Dell Shifts Tack With IPO Talks -- WSJ

September 24 2018 - 3:02AM

Dow Jones News

PC maker engages with banks after less conventional go-public

plan faces resistance

By Cara Lombardo and Dana Cimilluca

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (September 24, 2018).

Dell Technologies Inc. is exploring the possibility of launching

a traditional IPO instead of going public through a proposed

acquisition that has met resistance from several investors.

The PC and storage giant plans to interview several banks for

underwriting roles in an IPO this week, according to people

familiar with the matter. As a result, it has postponed by about a

week a roadshow to sell the takeover deal that was to begin this

week, the people said.

Dell would be one of the largest U.S. companies to launch an

IPO. It is far from certain that it will ultimately do so, however,

and interviewing banks could be seen as a tactic to put pressure on

investors to support the current deal.

Either way, the move is a sign tensions are rising between Dell

and investors who argue that the takeover deal undervalues its

Class V stock. Known as DVMT, that stock was created to track

Dell's controlling stake in VMware Inc., a fast-growing provider of

cloud-infrastructure services.

Acquiring DVMT would allow Dell to go public by swapping its

shares for the tracking stock. DVMT holders would receive cash too,

for total consideration of about $109 a share. But several

significant tracking-stock holders have privately balked at the

terms, with the chief complaint that Dell is overestimating the

value of its shares -- and thus underestimating the value of the

DVMT stock. Dell has said the deal is "extraordinarily fair" and

gives tracking-stock shareholders a path to invest in a broader

business.

Shareholders who are considering rejecting the current deal in a

vote that is required for it to go through include Elliott

Management Corp., Carl Icahn, some teams at BlackRock Inc., Dodge

& Cox, Farallon Capital Management LLC and Canyon Capital

Advisors LLC, according to people familiar with the matter. These

holders represent around 20% of the shares, according to

FactSet.

In a sign of the danger the deal won't go through, DVMT stock

currently trades at just over $96.

A straight IPO, in which Dell would sell shares directly to the

public and may buy out the tracking-stock holders at a smaller

premium, is seen as a backup. Even if the DVMT deal falls apart,

there is no guarantee Dell will hold a traditional IPO, which some

analysts have said would result in a lower valuation for the

company.

Last week, Dell said its current DVMT offer is final, meaning it

won't raise the price. When asked about the possibility of another

way of going public at an analyst day, Dell Chief Financial Officer

Tom Sweet said if shareholders reject the DVMT offer, the company

will "go back to status quo."

The deal on the table, which would help simplify Dell's

complicated ownership structure, was announced this summer. It was

the culmination of a strategic review the company had been

conducting for months that also looked at a straight IPO and a

combination with VMware itself.

The tracking stock was created as a way to help finance Dell's

2016 purchase of storage pioneer EMC. Dell, which was previously

public, went private in a roughly $25 billion leveraged buyout in

2013 by its founder, Michael Dell, and investment firm Silver

Lake.

Once the largest personal-computer maker, Dell is now known as

much for its corporate products such as storage, servers and

security software. It also is joining the crowded field of

companies wagering big money on the so-called Internet of Things,

as the computing giant looks for new avenues of growth amid a shift

in corporate spending to the cloud.

(END) Dow Jones Newswires

September 24, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

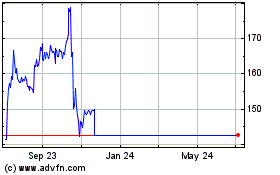

Vmware (NYSE:VMW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Vmware (NYSE:VMW)

Historical Stock Chart

From Apr 2023 to Apr 2024