Current Report Filing (8-k)

September 17 2018 - 9:02AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OFTHE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

September 17, 2018

|

MMEX RESOURCES CORPORATION

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

000-55831

|

|

26-1749145

|

|

(State of

incorporation)

|

|

(Commission File

Number)

|

|

(IRS Employer

Identification Number)

|

3616 Far West Blvd., #117-321

Austin, Texas 78731

(Address of principal executive offices)

Registrant's telephone number, including area code:

(855) 880-0400

Check the appropriate box if the Form 8-K filing is intended to simultaneously satisfy the reporting obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act

¨

Soliciting material pursuant to Rule 14a-12 of the Exchange Act

¨

Pre-commencement communications pursuant to Rule 14d-2(b) Exchange Act

¨

Pre-commencement communications pursuant to Rule 13e-4(c) Exchange Act

Item 1.01 Entry into a Material Definitive Agreement.

Reference is made to the disclosure under Item 3.02 of this report.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

Reference is made to the disclosure under Item 3.02 of this report.

Item 3.02 Unregistered Sales of Equity Securities.

On September 17, 2018, we announced that, effective September 13, 2018, we issued and delivered to Vista Capital Investments, LLC a 12% convertible note in the original maximum principal amount of $550,000, prior to original discount of $50,000 (consisting of an initial advance of $100,000 on such date and possible future advances, less the prorated discount). The holder of the note, at its option, may convert the unpaid principal balance of, and accrued interest on, the note into shares of common stock at a 40% discount from the lowest trading price during the 25 days prior to conversion. We may prepay the note at a 45% redemption premium during the first 90 days after issuance. The maturity date for each advance is two years from the date of advance.

We also announced that, effective September 13, 2018, we issued and delivered to GS Capital Partners, LLC a 10% convertible note in the principal amount of $110,000. The note was issued at a discount, resulting in our receipt of $100,000 after discount and expenses. The holder of the note, at its option, may convert the unpaid principal balance of, and accrued interest on, the note into shares of common stock (i) during the first 180 days, at a price of $.03 per share of common stock and (ii) thereafter at a 40% discount from the average of the three lowest trading price during the 25 days prior to conversion. The note matures on September 13, 2019. We may redeem the note at redemption prices ranging from 115% to 135% during the first 180 days after issuance.

Any issuance of the shares upon conversion of the note will be exempt from registration pursuant to the exemption provided by Section 4(2) of the Securities Act of 1933.

We utilized the net proceeds of the notes to repurchase in full the outstanding convertible note held by JSJ Investments, Inc. for the repurchase price of $188,606.16.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

MMEX Resources Corporation

|

|

|

|

|

|

|

|

Date: September 17, 2018

|

By:

|

/s/ Jack W. Hanks

|

|

|

|

|

Jack W. Hanks, President and

|

|

|

|

|

Chief Executive Officer

|

|

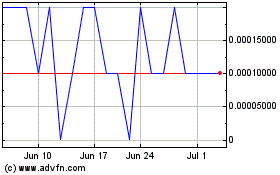

MMEX Resources (PK) (USOTC:MMEX)

Historical Stock Chart

From Mar 2024 to Apr 2024

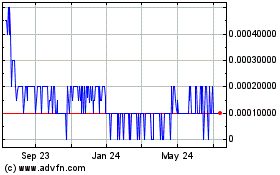

MMEX Resources (PK) (USOTC:MMEX)

Historical Stock Chart

From Apr 2023 to Apr 2024