Facebook Revenue Surges Nearly 50% -- 2nd Update

April 25 2018 - 6:18PM

Dow Jones News

By Deepa Seetharaman

Maybe everyone isn't so mad at Facebook Inc. after all.

In its first earnings report since the site began racing to

address privacy concerns and Chief Executive Mark Zuckerberg

squared off with angry lawmakers, Facebook posted rising revenue

and profit that highlighted the company's central place in the

digital economy.

The social-media giant has weathered one crisis after another in

the 17 months since the 2016 presidential election but its business

-- at least for now -- has remained healthy.

Facebook reported a quarterly per-share profit of $1.69, up from

$1.04 a year earlier, while revenue rose nearly 50% to $11.97

billion. Net income rose 63% to nearly $5 billion, compared with

$3.06 billion a year ago.

Analysts expected Facebook to report a per-share profit of $1.35

and quarterly revenue of $11.41 billion, according to data compiled

by Thomson Reuters.

Facebook added about 70 million monthly users during the first

three months of the year bringing its overall user base to 2.2

billion, up from 2.13 billion at the end of 2017.

The Menlo Park, Calif., firm also said it would buy back an

additional $9 billion in shares, adding to the $6 billion

previously authorized.

In after-hours trading Wednesday, Facebook shares rose about 7%

to $171.00.

Facebook's earnings report marks the first snapshot of how the

company's ties to political-data firm Cambridge Analytica are

affecting the Silicon Valley giant's business.

Cambridge Analytica aided the Trump campaign in 2016 and

allegedly bought data about tens of millions of Facebook users from

an outside developer. The incident, disclosed in mid-March,

highlighted Facebook's at times lax oversight of how outside

developers handled user data they extracted from the platform. It

also sparked widespread anger toward the site and a #deletefacebook

campaign. Cambridge Analytica has denied wrongdoing.

Much of the fallout from the incident happened after the quarter

ended in March and isn't fully reflected in Wednesday's report.

Still, the results underscore Facebook's continued ability to

generate cash during one of the toughest periods in the company's

14-year history.

Major advertisers "were very aware of the controversies swirling

and wanted to know more about what other brands were doing," said

Andy Taylor, associate director of research at data marketing firm

Merkle. "But really, in terms of making moves, advertisers are more

in a wait-and-see mode."

Mr. Taylor added that most advertisers generally remain happy

with Facebook's products.

Facebook's struggles haven't affected advertisers like last

year's controversy surrounding Alphabet Inc.'s YouTube and its

placement of ads adjacent to videos with objectionable content, Mr.

Taylor said.

"This situation isn't as controversial as [a brand's ad] popping

up against a racially charged video," he said. "In most cases,

that's very damning for a brand, whereas that same reaction hasn't

happened with Facebook."

Mr. Zuckerberg appeared twice in front of U.S. lawmakers this

month in hearings centered on the Cambridge Analytica episode, and

Facebook has redoubled efforts to stamp out abuse. Still, most

analysts and investors believe additional regulation is inevitable,

although it isn't clear what form it will take or what impact it

would have on Facebook's bottom line.

Mr. Zuckerberg told lawmakers this month that he was open to

some forms of regulation but added that too many rules could impede

American tech companies from competing head-to-head with Chinese

rivals.

The uproar over Cambridge Analytica is the latest episode to

spark widespread questions over Facebook's imprint on society. The

period since the 2016 presidential election has been tumultuous,

with users, advertisers and lawmakers questioning whether the

company sacrificed security and privacy in pursuit of relentless

growth.

Since reaching an all-time high in early February, Facebook

shares had fallen more than 18% before the earnings release.

Earlier this week, Facebook's biggest rival in the online-ad

space, Google parent Alphabet, reported a profit for the first

three months of the year that topped expectations, but investors

grappling with the company's higher expenses sent the shares down

4.8%, the stock's worst session in more than two months.

Write to Deepa Seetharaman at Deepa.Seetharaman@wsj.com

(END) Dow Jones Newswires

April 25, 2018 18:03 ET (22:03 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

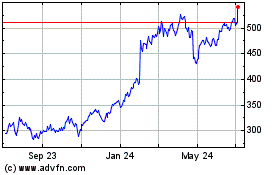

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Mar 2024 to Apr 2024

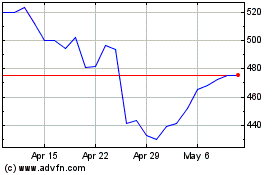

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Apr 2023 to Apr 2024