Earnings Scorecard: IFF - Analyst Blog

August 16 2012 - 7:15AM

Zacks

New York-based,

International Flavors & Fragrances Inc. (IFF)

reported decent second quarter 2012 results. Though the company’s

revenue had but a marginal jump due to impacts from a negative

foreign currency translation, its bottom-line grew 11%. The

company’s near-term results are expected to improve.

Let’s take a brief look at the

company’s financials for the second quarter 2012:

Earnings

Review

The fragrances and flavors

manufacturer posted an 11% year-over-year growth in earnings, which

settled at $1.08 per share. Its results surpassed the Zacks

Consensus Estimate of $1.02 by roughly 5.9%.

Revenue grew 0.8% or 4% on a

constant currency basis to $721.3 million. Results in the quarter

were driven by favorable performances at the Flavors division that

grew 8% year over year on a constant currency basis.

Please follow the link for further

details on International Flavors & Fragrances second quarter

2012 financials: IFF Posts Upbeat 2Q

Agreement/Magnitude of

Estimate Revisions

Both the impact of second quarter

2012 results and management’s outlook have triggered an estimate

revision for the company in either direction. In the last 7 days,

of the 10 estimates for 2012, 4 were revised upwards while 3 were

lowered by the analysts covering the stock. Roughly a similar trend

followed for 2013, as out of the 10 estimates, 3 were increased

while 4 were lowered.

For the third quarter of 2013, from

a total of 7 estimates, there were 5 negative revisions.

As for magnitude of estimate

revision, in the last 7 days, estimate for the third quarter

decreased from $1.11 to $1.07 per share. For 2012, estimate

increased by a cent to $3.99 while for 2013 estimate decreased by a

cent to $4.32.

The Zacks Consensus Estimates

represents a year-over-year growth of 7.0% for third quarter, 6.6%

for 2012 and 8.3% for 2013.

Our

Take

Negative foreign currency

translation restricted revenue growth that would have flourished

with a healthy performance reported by the Flavors division. Gross

margin improved and are expected to improve further based on lower

raw material cost increases, favorable pricing and manufacturing

efficiencies. Besides, expansion might get restricted due to

persistent weakness in Western Europe as well as in the company’s

Fragrances division.

Currently, we maintain a Neutral

recommendation on International Flavors & Fragrances. The stock

also bears a Zacks #3 (Hold) Rank.

About Zacks Earnings

Scorecard

As a PhD from MIT, Len Zacks

proved over 30 years ago that earnings estimate revisions are the

most powerful force impacting stock prices. He turned this ground

breaking discovery into two of the most celebrating stock rating

systems in use today. The Zacks Rank for stock trading in a 1 to 3

month time horizon and the Zacks Recommendation for long-term

investing (6+ months). These “Earnings Estimate Scorecard” articles

help analyze the important aspects of estimate revisions for each

stock after their quarterly earnings announcements. Learn more

about earnings estimates and our proven stock ratings at

http://www.zacks.com/education/

INTL F & F (IFF): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

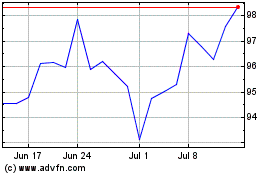

International Flavors an... (NYSE:IFF)

Historical Stock Chart

From Mar 2024 to Apr 2024

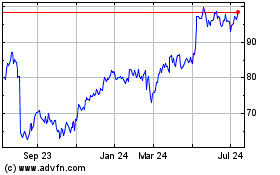

International Flavors an... (NYSE:IFF)

Historical Stock Chart

From Apr 2023 to Apr 2024