Dynavax Reports Second Quarter 2012 Financial Results

August 01 2012 - 4:31PM

Marketwired

Dynavax Technologies Corporation (NASDAQ: DVAX) today reported

financial results for the second quarter ended June 30, 2012. The

Company had $160.2 million in cash, cash equivalents and marketable

securities as of June 30, 2012 as compared to $114.0 million at

December 31, 2011. Total cash for the second quarter of 2012

included $69.6 million in net proceeds from the sale of 17,500,000

shares of common stock.

Total revenues were $2.7 million and $5.0 million for the three

and six months ended June 30, 2012, respectively, compared to $7.3

million and $9.0 million, respectively, reported for the same

periods of 2011. Revenues for the second quarter and first half of

2011 included a $6 million milestone earned under the Company's

collaboration with GlaxoSmithKline.

Research and development expenses were $11.4 million and $23.8

million for the three and six months ended June 30, 2012,

respectively. This compared to $13.3 million and $27.9 million,

respectively, reported for the same periods of 2011. Research and

development expenses decreased primarily due to the significant

decline in clinical activities for HEPLISAV™.

General and administrative expenses were $6.0 million and $11.8

million for the second quarter and first half of 2012,

respectively, compared to $4.1 million and $8.8 million,

respectively, in the same periods of the prior year. General and

administrative expenses increased primarily due to growth in

commercial development expenses.

About HEPLISAV

HEPLISAV is an investigational adult hepatitis B vaccine for

which a U.S. BLA has been accepted for review by the FDA and a

Marketing Authorization Application (MAA) has been submitted. In

Phase 3 trials, HEPLISAV demonstrated higher and earlier protection

with fewer doses than currently licensed vaccines. Dynavax has

worldwide commercial rights to HEPLISAV. HEPLISAV combines

hepatitis B surface antigen with a proprietary Toll-like Receptor 9

agonist known to enhance the immune response.

About Dynavax

Dynavax Technologies Corporation, a clinical-stage

biopharmaceutical company, discovers and develops novel products to

prevent and treat infectious and inflammatory diseases. The

Company's lead product candidate is HEPLISAV, a Phase 3

investigational adult hepatitis B vaccine designed to provide rapid

and earlier protection with fewer doses than currently licensed

vaccines. For more information visit www.dynavax.com.

- tables to follow -

DYNAVAX TECHNOLOGIES CORPORATION

CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share amounts)

(Unaudited)

Three Months Ended Six Months Ended

June 30, June 30,

-------------------- --------------------

2012 2011 2012 2011

--------- --------- --------- ---------

Revenues:

Collaboration revenue $ 1,623 $ 6,363 $ 2,552 $ 6,729

Grant revenue 882 890 1,969 1,779

Service and license revenue 179 16 513 505

--------- --------- --------- ---------

Total revenues 2,684 7,269 5,034 9,013

Operating expenses:

Research and development 11,376 13,257 23,781 27,929

General and administrative 5,957 4,054 11,750 8,808

Amortization of intangible

assets - 54 - 299

--------- --------- --------- ---------

Total operating expenses 17,333 17,365 35,531 37,036

--------- --------- --------- ---------

Loss from operations (14,649) (10,096) (30,497) (28,023)

Interest income 65 23 117 56

Interest expense (589) (487) (1,176) (977)

Other income (expense) 63 (75) (59) (157)

--------- --------- --------- ---------

Net loss $ (15,110) $ (10,635) $ (31,615) $ (29,101)

========= ========= ========= =========

Basic and diluted net loss per

share $ (0.09) $ (0.09) $ (0.20) $ (0.25)

========= ========= ========= =========

Shares used to compute basic and

diluted net loss per share 167,697 117,864 161,564 116,801

========= ========= ========= =========

DYNAVAX TECHNOLOGIES CORPORATION

SELECTED BALANCE SHEET DATA

(In thousands)

(Unaudited)

June 30, December 31,

2012 2011

------------- -------------

Assets

Cash and cash equivalents and marketable

securities $ 160,199 $ 113,961

Property and equipment, net 6,833 6,163

Goodwill 2,356 2,312

Other assets 6,507 11,666

------------- -------------

Total assets $ 175,895 $ 134,102

============= =============

Liabilities and stockholders' equity

Accounts payable $ 1,155 $ 2,040

Accrued liabilities 7,956 8,776

Current portion of deferred revenue 2,859 4,210

Non-current portion of deferred revenue 5,312 6,386

Short-term note payable to Holdings 13,905 12,810

Stockholders' equity 144,708 99,880

------------- -------------

Total liabilities and stockholders' equity $ 175,895 $ 134,102

============= =============

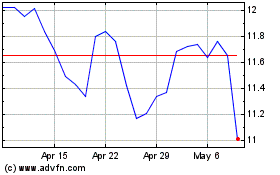

Dynavax Technologies (NASDAQ:DVAX)

Historical Stock Chart

From Mar 2024 to Apr 2024

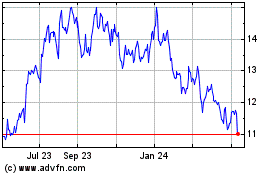

Dynavax Technologies (NASDAQ:DVAX)

Historical Stock Chart

From Apr 2023 to Apr 2024