TIDMFDM

RNS Number : 9027G

FDM Group (Holdings) plc

07 March 2018

FDM Group (Holdings) plc

Preliminary Results

FDM Group (Holdings) plc ("the Company") and its subsidiaries

(together "the Group" or "FDM"), a global professional services

provider with a focus on Information Technology ("IT"), today

announces its results for the year ended 31 December 2017.

Highlights

31 December 31 December % change

2017 2016

------------------------------ ------------ ------------ ---------

Revenue GBP233.6m GBP189.4m +23%

------------------------------ ------------ ------------ ---------

Mountie revenue(1) GBP207.3m GBP167.3m +24%

------------------------------ ------------ ------------ ---------

Adjusted operating profit(2) GBP47.3m GBP37.6m +26%

------------------------------ ------------ ------------ ---------

Profit before tax GBP43.7m GBP35.3m +24%

------------------------------ ------------ ------------ ---------

Adjusted profit before

tax(2) GBP47.2m GBP37.5m +26%

------------------------------ ------------ ------------ ---------

Basic earnings per share 29.8p 24.4p +22%

------------------------------ ------------ ------------ ---------

Adjusted basic earnings

per share(2) 32.6p 25.8p +26%

------------------------------ ------------ ------------ ---------

Net cash position at year

end GBP36.8m GBP27.8m +32%

------------------------------ ------------ ------------ ---------

Cash flow generated from

operations GBP48.3m GBP39.4m +23%

------------------------------ ------------ ------------ ---------

Adjusted cash conversion(2) 102.2% 104.9% -3%

------------------------------ ------------ ------------ ---------

Ordinary dividend per

share 26.0p 19.6p +33%

------------------------------ ------------ ------------ ---------

-- Strong operational and financial progress delivered Group-wide

-- Mounties assigned to client sites at week 52(3) were up 17% at 3,170 (2016: 2,705)

-- Mountie utilisation rate for the year to 31 December 2017 was 97.3% (2016: 97.4%)

-- 72 new clients secured globally (2016: 49)

-- Continued sector diversification, with 72% (2016: 67%) of new

clients won during the year outside the financial services

sector

-- Further successful geographic expansion particularly in APAC,

which grew Mounties assigned by 31% compared with week 52 2016

-- Continued investment in training Academies, with global

training capacity at year-end up 9% over December 2016

-- The Group continued to deliver strong cash conversion of over

100% of adjusted profit before tax

-- 2017 saw the Group report a 0.0% differential in its UK Gender Pay Gap reporting

-- Final dividend of 14.0 pence per share giving a total

ordinary dividend for the year of 26.0 pence, an increase of 33% on

2016

-- Group well positioned for continued success in 2018 and beyond

(1) Mountie revenue excludes revenue from contractors.

(2) The adjusted operating profit, adjusted profit before tax

and adjusted cash conversion are calculated before Performance

Share Plan expenses (including social security costs) of GBP3.6m

(2016: GBP2.2m). The adjusted basic earnings per share is

calculated before the impact of Performance Share Plan expenses

(including social security costs and associated deferred tax).

Adjusted cash conversion is calculated by dividing cash flow from

operations by adjusted profit before tax.

(3) Week 52 in 2017 commenced on 18 December 2017 (2016: week 52

commenced on 26 December 2016).

Rod Flavell, Chief Executive Officer, said:

"The Group returned a strong performance in 2017, generating

growth in Mountie numbers, revenue and profit while continuing to

invest, in each of its territories, in sustainable and long term

growth.

During the early part of 2018 FDM has seen continued strong

momentum across all of its markets and I am confident that FDM will

deliver another year of good operational and financial performance

in 2018."

Enquiries

For further information:

FDM Rod Flavell - CEO 020 7067 0000 (today)

Mike McLaren - CFO 0203 056 8240 (thereafter)

Weber Shandwick Nick Oborne/ Tom Jenkins 020 7067 0000

Forward-looking statements

This announcement contains statements which constitute

'forward-looking statements'. Although the Group believes that the

expectations reflected in these forward-looking statements are

reasonable, it can give no assurance that these expectations will

prove to have been correct. Because these statements involve risks

and uncertainties, actual results may differ materially from those

expressed or implied by these forward-looking statements.

About FDM

FDM is a global professional services provider with a focus on

IT. FDM brings people and technology together; creating and

inspiring exciting careers that shape our digital future.

