- Current report filing (8-K)

May 29 2012 - 4:08PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of

1934

Date of Report (Date of earliest event reported): May 24, 2012

EnerSys

(Exact name of registrant as specified in its charter)

Commission File Number: 1-32253

|

|

|

|

|

Delaware

|

|

23-3058564

|

|

(State or other jurisdiction

of incorporation)

|

|

(IRS Employer

Identification No.)

|

2366 Bernville Road, Reading, Pennsylvania 19605

(Address of principal executive offices, including zip code)

(610) 208-1991

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Item 5.03

|

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year

|

On and effective as of May 24, 2012, the Board of Directors of EnerSys amended its Bylaws to provide for a majority voting standard in uncontested director elections, instead of the previous

plurality voting standard (the “Bylaw Amendment”), and also approved conforming changes to EnerSys’ Corporate Governance Guidelines to make them consistent with the voting standards provided for in the Bylaw Amendment (the

“Guidelines Amendment”). Under the new majority voting standard, a director must be elected by the vote of the majority of votes cast, which means that the number of shares voted “for” the nominee’s election must exceed the

number of shares voted “against” the nominee’s election. If an incumbent director receives more “against” than “for” votes, in accordance with the Guidelines Amendment, the Nominating and Corporate Governance

Committee will consider such director’s contingent resignation and recommend to the Board of Directors the action to be taken. The Board of Directors will act on such recommendation and publicly disclose its decision and the rationale behind

such decision within 90 days from the date of the certification of the election results. The plurality voting standard will continue to apply to contested director elections pursuant to the Bylaw Amendment. A copy of the Bylaw Amendment is

attached hereto as Exhibit 3.1.

|

Item 7.01.

|

Regulation FD Disclosure

|

On May 29, 2012, EnerSys issued an earnings press release discussing its financial results for the fourth quarter and fiscal year

2012. The press release, attached as Exhibit 99.1 hereto and incorporated herein by reference, is being furnished to the SEC and shall not be deemed to be “filed” for any purpose.

On

May 24, 2012, the Board of Directors of EnerSys authorized the repurchase of up to $50 million of its common stock. The authorized repurchases will be made from time to time in either the open market or through privately negotiated

transactions and in compliance with its credit facility. The timing, volume and nature of share repurchases will be at the sole discretion of management, dependent on market conditions, other priorities for cash investment, applicable securities

laws, and other factors, and may be suspended or discontinued at any time. No assurance can be given that any particular amount of common stock will be repurchased. All or part of the repurchases may be implemented under a Rule 10b5-1 trading plan,

which would allow repurchases under pre-set terms at times when EnerSys might otherwise be prevented from doing so under insider trading laws or because of self-imposed blackout periods. This repurchase program is valid until March 31, 2013 and

may be modified, extended or terminated by the Board of Directors at any time. It is in addition to EnerSys’ previously authorized repurchase program of up to the number of shares exercised through previous stock option awards and common stock

issued under its 2010 Equity Incentive Plan.

|

Item 9.01.

|

Financial Statements and Exhibits

|

(d) Exhibits

3.1 Amendment to Bylaws.

99.1 Press Release, dated May 29, 2012, of EnerSys regarding the financial results for the fourth quarter and fiscal year 2012.

Signature(s)

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EnerSys

|

|

|

|

|

|

|

Date: May 29, 2012

|

|

|

|

By:

|

|

/s/ Richard W. Zuidema

|

|

|

|

|

|

|

|

Richard W. Zuidema

|

|

|

|

|

|

|

|

Executive Vice President

|

Exhibit Index

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

EX-3.1

|

|

Amendment to Bylaws.

|

|

|

|

|

EX-99.1

|

|

Press Release, dated May 29, 2012, of EnerSys regarding the financial results for the fourth quarter and fiscal year 2012.

|

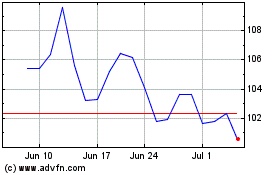

Enersys (NYSE:ENS)

Historical Stock Chart

From Mar 2024 to Apr 2024

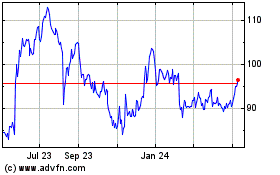

Enersys (NYSE:ENS)

Historical Stock Chart

From Apr 2023 to Apr 2024