Edwards Life's Valve Data To Highlight Upcoming Heart Meeting

March 21 2012 - 12:39PM

Dow Jones News

New data on a catheter-delivered heart valve marketed by Edwards

Lifesciences Corp. (EW) will be presented at a medical meeting this

week, providing key clues on the device's potential market size in

the U.S.

The data will be discussed at one of hundreds of sessions at the

American College of Cardiology's annual conference, which runs from

Saturday to Tuesday in Chicago. Other items to watch include data

on Merck & Co.'s (MRK) antiplatelet drug vorapaxar and an

anticlotting drug co-marketed by Bayer AG (BAYRY, BAYN.XE) and

Johnson & Johnson (JNJ).

So far, Edwards's Sapien device has been approved by the U.S.

Food and Drug Administration for inoperable patients, but the

Irvine, Calif., company is trying to expand the market to patients

at high risk for surgery. Two-year data on those patients is key to

watch at the conference as the company seeks to gain FDA approval

for the group later this year.

On its most recent post-earnings conference call, Edwards said

it expects 2012 world-wide sales of its catheter-delivered heart

valves to increase 70% to 90% to $560 million to $630 million,

assuming Sapien is approved for high-risk patients in the U.S.

mid-year.

According to J.P. Morgan Chase & Co., FDA approval for the

high-risk group would add 2,000 to 2,500 patients a year receiving

Sapien. While an incremental step to its current market of 22,000

inoperable patients, the research firm said, failure to gain

approval would call into question Edwards's ability to broaden the

market for the device to healthier patients down the road,

considered a more lucrative opportunity.

Sapien treats patients with severe narrowing of the aortic

valve. The condition can lead to symptoms such as fatigue,

dizziness and serious heart problems. About 300,000 patients in the

U.S. have a sufficiently severe condition as to require an

artificial valve replacement, which is done through hours-long

heart surgery. Catheter-delivered heart valves, a less-invasive

alternative to surgery, are considered to have multibillion-dollar

market potential.

The data to be presented Monday are part of Edwards's key

"Partner" study used to gather evidence for the company's Sapien

valves in the U.S. The company's one-year data on high-risk

patients, presented at last year's conference, showed that patients

treated with catheter-delivered valves were at least as likely to

survive a year as patients treated through open-heart surgery but

were more likely to suffer strokes.

Mortality rates and stroke rates in patients treated with the

valve compared with those receiving surgery will be key to watch.

If patients receiving Sapien continue to experience higher rates of

stroke, "it could raise concerns that this neurological risk

compounds over time," J.P. Morgan's Michael Weinstein said.

The conference also will feature sessions on wiring problems in

some of St. Jude Medical Inc.'s (STJ) implantable defibrillators, a

key business for the company. The problems have involved cables no

longer on the market, but there have been questions on whether they

could affect other cables that St. Jude sells.

With this week's conference and a separate medical meeting in

May, "we only expect the scrutiny to grow," said Raj Denhoy,

analyst at Jefferies & Co.

On the pharmaceutical side, several notable studies on

approaches to cardiovascular treatment will be featured at the

meeting, including:

--Full results Saturday from Merck's "TRA-2P" study of an

experimental antiplatelet agent, vorapaxar. Merck said last month

that the drug met the study's primary efficacy goal of reducing

risk of heart attacks and related events in people with a history

of cardiovascular disease but significantly increased bleeding

risk.

The full results will show the magnitude of the drug's efficacy

and safety risks, shedding light on whether it has a chance of

reaching the market. Merck and analysts have already reduced their

expectations for the drug's potential because of the bleeding risk,

especially those patients with a history of stroke.

--Results Monday of the "Einstein PE" study of Xarelto, an

anti-clotting drug co-marketed by Bayer and Johnson & Johnson.

This study compared Xarelto with another drug regimen including

enoxaparin in preventing certain blood clots in patients with a

condition called pulmonary embolism. Positive results could lead to

expanded use of the drug, which is currently approved to reduce

risk of stroke in patients with a heart-rhythm disorder called

atrial fibrillation, and to prevent certain clots in knee or hip

replacement surgery.

--Results Monday of a study testing an experimental

cholesterol-lowering drug co-developed by Regeneron Pharmaceuticals

Inc. (REGN) and Sanofi SA (SAN.FR). The drug, code-named

REGN727/SAR236553, is a fully human monoclonal antibody that binds

to a protein called PCSK9, and has the potential to significantly

lower bad cholesterol levels. Analysts say this class of PCSK9

drugs, which includes one being developed by Amgen Inc. (AMGN), has

big market potential if the drugs are successful in further

clinical studies and clear regulatory hurdles.

--By Anjali Athavaley and Peter Loftus, Dow Jones Newswires;

212-416-4912; anjali.athavaley@dowjones.com

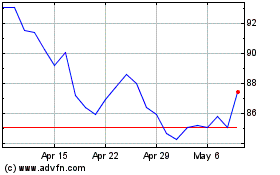

Edwards Lifesciences (NYSE:EW)

Historical Stock Chart

From Mar 2024 to Apr 2024

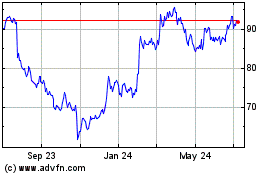

Edwards Lifesciences (NYSE:EW)

Historical Stock Chart

From Apr 2023 to Apr 2024