are being circulated to all shareholders and

can be downloaded from the company's web site (www.fprop.com).

Further copies can be obtained from the registered office at 32 St

James's Street, London SW1A 1HD.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR BLLLLDFFZFBE

(END) Dow Jones Newswires

November 23, 2017 02:00 ET (07:00 GMT)

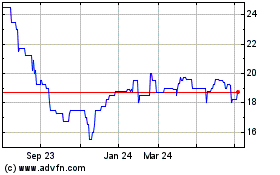

First Property (LSE:FPO)

Historical Stock Chart

From Mar 2024 to Apr 2024

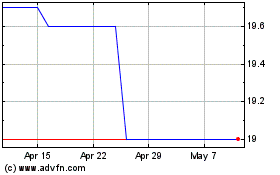

First Property (LSE:FPO)

Historical Stock Chart

From Apr 2023 to Apr 2024