Current Report Filing (8-k)

October 04 2018 - 12:21PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of

1934

Date of

Report (Date of earliest event reported):

September 28, 2018

|

Bright Mountain Media, Inc.

|

|

(Exact

name of registrant as specified in its charter)

|

|

Florida

|

000-54887

|

27-2977890

|

|

(State

or other jurisdiction of incorporation)

|

(Commission

File Number)

|

(IRS

Employer Identification No.)

|

|

6400 Congress Avenue, Suite 2050, Boca Raton, Florida

|

33487

|

|

(Address

of principal executive offices)

|

(Zip

Code)

|

|

Registrant's telephone number, including area code:

|

561-998-2440

|

|

not applicable

|

|

(Former

name or former address, if changed since last report)

|

Check

the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2.

below):

|

☐

|

Written

communications pursuant to Rule 425 under the Securities Act (17

CFR 230.425)

|

|

|

|

|

☐

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17

CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17

CFR 240.13e-4(c))

|

|

Indicate by check mark whether the registrant is an emerging growth

company as defined in in Rule 405 of the Securities Act of 1933

(

§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this

chapter)

.

|

|

|

Emerging growth company

|

☒

|

|

If an

emerging growth company, indicate by checkmark if the registrant

has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange Act. ☐

|

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

|

Item 3.02

|

Unregistered Sales of Equity Securities.

|

Agreements with Spartan Capital Securities

On

September 6, 2017 Bright Mountain Media, Inc. entered into a five

year Consulting Agreement with the Spartan Capital Securities, LLC

(“Spartan Capital”), a broker-dealer and member of

FINRA, which under its terms would not become effective until the

closing of the maximum offering of our securities in a private

placement in which Spartan Capital served as placement agent as

described below. On September 28, 2018 the Consulting Agreement

became effective and Spartan Capital was engaged to provide such

advisory services that we may reasonably request related to general

corporate matters, including, but not limited to advice and input

with respect to raising capital, assisting us with strategic

introductions, and assisting management with enhancing corporate

and shareholder value. As compensation for these services, on the

effective date of the agreement we paid Spartan Capital $500,000

and issued it 1,000,000 shares of our common stock valued at

$750,000 (the “Consulting Shares”). We agreed to

register the Consulting Shares for public resale under the resale

registration statement to be filed by us with the Securities and

Exchange Commission (the “SEC”) described

below.

Spartan

Capital is an accredited investor and the issuance of the

Consulting Shares was exempt from registration under the Securities

Act of 1933, as amended (the “Securities Act”) in

reliance on an exemption provided by Section 4(a)(2) of the

Securities Act.

On

September 6, 2017 we also entered into a five year M&A Advisory

Agreement with Spartan Capital which became effective on September

28, 2018 following the sale of the maximum offering in the private

placement described below. Under the terms of the agreement,

Spartan Capital will provide consulting services to us related to

potential mergers or acquisitions, including candidates, valuations

and transaction terms and structures. As compensation, we paid

Spartan Capital a fee of $500,000 on the effective date of the

agreement.

Both

agreements contain customary confidentiality and indemnification

provisions.

The

foregoing descriptions of the terms and conditions of the

Consulting Agreement and M&A Advisory Agreement are qualified

in their entirety by reference to the agreements which are filed as

Exhibit 10.45 and 10.46, respectively, to this Current Report on

from 8-K.

Final closing of private placement

On

September 28, 2018, we sold 3,475,000 units of our securities to 26

accredited investors in a private placement exempt from

registration under the Securities Act in reliance on exemptions

provided by Section 4(a)(2) and Rule 506(b) of Regulation D. The

units (the “Units”) were sold at a purchase price of

$0.40 per Unit resulting in gross proceeds to us of $1,390,000.

Each unit consisted of one share of our common stock and one five

year common stock purchase warrant to purchase one share of our

common stock at an exercise price of $0.65 per share (the

“Private Placement Warrants”).

We paid

Spartan Capital a cash commission of $139,000 and issued it five

year placement agent warrants (“Placement Agent

Warrants”) to purchase an aggregate of 347,500 shares of our

common stock as compensation for its services. We used $1 million

of the proceeds from this final closing for the payment of the fees

due Spartan Capital under the terms of the Consulting Agreement and

M&A Advisory Agreement described above, and are using the

balance of $251,000 for general working capital.

