David Lang to Join KKR as a Member in Australia

October 22 2017 - 6:00PM

Business Wire

KKR today announced the appointment of David Lang as a Member in

the Sydney office, effective early 2018.

This press release features multimedia. View

the full release here:

http://www.businesswire.com/news/home/20171022005059/en/

(Photo: Business Wire)

Mr. Lang joins KKR from Pamplona Capital Management, a US$10

billion global private equity fund where Mr. Lang was a partner and

founding member. With 20 years of industry experience, he has

successfully invested across a diverse range of sectors - from

consumer staples and retail, to industrials and infrastructure.

“We are thrilled to have an Australian of David’s impressive

calibre and experience join our team in Sydney,” Scott Bookmyer,

Member & Head of KKR Australia, said. “After spending the past

15 years in Europe and the United States, he brings back a wealth

of relationships and best practices to his home market. David

personifies the global & local nature of KKR’s strengths and

enables us to offer an even greater array of flexible capital

solutions to local institutions and entrepreneurs. David’s arrival,

and appointment as a fellow Member to help me lead the team,

reinforces KKR’s long-term commitment to the vibrant Australian

market.”

Mr. Lang said, “I am excited to return home after 15 years and

join an investment firm with such an outstanding reputation and

established presence in the region. Australia is a dynamic market

and I am convinced there is growing demand for entrepreneurs,

family-owned businesses and corporate CEOs to find like-minded

partners to help them expand domestically and abroad. With KKR's

experienced team and vast global network, we will continue to forge

such partnerships and I will be focused on continuing to build on

the firm’s success in Australia.”

KKR has been investing in Australia through its pan-regional

private equity funds since 2006 and opened its office in Sydney in

2007. As the Australian economy offers opportunities to invest in

high-quality companies poised for expansion domestically and

overseas, the country plays an important role in KKR's Asia Pacific

strategy. To date, KKR has deployed more than A$3 billion across

its Private Equity, Credit, Energy & Resources and Real Estate

businesses. KKR's existing private equity investments include Dixon

Hospitality, Latitude Financial Services, Laser Clinics Australia,

Santanol and Sundrop Farms.

About KKRKKR is a leading global investment firm that

manages multiple alternative asset classes, including private

equity, energy, infrastructure, real estate, credit and, through

its strategic partners, hedge funds. KKR aims to generate

attractive investment returns by following a patient and

disciplined investment approach, employing world-class people, and

driving growth and value creation with KKR portfolio companies. KKR

invests its own capital alongside its partners' capital and

provides financing solutions and investment opportunities through

its capital markets business. References to KKR's investments may

include the activities of its sponsored funds. For additional

information about KKR & Co. L.P.(NYSE: KKR), please visit

KKR's website at www.kkr.com and on Twitter @KKR_Co.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171022005059/en/

Media:KKRKristi Huller or Anita Davis, +852

3602-7335media@kkr.comorBespoke Approach (For KKR Australia)Ian

Smith, +61 8 8419 2888ismith@bespokeapproach.com

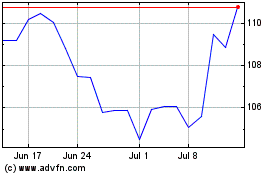

KKR (NYSE:KKR)

Historical Stock Chart

From Mar 2024 to Apr 2024

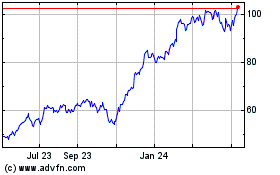

KKR (NYSE:KKR)

Historical Stock Chart

From Apr 2023 to Apr 2024