Euro Recovers Against Most Majors; U.S. Jobs Data Eyed

August 03 2012 - 3:49AM

RTTF2

The euro strengthened against most major currencies on Friday,

thereby recovering the losses it incurred on Thursday amid

disappointment over the European Central Bank's steps to cope with

the eurozone debt crisis.

The euro was under heavy selling pressure yesterday as the

European Central Bank President Mario Draghi failed to announce any

measures to curb the region's debt crisis.

Draghi told reporters that the central bank "may undertake

outright open market operations," but traders seemed disappointed

that there was not more conviction behind his remarks. Last week,

Draghi promised to do whatever is necessary to support the

beleaguered eurozone, leading to a rally on Wall Street.

The euro's rise came today as investors are now bracing for the

U.S. jobs data due out later in the day for cues.

Economists expect the Labor Department report to show that U.S.

employment rose by about 100,000 jobs in July following a weaker

than expected increase of 80,000 jobs in June. The unemployment

rate is expected to remain unchanged at 8.2 percent.

Any upside surprise in employment could temper hopes of more

stimulus from the Federal Reserve, which earlier this week signaled

it is prepared to act unless the economy stages an unlikely

comeback in the next six weeks.

A surprisingly strong jobs report could also boost the dollar,

while a weaker-than-expected jobs number will put the dollar under

fresh pressure.

The euro is now worth 1.2205 against the dollar, up 0.6 percent

from yesterday's 1-week low of 1.2136. If the euro-dollar pair

rises further, it will target the 1.225 level.

Against the Japanese yen, the euro is trading at 95.52, compared

to a 1-week low of 94.95 hit yesterday. The next upside target

level for the euro-yen pair is seen at 95.8.

The euro also followed a similar trend against the pound, with

the pair bouncing back from yesterday's 2-day low of 0.7827. At

present, the pair is worth 0.7867 with 0.790 seen as the next

upside target level.

Looking ahead, services PMI reports for July from Eurozone and

U.K. and the Eurozone retail sales for June are due shortly.

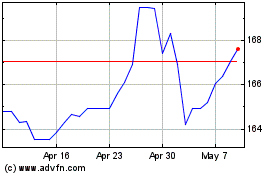

Euro vs Yen (FX:EURJPY)

Forex Chart

From Mar 2024 to Apr 2024

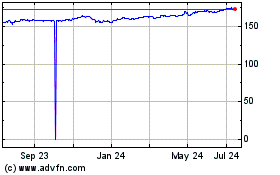

Euro vs Yen (FX:EURJPY)

Forex Chart

From Apr 2023 to Apr 2024