The Group's principal business activities involve employing,

training and placing its own permanent IT and business consultants

("Mounties") at client sites. The Group also supplies contractors

to clients, either to supplement its own employed consultants'

skill sets or to provide additional experience where required. FDM

specialises in a range of technical and business disciplines

including Development, Testing, IT Service Management, Project

Management Office, Data Services, Business Analysis, Business

Intelligence and Cyber Security.

The FDM Careers Programme bridges the gap for graduates,

ex-Forces and returners to work, providing them with the training

and experience required to successfully launch or re-launch their

career. FDM has dedicated training centres and sales operations

located in London, Leeds, Glasgow, New York, Virginia, Toronto,

Frankfurt, Singapore and Hong Kong. FDM also operates in China,

Ireland, France, Switzerland, Austria, Denmark, Spain, Australia

and South Africa.

FDM is a strong advocate of diversity and inclusion in the

workplace, with over 75 nationalities working together as a team.

The Group became an early adopter of the UK's Gender Pay Gap

reporting policy, being the sixth company in the UK to release its

figures and reporting a median pay gap of 0%. FDM was featured as

one of the Best Employers for Race by Business in the Community and

in the first Social Mobility Employer Index by the Social Mobility

Foundation and Social Mobility Commission in 2017. FDM was also

recognised as Company of the Year at the TechWomen50 Awards

2017.

INTRODUCTION

The Group recorded a strong performance for 2017, with a 17%

growth in Mountie headcount, including growth of at least 15% in

Mountie headcount in each of our operating regions, and ending the

year with a record 3,170 Mounties placed on client site. The

Group's financial position remains strong with a closing cash

balance GBP9.0 million higher than 2016 at GBP36.8 million and no

debt.

STRATEGY

FDM's strategy is to deliver customer led, sustainable,

profitable growth on a consistent basis, through its

well-established Mountie model. This strategy requires that all

activities and investments produce the appropriate level of profit

and return on cash, that they deliver sustained and measurable

improvements for all our stakeholders including customers, staff

and shareholders, and that they further FDM's objective of

launching the careers of talented people worldwide.

GROUP RESULTS

2017 was a year of strong financial performance and continued

growth as we delivered 23% growth in revenue to GBP233.6 million

(2016: GBP189.4 million) and a 26% increase in both adjusted

operating profit, to GBP47.3 million (2016: GBP37.6 million) and

adjusted basic earnings per share, to 32.6 pence (2016: 25.8

pence). We are well-positioned for future growth with a healthy

balance sheet and a proven business model.

Mountie revenue increased by 24% to GBP207.3 million (2016:

GBP167.3 million), a 21% increase at constant currencies.

Contractor revenue increased by 19% to GBP26.3 million (2016:

GBP22.1 million), the result of meeting specific customer needs

during the first three quarters of 2017. Reflecting this mix of

revenues, gross margin was lower at 44.6% (2016: 45.5%). The

Group's strategy remains focussed on growing Mountie numbers and

revenues whilst contractor revenues remain ancillary to the Group

and will continue, over the longer term, in managed decline.

2017 2016 2017 2016

Mountie Mountie Mounties Mounties

revenue revenue assigned assigned

GBPm GBPm to client to client

site site

at week at week

52 52

UK and Ireland 106.7 93.9 1,744 1,505

North America 73.8 54.2 965 832

EMEA 13.1 12.0 155 135

APAC 13.7 7.2 306 233

---------------- --------- --------- ----------- -----------

207.3 167.3 3,170 2,705

---------------- --------- --------- ----------- -----------

The Group has used cash generated from operations to continue

significant investment in people and infrastructure. Overheads have

increased to GBP60.5 million (2016: GBP50.7 million), reflecting

the Group's investment in its management, support, recruitment,

sales and training teams during the year with average headcount in

these areas of the business increasing to 447 in 2017 compared with

371 in 2016. Despite the increase in overheads, adjusted operating

margin in 2017 has increased to 20.2% (2016: 19.9%).

Brexit has created some uncertainty in the economy and it is

difficult to predict the medium to long term potential impact on

the Group. FDM has a global footprint and is diversified from a

geographic perspective as it operates from well-established,

self-contained operating units. Although the risks associated with

the uncertainty in the UK and the potential impact across Europe

remain, to date no material negative impact on trading has been

noted.

