Euro Falls As European Shares Decline On Rising Trade War Worries

July 11 2018 - 3:03AM

RTTF2

The euro declined against its major counterparts in the European

session on Wednesday amid risk aversion, as investors fretted about

an escalating trade war between the world's two largest

economies.

Beijing vowed to take countermeasures after the U.S. proposed

tariffs on an extra $200 billion of Chinese goods.

The move comes after the U.S. imposed 25 percent tariffs on $34

billion of Chinese imports on Friday, for which Beijing immediately

retaliated in equal measure.

German bond yields also declined, with the yield on 10-year note

down by 0.30 percent. Yields move inversely to bond prices.

The currency traded mixed against its major counterparts in the

Asian session. While it held steady against the greenback and the

pound, it fell against the yen and the franc.

The euro slipped to 1.1695 against the greenback, from a high of

1.1746 hit at 5:10 pm ET. If the euro continues its fall, 1.15 is

possibly seen as its next support level.

The 19-nation currency weakened to a 2-day low of 1.1619 against

the franc, after having advanced to 1.1653 at 5:10 pm ET. The euro

is seen finding support around the 1.14 level.

The European currency dropped to 0.8830 against the pound,

reversing from a high of 0.8852 hit at 6:30 pm ET. The next likely

support for the euro is seen around the 0.87 area.

The euro retreated to 1.5394 against the loonie, coming from a

5-day high of 1.5430 hit at 9:05 pm ET. On the downside, 1.52 is

possibly seen as the next support level for the euro.

The euro held steady against the yen, after having fallen to a

2-day low of 129.91 at 9:00 pm ET. At Tuesday's close, the pair was

worth 130.34.

Data from the Ministry of Economy, Trade and Industry showed

that Japan's tertiary activity index increased for the second

straight month in May.

The tertiary activity index edged up 0.1 percent

month-over-month in May, following a 1.0 percent rise in April. In

contrast, economists had expected a 0.3 percent decrease for the

month.

On the flip side, the euro advanced to 6-day highs of 1.7255

against the kiwi and 1.5854 against the aussie, from its early lows

of 1.7164 and 1.5735, respectively. The next possible resistance

for the euro is seen around 1.74 against the kiwi and 1.60 against

the aussie.

Looking ahead, U.S. PPI for June and wholesale inventories for

May are due in the New York session.

The Bank of Canada is scheduled to release its interest rate

decision at 10:00 am ET. Economists forecast the benchmark rate to

be raised to 1.50 percent from 1.25 percent.

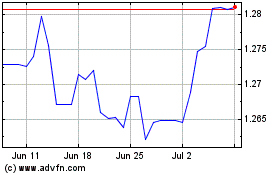

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

From Mar 2024 to Apr 2024

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

From Apr 2023 to Apr 2024