Current Report Filing (8-k)

July 09 2018 - 10:01AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 6, 2018

Eldorado Resorts, Inc.

(Exact Name of registrant as specified in its charter)

|

|

|

|

|

|

|

Nevada

|

|

001-36629

|

|

46-3657681

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

100 West Liberty Street, Suite 1150

Reno, Nevada

|

|

89501

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (775)

328-0100

Not applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of

the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as

defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2

of the Securities Exchange Act of 1934

(§240.12b-2

of this chapter).

Emerging growth company ☐

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

As previously disclosed, on February 28, 2018, Eldorado Resorts, Inc.

(“ERI” or the “Company”) announced that it had entered into two definitive asset purchase agreements with Churchill Downs Incorporated (“CDI”) and certain of its subsidiaries to sell substantially all of the assets and

liabilities of Presque Isle Downs & Casino in Erie, Pennsylvania (the “Presque Isle Transaction”) and Lady Luck Casino Vicksburg in Vicksburg, Mississippi (the “Lady Luck Vicksburg Transaction”).

Also as previously disclosed, on May 7, 2018, each of the Company and CDI received a request for additional information and documentary

material (a “Second Request”) pursuant to the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the “HSR Act”), from the Federal Trade Commission (the “FTC”) in connection with the FTC’s review of

the pending Lady Luck Vicksburg Transaction.

Following receipt of, and consideration of the time and expense needed to reply to, the

Second Request, pursuant to a Termination Agreement and Release, dated as of July 6, 2018 (the “Vicksburg Termination Agreement”), by and among CDI, ERI and a wholly owned subsidiary of ERI, the Company and CDI mutually agreed to

terminate the asset purchase agreement with respect to the Lady Luck Vicksburg Transaction. In connection with the Vicksburg Termination Agreement, CDI has agreed to pay the Company a $5.0 million termination fee, subject to the parties’

execution of a definitive agreement with respect to the Lady Luck Nemacolin Transaction, as described below.

Concurrently with the entry

into the Vicksburg Termination Agreement, on July 6, 2018, the Company, a wholly-owned subsidiary of the Company and CDI also entered into an amendment to the previously announced asset purchase agreement relating to the Presque Isle

Transaction (the “PID Amendment”). Pursuant to the PID Amendment, the Company and CDI have agreed to, among other things, (i) eliminate the consummation of the Lady Luck Vicksburg Transaction as a condition to closing the Presque Isle

Transaction, (ii) withdraw the parties’ filings previously submitted in connection with the HSR Act and submit new filings pursuant to the HSR Act to reflect the transactions contemplated by the PID Amendment and the Vicksburg Termination

Agreement and (iii) cooperate in good faith, subject to certain conditions, to enter into an agreement pursuant to which CDI will assume the rights and obligations to operate the Lady Luck Casino Nemacolin in Farmington, Pennsylvania (the

“Lady Luck Nemacolin Transaction”). The Presque Isle Transaction remains dependent on usual and customary closing conditions and is also conditioned on the execution of the definitive agreement with respect to the Lady Luck Nemacolin

Transaction.

A copy of the press release announcing the Termination Agreement and Amendment is furnished herewith as Exhibit 99.1.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

Date: July 9, 2018

|

|

|

|

ELDORADO RESORTS, INC.

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/Edmund L. Quatmann, Jr.

|

|

|

|

|

|

|

|

Name: Edmund L. Quatmann, Jr.

|

|

|

|

|

|

|

|

Title: EVP, Chief Legal Officer and Secretary

|

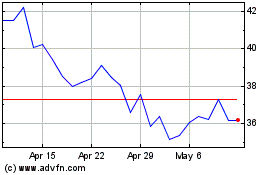

Caesars Entertainment (NASDAQ:CZR)

Historical Stock Chart

From Mar 2024 to Apr 2024

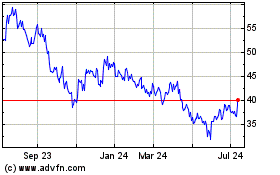

Caesars Entertainment (NASDAQ:CZR)

Historical Stock Chart

From Apr 2023 to Apr 2024