Adjusting items

The Group presents adjusted results, in addition to the

statutory results, as the Directors consider that they provide a

useful indication of underlying performance. The adjusted results

are stated before Performance Share Plan expenses including

associated taxes. The Performance Share Plan expenses including

social security costs were GBP3.6 million in 2017 (2016: GBP2.2

million). The Directors believe that, as these excluded costs are

non-cash items, it better allows a comparison of performance and

cash generation.

Net finance costs

As the Group has no borrowings, finance costs are minimal. The

net charge for the year comprises GBP29,000 (2016: GBP28,000) of

finance income and a finance expense of GBP130,000 (2016:

GBP128,000) representing non-utilisation charges on the undrawn

element of the Group's revolving credit facility.

Taxation

The Group's total tax charge for the year was GBP11.6 million,

equivalent to an effective tax rate of 26.7%, on profit before tax

of GBP43.7 million (2016: effective tax rate of 25.9% based on a

tax charge of GBP9.1 million and a profit before tax of GBP35.3

million). The effective tax rate in 2017 is higher than the

underlying UK tax rate of 19.25% primarily due to Group profits

earned in higher tax jurisdictions.

Earnings per share

The basic earnings per share increased in the year to 29.8 pence

(2016: 24.4 pence) whilst adjusted basic earnings per share was

32.6 pence (2016: 25.8 pence). Diluted earnings per share was 29.4

pence (2016: 24.2 pence).

Dividends

Subject to shareholders' approval of the final dividend of 14.0

pence per share, the Group's total dividend for the year will be

26.0 pence per share (2016: 19.6 pence per share). The total

ordinary dividends of 26.0 pence per share will be covered 1.15

times by basic earnings per share (2016: 1.2 times covered).

The Group has adopted a progressive dividend policy. The aim of

this policy is to steadily increase the Group's base dividend, on

an annual basis, approximately in line with growth in the Group's

earnings per share. The Board reviews the Group's dividend policy

on a regular basis and is confident that there are currently no

significant constraints which would impact this policy. The Group

is debt free, has no significant capital commitments (its

properties are all leasehold) and has sufficient distributable

reserves and cash balances to continue to apply this policy. As at

31 December 2017, the Company had distributable reserves of GBP35.4

million.

Cash flow and net funds

Net cash inflow generated from operating activities increased

from GBP30.7 million in 2016 to GBP35.0 million in 2017. Adjusted

cash conversion was 102%, with the reduction from 105% in 2016

attributable to movements in working capital. At the end of the

financial year, the Group had cash balances of GBP36.8 million

(2016: GBP27.8 million) and undrawn facilities of GBP20.0 million

available until 31 August 2018 (2016: GBP20.0 million).

Balance sheet

The Group has a robust balance sheet with no debt and GBP36.8

million of cash and cash equivalents.

SEGMENTAL PERFORMANCE

UK and Ireland

We closed the year with 1,744 Mounties placed on client sites,

an increase of 16% on the 1,505 at week 52 2016. Adjusted operating

profit(2) increased by 13% to GBP31.5 million (2016: GBP27.8

million). The UK and Ireland gained 43 new clients in 2017, 77% of

which were from outside the financial services and banking sector.

Growth in government work continued in 2017, with 315 Mounties

placed with UK government clients at the end of the year (2016 week

52: 206).

Our geographic presence in the UK increased with the opening of

a temporary training centre in Birmingham, allowing us to meet and

generate client demand and tap into the local graduate market. At

week 52, 55% of UK placements were based outside of London (2016:

57%).

2017 saw 839 Mounties complete their training (2016: 1,068).

While there was no material change to training capacity, this

reflects phasing of courses during the year, including an update to

the training timetable, to better align training completions with

the increase in client demand which follows the traditional end of

year break and a varying mix of the disciplines trained.

The number of ex-Forces Mounties placed with clients grew by 55%

to 239; this represents 14% of total UK and Ireland Mountie

headcount at week 52 (2016 week 52: 154 representing 10% of total

Mountie headcount). FDM has been a signatory to the Ministry of

Defence ("MoD") Armed Forces Covenant since 2015. This was

recognised in 2017 when the MoD awarded FDM the prestigious

Employer Recognition Scheme Gold Award, for "Outstanding support

for those who serve and have served".

Getting Back to Business courses were run from our London and

Glasgow Academies, as we introduced the programme to our Scottish

clients. The number of Getting Back to Business Mounties deployed

on client sites at week 52 2017 was 44 (2016: 7). In 2017 FDM in

Scotland won 'Best Employer Training and Development 2017' at the

s1 Recruitment Awards and the 'Diversity Star Performer 2017' at

the Scottish Diversity Awards.

