Current Report Filing (8-k)

October 11 2018 - 6:03AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported):

October 10

, 2018

MURPHY OIL CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

1-8590

|

|

71-0361522

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

300 Peach Street

|

|

|

P.O. Box 7000, El Dorado, Arkansas

|

71730-7000

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

|

|

Registrant’s telephone number, including area code

870-862-6411

|

|

|

|

Not applicable

|

|

(Former Name or Former Address, if Changed Since Last Report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item 1.01 Entry into a Material Definitive Agreement

Contribution Agreement

On October 10, 2018,

Murphy Oil Corporation (the “Company”), through its wholly owned subsidiary, Murphy Exploration & Production Company – USA (“Murphy”), entered into a definitive agreement to form a new joint venture company with Petrobras America Inc. (“PAI”), a subsidiary of Petrobras (NYSE: PBR). The joint venture company will be comprised of Gulf of Mexico producing assets from Murphy and PAI with Murphy

overseeing the operations

. The transaction will have an effective date of October 1, 2018, and is expected to close

by year-end

2018.

A full text of a news release announcing the details of this agreement is attached as Exhibit 99.1 and incorporated herein by reference.

Fourth Amendment to Existing Credit Agreement

In connection with the entry into the definitive agreement described in the paragraph above, on October 10, 2018 the Company entered into an amendment (the “Amendment”) to its Credit Agreement dated August

10

, 2016 among the Company, Murphy Exploration & Production Company – International and Murphy Oil Company Ltd., as Borrowers, and JPMorgan Chase Bank, N.A., as administrative agent, to among other things, permanently remove the springing collateral requirement, modify the definition of consolidated net income to include the joint venture company’s net income, permanently remove the minimum domestic liquidity requirement and permit the entering into the transaction described above. The Amendment will become effective at the closing of the transaction.

The description of the Amendment contained herein is qualified in its entirety by reference to the Amendment attached as Exhibit 10.1 and incorporated by reference herein.

Item 2.03 Creation of

a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The description of the Amendment provided in Item 1.01 is incorporated herein by reference.

Ite

m 7.01 Regulation FD Disclosure

The Company will host a conference call

and webcast

to discuss the transaction on October 11, 2018, at 9:00 a.m. (EDT). The materials to be used during the presentation are attached as Exhibit 99.2 hereto and will also be available on the Company’s website at

http://ir.murphyoilcorp.com

on October 1

1

, 2018, prior to the call.

Forward-Looking Statements: This report contains forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Words such as “targets”, “expectations”, “plans”, “forecasts”, “projections” and other comparable terminology often identify forward-looking statements. These statements, which express management's current views concerning future events or results are subject to inherent risks and uncertainties. Factors that could cause one or more of these forecasted events not to occur include, but are not limited to, a failure to obtain necessary regulatory approvals, a deterioration in the business or prospects of Murphy, adverse developments in Murphy business' markets, adverse developments in the U.S. or global capital markets, credit markets or economies in general. Factors that could cause actual results to differ materially from those expressed or implied in our forward-looking statements include, but are not limited to, the volatility and level of crude oil and natural gas prices, the level and success rate of our exploration programs, our ability to maintain production rates and replace reserves, customer demand for our products, adverse foreign exchange movements, political and regulatory instability, and uncontrollable natural hazards. For further discussion of risk factors, see Murphy's most recent Annual Report on Form 10-K, on file with the U.S. Securities and Exchange Commission. Murphy undertakes no duty to publicly update or revise any forward-looking statements.

NOTE: All reserves are based on internally prepared engineering estimates using prices in effect on July 11, 2018.

The information in this Item 7.01, including Exhibit 99.2 attached hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section and shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended, or the Exchange Act, except as otherwise expressly stated in such filing.

Item 9.01 Financial Statements and Exhibits

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

MURPHY OIL CORPORATION

|

|

|

|

|

|

|

By:

|

/s/ Christopher D. Hulse

|

|

|

|

Christopher D. Hulse

|

|

|

|

Vice President and Controller

|

|

|

|

|

|

|

|

|

|

Date: October 10, 2018

|

|

|

Exhibit Index

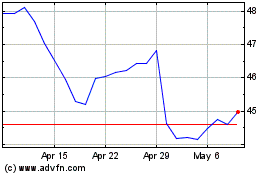

Murphy Oil (NYSE:MUR)

Historical Stock Chart

From Mar 2024 to Apr 2024

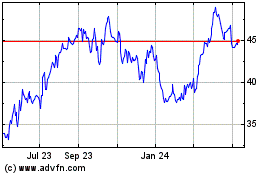

Murphy Oil (NYSE:MUR)

Historical Stock Chart

From Apr 2023 to Apr 2024