Spartan

Capital acted as placement agent for us in this private placement,

and this latest closing represented the final closing of the

offering which commenced in January 2018 pursuant to which we

issued and sold an aggregate of 10,100,000 Units resulting in gross

proceeds to us of $4,040,000. During the course of this offering,

we paid Spartan Capital an aggregate cash commission of $404,000

and issued it Placement Agents Warrants to purchase an aggregate of

1,010,000 shares of our common stock, including the cash commission

and Placement Agent Warrants issued pursuant to the final closing

on September 28, 2018.

For the

36 months from the final closing of this private placement, we

granted Spartan Capital certain rights of first refusal if we

decide to undertake a future private or public offering or if we

decide to engage an investment banking firm.

We

granted the purchasers in the offering demand and piggy-back

registration rights with respect to the shares of our common stock

included in the Units and the shares of common stock issuable upon

the exercise of the Private Placement Warrants. In addition, we

agreed to file a resale registration statement within 120 days

following the final closing of this offering covering the shares of

our common stock issuable upon the exercise of the Private

Placement Warrants included in the Units. If we should fail to

timely file this resale registration statement, then within five

business days of the end of month we will pay the holders an amount

in cash, as partial liquidated damages, equal to 2% of the

aggregate purchase price paid by the holder for each 30 days, or

portion thereof, until the earlier of the date the deficiency is

cured or the expiration of six months from filing deadline. We will

keep any such registration statement effective until the earlier of

the date upon which all such securities may be sold without

registration under Rule 144 promulgated under the Securities Act or

the date which is six months after the expiration date of the

Private Placement Warrants. We are obligated to pay all costs

associated with this registration statement, other than selling

expenses of the holders.

Additional terms of

the Private Placement Warrants include:

|

●

|

standard

anti-dilution provisions;

|

|

|

|

|

●

|

become

subject to a “cashless exercise” under certain

conditions; and

|

|

|

|

|

●

|

certain

call provisions at $0.01 per warrant if our stock trades at or

above $1.50 per share for 10 consecutive trading days with an

average daily trading volume of not less than 30,000 shares during

such 10 consecutive trading day period.

|

The

exercise price of the Placement Agent Warrants is also subject to

the proportional adjustment in the event of stock splits, stock

dividends and similar corporate events, and may be exercised on a

cashless basis. We also granted Spartan Capital piggy-back

registration rights with respect to the shares of our common stock

issuable upon the exercise of the Placement Agent

Warrants.

The

foregoing descriptions of the terms and conditions of the Private

Placement Warrants and Placement Agent Warrants are qualified in

their entirety by reference to the warrants which are filed as

Exhibit 4.1 and 4.2, respectively, to this Current Report on from

8-K.

|

Item 9.01

|

Financial Statements and Exhibits.

|

|

|

|

|

|

Incorporated by Reference

|

|

Filed or

Furnished

Herewith

|

|

No.

|

|

Exhibit Description

|

|

Form

|

|

Date Filed

|

|

Number

|

|

|

|

|

Form of

Private Placement Warrant

|

|

10-K

|

|

4/2/18

|

|

4.1

|

|

|

|

|

|

Form of

Placement Agent Warrant

|

|

10-K

|

|

4/2/18

|

|

4.2

|

|

|

|

|

|

Consulting

Agreement dated September 6, 2017 by and between Spartan Capital

Securities, LLC and Bright Mountain Media, Inc.

|

|

|

|

|

|

|

|

Filed

|

|

|

|

M&A

Advisory Agreement dated September 6, 2017 by and between Spartan

Capital Securities, LLC and Bright Mountain Media,

Inc.

|

|

|

|

|

|

|

|

Filed

|

SIGNATURES

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant

has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

Date:

October 3, 2018

|

Bright

Mountain Media, Inc.

|

|

|

|

|

|

By: /s/

W. Kip Speyer

|

|

|

W. Kip

Speyer, Chief Executive Officer

|

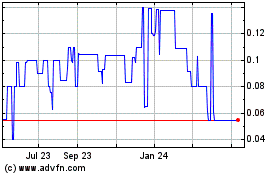

Bright Mountain Media (QB) (USOTC:BMTM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bright Mountain Media (QB) (USOTC:BMTM)

Historical Stock Chart

From Apr 2023 to Apr 2024