As highlighted above, contractor revenue increased by 19% on the

prior year, the result of meeting specific customer needs primarily

during the first three quarters of 2017.

North America

North America Mountie revenue grew 36%, with demand from both

existing and new clients. 12 new clients were won in the year.

Adjusted operating profit(2) increased by 65% to GBP15.3 million

(2016: GBP9.3 million), benefiting from operational gearing as we

scaled the business.

Following the significant investment in training capacity in

2016, 2017 saw a modest 4% increase in capacity, achieved through

internal reorganisation of existing classrooms. In October 2017 FDM

committed to an additional lease allowing us to double the floor

space of our Toronto Academy in 2018. The work to design and

develop the new space, including the addition of six new

classrooms, commenced in January 2018 and has an expected

completion date of mid-2018.

FDM was recognised as Fastest Growing Company at the Best in Biz

Awards 2017 (silver winner) for its impressive performance.

EMEA (Europe, Middle East and Africa, excluding UK and

Ireland)

Mountie revenue from our EMEA business grew by 9% to GBP13.1

million (2016: GBP12.0 million). Adjusted operating profit(2) was

25% lower at GBP0.9 million (2016: GBP1.2 million) reflecting

investment during the year in facilities and people.

Mounties on client sites increased to 155 at week 52 2017

compared with 135 at week 52 2016. The German business benefitted

from FDM's pro-active approach to the introduction of the new

labour leasing laws. Growth in demand has been supported by a 140%

increase in the training capacity of the Frankfurt Academy in the

first half of the year. The larger Frankfurt office has enabled us

to hire more operational staff, strengthening the foundation for

continued business growth in the future. Swiss Mountie headcount

tailed off in 2017 following changes to client resource planning.

During 2017 FDM's Austrian subsidiary was incorporated; this will

provide a further arm for the EMEA business to develop.

APAC (Asia Pacific)

APAC Mountie revenue increased by 90% over 2016, to GBP13.7

million (2016: GBP7.2 million). Customer growth in 2017 was

generated by eight new customers, as well as diversification of

services provided to existing customers. This led to a healthy

increase in Mountie numbers, with 306 Mounties placed on client

site at week 52 (week 52 2016: 233).

The adjusted operating loss(2) decreased from GBP0.7 million in

2016 to GBP0.3 million in 2017, reflecting the growth of the

business following investment in our two Academies, additional

operational staff in the region as well as the operating costs

associated with development of the Australian facility. The

Singapore Academy and sales office opened in April 2017, and the

Hong Kong Academy and sales office opened in January 2016. These

dedicated facilities, together with our temporary training facility

in Sydney, have resulted in APAC training completions increasing

20% from 129 to 155 during the year. Our first locally sourced and

trained Mounties were placed with clients in Australia during 2017.

In the second half of 2017 APAC recorded a break-even operating

performance.

BOARD

Ivan Martin, FDM's non-executive Chairman, has today informed

the Board that he intends to step down later in the current year

and has asked the Board to start the process to find a new Chairman

to succeed him. The current intention is that he will step down

once that search has been successfully completed.

Ivan has served as Chairman of FDM since October 2006. Since the

Company's IPO in June 2014, FDM has reported four consecutive years

of strong profit performance while continuing to expand overseas

and grow revenue. This has been reflected in the Company's share

price, which has increased by around 280% since the Company's IPO

in June 2014. The continued success of FDM in the period since the

IPO has also resulted in the Company's entry into the FTSE 250 in

June 2017 - marking a key milestone in the Company's evolution.

In recognition of the fact that Ivan is in his 12th year as

Chairman, and having recently adopted a new three-year strategic

plan, the Board is looking ahead to the next phase of the Company's

development and growth. In the light of this, Ivan and the Board

now believe that the time is right to begin the search for a new

independent non-executive Chairman.

The search has commenced and will be led by the Company's

Nomination Committee, to be chaired by the Senior Independent

Director. A further update will be provided to shareholders in due

course.

There were no changes to the Directors of the Company in office

during the year and up to the date of signing the financial

statements.

OUR PEOPLE

Our results this year once again reflect the dedication and

professionalism of all employees across the Group in 2017. We are

very proud that our unique and proven business model enables us to

create and inspire exciting careers that shape our digital future.

