Energy Future Wins Chapter 11 Plan Confirmation

February 17 2017 - 11:37AM

Dow Jones News

By Peg Brickley and Jonathan Randles

NextEra Energy Inc.'s planned acquisition of one of the

country's largest electricity transmissions businesses, Oncor,

moved to the next phase Friday, when a judge said he would confirm

the bankruptcy-exit plan of Oncor owner Energy Future Holdings

Corp.

Confirmation sets the stage for hearings before the Public

Utility Commission of Texas, which must approve the acquisition of

Oncor, a critical element of the state's power system, by NextEra,

a Florida company.

Judge Christopher Sontchi's confirmation ruling is the second

for an Energy Future bankruptcy-exit plan. An earlier chapter 11

plan built around the planned sale of Oncor to a group of investors

led by Hunt Consolidated Inc. was confirmed last year, but the deal

fell apart after Texas regulators put conditions on the

transaction.

NextEra will pay $4.4 billion in cash and stock, plus pay off

$5.4 billion in financing that helped Energy Future through

bankruptcy, to gain control of Oncor, which carries power to some

10 million Texans.

Energy Future, the former TXU Corp., filed for chapter 11

protection in April 2014 with $42 billion in debt. Most of the debt

was resolved when Energy Future's electricity generating and

retailing businesses exited bankruptcy last year as a new company

called Vistra Energy.

Parent company Energy Future remained in bankruptcy, with an 80%

stake in Oncor as its principal asset. NextEra had been trying to

buy Oncor since 2014. Two years later, NextEra was declared the

winner of a bidding contest that revived after the Hunt deal was

scrapped.

Write to Peg Brickley at peg.brickley@wsj.com and Jonathan

Randles at Jonathan.Randles@wsj.com

(END) Dow Jones Newswires

February 17, 2017 11:22 ET (16:22 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

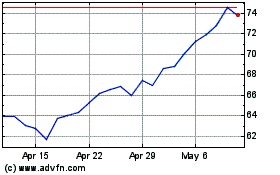

NextEra Energy (NYSE:NEE)

Historical Stock Chart

From Mar 2024 to Apr 2024

NextEra Energy (NYSE:NEE)

Historical Stock Chart

From Apr 2023 to Apr 2024