European Economics Preview: Bank Of England Rate Decision Due

March 21 2018 - 10:47PM

RTTF2

Interest rate announcement from the UK and business confidence

from Germany are due on Thursday, headlining a hectic day for the

European economic news.

At 3.45 am ET, the French statistical office Insee publishes

manufacturing sentiment survey results. The confidence index is

forecast to drop to 111 in March from 112 in February.

At 4.00 am ET, flash Purchasing Managers' survey data is due

from France. The composite PMI is seen at 57.0 in March versus 57.3

in February.

Half an hour later, Germany's flash PMI data is due. Economists

forecast the composite PMI to fall to 57 in March from 57.6 in

February.

At 5.00 am ET, Ifo business confidence from Germany and

composite PMI from euro area are due. The business sentiment index

is seen falling to 114.6 in March from 115.4 in February.

The Eurozone composite PMI is expected to ease to 56.8 in March

from 57.1 a month ago.

At 5.30 am ET, the Office for National Statistics releases UK

retail sales data. Sales are forecast to rise 0.3 percent on month

in February, faster than the 0.1 percent rise seen in January.

At 8.00 am ET, the Bank of England is set to announce its rate

decision and the minutes of the meeting. The bank is widely

expected to hold its key rate at 0.50 percent and the asset

purchase plan unchanged at GBP 435 billion.

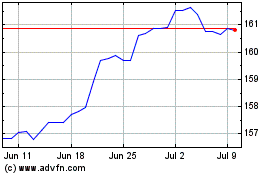

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Apr 2023 to Apr 2024