The Board would like to thank all our employees for their

significant contribution to the performance of the Group.

CURRENT TRADING AND OUTLOOK

The Board anticipate that 2018 will be another year in which FDM

delivers good operational and financial performances.

Consolidated Income Statement

for the year ended 31 December 2017

Note 2017 2016

GBP000 GBP000

Revenue 4 233,575 189,403

Cost of sales (129,323) (103,291)

Gross profit 104,252 86,112

Administrative expenses (60,496) (50,691)

Operating profit 5 43,756 35,421

Finance income 6 29 28

Finance expense 6 (130) (128)

Net finance expense (101) (100)

Profit before income tax 43,655 35,321

Taxation 7 (11,643) (9,139)

Profit for the year 32,012 26,182

Earnings per ordinary share

2017 2016

pence pence

Basic 8 29.8 24.4

Diluted 8 29.4 24.2

The results for the year shown above arise from continuing

operations.

Consolidated Statement of Comprehensive Income

for the year ended 31 December 2017

2017 2016

GBP000 GBP000

Profit for the year 32,012 26,182

Other comprehensive income

Items that may be subsequently reclassified

to profit or loss

Exchange differences on retranslation of

foreign operations (net of tax) (673) 1,388

Total other comprehensive (expense)/ income (673) 1,388

Total comprehensive income for the year 31,339 27,570

Consolidated Statement of Financial Position

as at 31 December 2017

2017 2016

Note GBP000 GBP000

Non-current assets

Property, plant and equipment 4,926 5,011

Intangible assets 19,471 19,533

Deferred income tax assets 2,275 772

26,672 25,316

Current assets

Trade and other receivables 30,716 29,164

Cash and cash equivalents 36,846 27,844

67,562 57,008

Total assets 94,234 82,324

Current liabilities

Trade and other payables 26,616 24,628

Current income tax liabilities 3,239 4,358

29,855 28,986

Total liabilities 29,855 28,986

Net assets 64,379 53,338

Equity attributable to owners of

the parent

Share capital 10 1,075 1,075

Share premium 7,873 7,873

Capital redemption reserve 52 52

Translation reserve 791 1,464

Other reserves 6,148 2,470

Retained earnings 48,440 40,404

Total equity 64,379 53,338

Consolidated Statement of Cash Flows

for the year ended 31 December 2017

Note 2017 2016

GBP000 GBP000

Cash flows from operating activities

Group profit before tax for the

year 43,655 35,321

Adjustments for:

Depreciation and amortisation 1,408 1,180

Loss on disposal of non-current

assets 4 -

Finance income 6 (29) (28)

Finance expense 6 130 128

Share-based payment charge (including

associated social security costs) 3,576 2,217

Increase in trade and other receivables (1,552) (4,571)

Increase in trade and other payables 1,088 5,126

Cash flows generated from operations 48,280 39,373

Interest received 29 28

Income tax paid (13,263) (8,751)

Net cash flow from operating

activities 35,046 30,650

Cash flows from investing activities

Acquisition of property, plant

and equipment (1,350) (1,735)

Acquisition of intangible assets (18) (60)

Net cash used in investing activities (1,368) (1,795)

Cash flows from financing activities

Finance costs paid (130) (128)

Dividends paid 9 (23,976) (24,514)

Net cash used in financing activities (24,106) (24,642)

Exchange (losses)/ gains on cash

and cash equivalents (570) 1,271

Net increase in cash and cash

equivalents 9,002 5,484

Cash and cash equivalents at

beginning of year 27,844 22,360

Cash and cash equivalents at

end of year 36,846 27,844

Consolidated Statement of Changes in Equity

for the year ended 31 December 2017

Capital Other

Share Share redemption Translation reserves Retained Total

capital premium reserve reserve earnings equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Balance at 1 January

2017 1,075 7,873 52 1,464 2,470 40,404 53,338

Profit for the year - - - - - 32,012 32,012

Other comprehensive

expense

for the year - - - (673) - - (673)

Total comprehensive

(expense)/ income

for the year - - - (673) - 32,012 31,339

Share-based payments - - - - 3,678 - 3,678

Dividends (Note

9) - - - - - (23,976) (23,976)

Total transactions

with owners, recognised

directly in equity - - - - 3,678 (23,976) (20,298)

