Current Report Filing (8-k)

October 09 2018 - 6:05AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report: October 5, 2018

(Date of earliest event reported)

CLS Holdings USA, Inc.

(Exact name of registrant as specified in its charter)

Commission File Number:

333-174705

|

Nevada

|

45-1352286

|

|

(State or other jurisdiction of incorporation)

|

(IRS Employer Identification No.)

|

11767 South Dixie Highway, Suite115, Miami, Florida 33156

(Address of principal executive offices, including zip code)

(888) 438-9132

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (Section 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (Section 240.12b-2 of this chapter).

|

|

Emerging Growth Company ☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

On October 5, 2018, CLS Holdings USA, Inc. ("

CLS"

or the "

Company

") issued a press release announcing that it has entered into an agreement with a Canadian agent, whereby the Agent will sell on a commercially reasonable efforts private placement basis, up to US$40 million of convertible debentures of the Company. The press release was issued in compliance with Rule 135c of the Securities Act of 1933, as amended (the “

U.S. Securities Act

”). A copy of the press release is attached as Exhibit 99.1 and incorporated herein by reference.

In accordance with General Instruction B.2 of Form 8-K, the information in this report, including the exhibits attached hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “

Exchange Act

”), nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Caution With Respect To Forward-looking Statements:

The information in the press news includes certain "forward-looking statements". All statements in the press release, other than statements of historical fact are forward-looking statements, including but limited to, statements relating to whether certain transactions, including the offering will be completed, the terms and timing of such transactions, receipt of all necessary regulatory approvals, the descriptions of the companies and the business that any potential target companies could bring to CLS. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from statements in this news release regarding our intentions include, without limitation, risks and uncertainties regarding: the timing of the proposed acquisition and closing of the offering; regulatory and legal risks associated with the cannabis industry; investor ability to clear securities through U.S. clearing agencies; volatility of the trading price of our securities; and other risks and uncertainties disclosed in the section entitled "Risk Factors" contained in our Annual Report on Form 10-K for the year ended May 31, 2018. Investors are cautioned that forward-looking statements are not guarantees of future performance and, accordingly, investors should not put undue reliance on forward-looking statements. Any forward-looking statement made by the Company in the press release is based only on information currently available to us and speaks only as of the date on which it is made.

Item 8

.01

Other Events

.

The Company issued a press release pursuant to Rule 135c of the U.S. Securities Act, related to a proposed offering of convertible debentures of the Company (the "

Debentures

"), not registered or required to be registered under the U.S. Securities Act. The Debentures have an issue price of US$1,000 per Debenture and are convertible into units of the Company (the “

Units

”) at the option of the holder at a conversion price of US$0.80 per Unit (the “

Conversion Price

”) at any time prior to the close of business on the earlier of: (i) the last business day immediately preceding the maturity date of the Debentures, being the date that is three (3) years from the closing date of the Offering (the “Closing Date”), and (ii) the date fixed for redemption (as set out in the Debentures (the “

Offering

”).

Each Unit shall be comprised of one common share of the Company (a “

Common Share

”) and one-half of one common share purchase warrant (each whole warrant, a “

Warrant

”). Each Warrant shall be exercisable into one Common Share at a price of US$1.10 per Warrant (the “

Exercise Price

”) for a period of 36 months from the Closing Date.

The Debentures may not be offered or sold in the United States absent registration or an applicable exemption from such registration requirements. Neither the press release nor this Form 8-K constitutes an offer for sale, or solicitation of an offer to buy, in the United States or to, or for the account or benefit of, any U.S. Person (as defined in Regulation S under the U.S. Securities) of any equity shares or any other securities of the Company.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

Exhibit No.

Description

99.1

Press Release dated October 5, 2018.*

* Furnished to not filed with the SEC pursuant to Item 7.01 above.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

CLS HOLDINGS USA, INC

.

|

|

|

Date: October 5, 2018

|

By:

|

/s/ Jeffrey I. Binder

|

|

|

|

|

Jeffrey I. Binder

Chairman and Chief Executive Officer

|

EXHIBIT INDEX

Exhibit No.

Description

99.1

Press Release dated October 5, 2018.*

* Furnished to not filed with the SEC pursuant to Item 7.01 above.

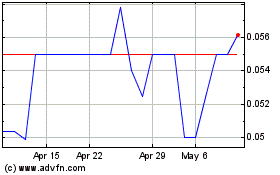

CLS Holdings USA (QB) (USOTC:CLSH)

Historical Stock Chart

From Mar 2024 to Apr 2024

CLS Holdings USA (QB) (USOTC:CLSH)

Historical Stock Chart

From Apr 2023 to Apr 2024