Balance at 31 December

2017 1,075 7,873 52 791 6,148 48,440 64,379

Capital Other

Share Share redemption Translation reserves Retained Total

capital premium reserve reserve earnings equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Balance at 1 January

2016 1,075 7,873 52 76 589 38,736 48,401

Profit for the year - - - - - 26,182 26,182

Other comprehensive

income for the year - - - 1,388 - - 1,388

Total comprehensive

income for the year - - - 1,388 - 26,182 27,570

Share-based payments - - - - 1,881 - 1,881

Dividends (Note

9) - - - - - (24,514) (24,514)

Total transactions

with owners, recognised

directly in equity - - - - 1,881 (24,514) (22,633)

Balance at 31 December

2016 1,075 7,873 52 1,464 2,470 40,404 53,338

Notes to the Consolidated Financial Statements

1 General information

The Company is a public limited company incorporated and

domiciled in the UK with a Premium Listing on the London Stock

Exchange. The Company's registered office is 3rd Floor, Cottons

Centre, Cottons Lane, London,

SE1 2QG and its registered number is 07078823.

2 Basis of preparation

The financial information set out in this preliminary

announcement does not constitute statutory accounts for the years

ended 31 December 2017 and 31 December 2016, for the purpose of the

Companies Act 2006, but is derived from those accounts. The audited

statutory accounts for 2016 have been delivered to the Registrar of

Companies and those for 2017 were approved for issue on 6 March

2018. The Group's auditor reported on the Annual Report and

Accounts for the year ended 31 December 2017 on 6 March 2018. Their

report was unqualified, did not draw attention to any matters by

way of emphasis without qualifying their report and did not contain

statements under Section 498(2) or (3) of the Companies Act

2006.

Whilst the financial information included in this preliminary

announcement has been prepared in accordance with the International

Financial Reporting Standards (IFRSs) as adopted for the use in the

European Union and as issued by the International Accounting

Standards Board, this announcement does not itself contain

sufficient information to comply with IFRS. The accounting policies

applied in preparing this financial information are consistent with

the Group's financial statements for the year ended 31 December

2016 with the exception of the following amendments which were

effective during the year and were adopted by the Group in

preparing the financial statements. The adoption of these

amendments has not had a material impact on the Group's financial

statements in the year:

* Amendments to IAS 7, 'Statement of cash flows'

(effective 1 January 2017)

* Amendments to IAS 12,'Income taxes' on recognition of

deferred tax assets for unrealised losses (effective

1 January 2017)

3 Going concern

The Group's continued and forecast global growth, positive

operating cash flow and liquidity position, together with its

distinctive business model and infrastructure, enable the Group to

manage its business risks. The Group's forecasts and projections

show that it will continue to operate with adequate cash resources

and within the current working capital facilities. The Group passed

all bank covenants tested in the year and forecasts that all

covenants will be passed for a period of at least twelve months

from the date of signing this Annual Report.

The Directors therefore have a reasonable expectation that the

Company and the Group will have adequate resources to continue in

operational existence for the foreseeable future. Accordingly the

Directors continue to adopt the going concern basis for preparing

the financial statements.

4 Segmental reporting

Management has determined the operating segments based on the

operating reports reviewed by the Board of Directors that are used

to assess both performance and strategic decisions. Management has

identified that the Executive Directors are the chief operating

decision maker in accordance with the requirements of IFRS 8

'Operating segments'.

At 31 December 2017, the Board of Directors consider that the

Group is organised on a worldwide basis into four core geographical

operating segments:

(1) UK and Ireland;

(2) North America;

(3) Rest of Europe, Middle East and Africa, excluding UK and Ireland ("EMEA"); and

(4) Asia Pacific ("APAC").

Each geographical segment is engaged in providing services

within a particular economic environment and is subject to risks

and returns that are different from those of segments operating in

other economic environments.

All segment revenue, profit before taxation, assets and

liabilities are attributable to the principal activity of the

Group, being a global professional services provider with a focus

on IT.

For the year ended 31 December 2017

UK and North

Ireland America EMEA APAC Total

GBP000 GBP000 GBP000 GBP000 GBP000

Revenue 131,479 75,069 13,077 13,950 233,575

Depreciation and amortisation (792) (447) (57) (112) (1,408)

Segment operating profit/

(loss) 28,694 14,700 765 (403) 43,756

Finance income 24 3 1 1 29

Finance costs (110) (5) (10) (5) (130)

Profit/ (loss) before

income tax 28,608 14,698 756 (407) 43,655

Total assets 66,565 17,601 4,563 5,505 94,234

Total liabilities (16,426) (6,253) (1,534) (5,642) (29,855)

Included in total assets above are non-current assets (excluding

deferred tax) as follows:

UK and North

Ireland America EMEA APAC Total

GBP000 GBP000 GBP000 GBP000 GBP000

31 December 2017 22,431 1,322 384 260 24,397

For the year ended 31 December 2016

UK and North

Ireland America EMEA APAC Total

GBP000 GBP000 GBP000 GBP000 GBP000

Revenue 112,912 56,782 12,082 7,627 189,403

Depreciation and amortisation (762) (334) (18) (66) (1,180)

Segment operating profit/

(loss) 26,058 8,909 1,199 (745) 35,421

Finance income 20 - 7 1 28

Finance costs (106) (4) (14) (4) (128)

Profit/ (loss) before income

tax 25,972 8,905 1,192 (748) 35,321

Total assets 60,232 14,265 4,974 2,853 82,324

Total liabilities (17,791) (6,686) (1,862) (2,647) (28,986)

Included in total assets above are non-current assets (excluding

deferred tax) as follows:

UK and North

Ireland America EMEA APAC Total

GBP000 GBP000 GBP000 GBP000 GBP000

31 December 2016 22,755 1,551 26 212 24,544

Information about major customers

Customers A and B each represent 10% or more of the Group's 2017

revenues from all four operating segments and are presented below.

Customers A and C each represent 10% or more of the Group's 2016

revenues.

2017 2016

GBP000 GBP000

Revenue from customer A 40,328 26,126

Revenue from customer B 23,718 15,761

Revenue from customer C 8,861 19,647

5 Operating profit

Operating profit for the year has been arrived at after

charging/ (crediting):

2017 2016

GBP000 GBP000

Hire of property - operating leases 3,946 3,515

Net foreign exchange differences (153) 3

Depreciation and amortisation 1,408 1,180

6 Finance income and expense

2017 2016

GBP000 GBP000

Bank interest 29 28

Finance income 29 28

2017 2016

GBP000 GBP000

Non utilisation fees on revolving

credit facility (80) (80)

Finance fees and charges (50) (48)

Finance expense (130) (128)

7 Taxation

The major components of income tax expense for the years ended

31 December 2017 and 2016 are:

2017 2016

GBP000 GBP000

Current income tax:

Current income tax charge 12,619 9,956

Adjustments in respect of prior

periods (474) 64

Total current tax 12,145 10,020

Deferred tax:

Relating to origination and reversal

of temporary differences (502) (881)

Total deferred tax (502) (881)

Total tax expense reported in the

income statement 11,643 9,139

The standard rate of corporation tax in the UK is 19%. The rate

changed from 20% to 19% with effect from 1 April 2017. Accordingly,

the profits for the respective accounting periods are taxed at an

effective rate of 19.25% (2016: 20%). The tax charge for the year

is higher (2016: higher) than the standard rate of corporation tax

in the UK. The differences are set out below:

2017 2016

GBP000 GBP000

Profit before income tax 43,655 35,321

Profit multiplied by UK standard rate of corporation tax of 19.25% (2016: 20%) 8,404 7,064

Effect of different tax rates on overseas earnings 3,267 1,893

Expenses not deductible for tax purposes 446 118

Adjustments in respect of prior periods (474) 64

Total tax charge 11,643 9,139

Factors affecting future tax charges

Deferred tax assets and liabilities are measured at the rate

that is expected to apply to the period when the asset is realised

or the liability is settled, based on the rates that have been

enacted or substantively enacted at the reporting date. Therefore,

at each year end, deferred tax assets and liabilities have been

calculated based on the rates that have been substantively enacted

by the reporting date.

In 2015 the UK government announced legislation setting out that

the main UK corporation tax rate will be 17% with effect from 1

April 2020. At 31 December 2017 and 31 December 2016, deferred tax

assets and liabilities have been calculated based upon the rate at

which the temporary difference is expected to reverse. During the

year it was announced that the US Federal tax charge will drop from

35% to 21% effective 1 January 2018. These reductions may also

reduce the Group's future current tax charges accordingly.

8 Earnings per ordinary share

Basic earnings per share is calculated by dividing the profit

attributable to ordinary equity holders of the Parent Company by

the weighted average number of ordinary shares in issue during the

year.

2017 2016

GBP0

Profit for the year 00 32,012 26,182

Average number of ordinary shares in

issue (thousands) 107,518 107,518

Basic earnings per share Pence 29.8 24.4

Adjusted basic earnings per share is calculated by dividing the

profit attributable to ordinary equity holders of the Parent

Company, excluding Performance Share Plan expense (including social

security costs and associated deferred tax), by the weighted

average number of ordinary shares in issue during the year.

2017 2016

Profit for the year (basic

earnings) GBP000 32,012 26,182

Share-based payment expense

(including social security

costs) GBP000 3,576 2,217

Tax effect of share-based

payment expense GBP000 (483) (672)

Adjusted profit for the

year GBP000 35,105 27,727

Average number of ordinary shares in issue

(thousands) 107,518 107,518

Adjusted basic earnings per share Pence 32.6 25.8

Diluted earnings per share

Diluted earnings per share is calculated by adjusting the

weighted average number of ordinary shares outstanding to assume

conversion of all dilutive potential ordinary shares. The company

has one type of dilutive potential ordinary shares in the form of

share options; the number of shares in issue has been adjusted to

include the number of shares that would have been issued assuming

the exercise of the share options.

2017 2016

Profit for the year (basic earnings) GBP000 32,012 26,182

Average number of ordinary shares

in issue (thousands) 107,518 107,518

Adjustment for share options (thousands) 1,465 585

Diluted number of ordinary shares

in issue (thousands) 108,983 108,103

Diluted earnings per share Pence 29.4 24.2

9 Dividends

2017 2016

GBP000 GBP000

Dividends paid

Paid to shareholders 23,976 24,514

2017

An interim dividend of 12.0 pence per ordinary share was

declared by the Directors on 28 July 2017 and was paid on 22

September 2017 to holders of record on 25 August 2017.

The Board is proposing a final dividend of 14.0 pence per share

in respect of the year to 31 December 2017, for approval by

shareholders at the AGM on 26 April 2018.

Subject to shareholder approval the dividend will be paid on 15

June 2018 to shareholders of record on 25 May 2018.

This brings the Company's total dividend for the year to 26.0

pence per share (2016: 19.6 pence per share). The total ordinary

dividends of 26.0 pence per share will be covered 1.15 times by

basic earnings per share.

The Board has adopted a progressive dividend policy; the Group

will retain sufficient capital to fund ongoing operating

requirements, maintain an appropriate level of dividend cover and

sufficient funds to invest in the Group's longer term growth.

2016

An interim dividend of 9.3 pence per ordinary share was declared

by the Directors on 26 July 2016 and was paid on 23 September 2016

to holders of record on 26 August 2016. The final dividend of 10.3

pence per share in respect of the year to 31 December 2016 was

approved by shareholders at the AGM on 27 April 2017, the dividend

was paid on 16 June 2017 to shareholders of record on 26 May

2017.

10 Share capital

Authorised, called up, allotted and fully

paid share capital

2017 2017 2016 2016

Number of GBP000 Number GBP000

shares of

shares

Ordinary shares of GBP0.01

each 107,517,506 1,075 107,517,506 1,075

11 Directors' remuneration

Details of the Directors' (who also represent the key management

personnel of the Group) remuneration in respect of the year ended

31 December 2017 is set out below:

2017 2016

GBP000 GBP000

Short term employee benefits 2,490 2,712

Post-employment benefits 32 32

Share-based payments 566 241

3,088 2,985

12 Financial instruments

There are no differences between the fair value of the financial

assets and liabilities included within the following categories in

the Consolidated Statement of Financial Position and their carrying

value:

-- Trade and other receivables

-- Cash and cash equivalents

-- Trade and other payables

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR BIGDXUXGBGIL

(END) Dow Jones Newswires

March 07, 2018 02:00 ET (07:00 GMT)

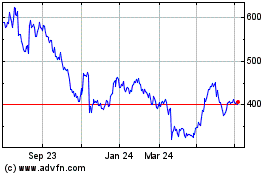

Fdm Group (holdings) (LSE:FDM)

Historical Stock Chart

From Mar 2024 to Apr 2024

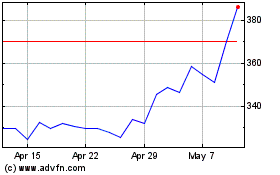

Fdm Group (holdings) (LSE:FDM)

Historical Stock Chart

From Apr 2023 to Apr 2024