Current Report Filing (8-k)

July 05 2018 - 5:28PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): June 28, 2018

ALLIANCE

MMA, INC.

(Exact name of registrant as specified

in its charter)

|

Delaware

|

001-37899

|

47-5412331

|

|

(State or Other Jurisdiction of

Incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

590 Madison Avenue, 21st Floor

New York, New York 10022

(Address of principal executive offices

and zip code)

Registrant’s telephone number,

including area code: (212) 739-7825

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

|

|

¨

|

Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company

¨

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised

financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

Item 1.01. Entry into a Material Definitive Agreement

Item 2.03. Creation of a Direct Financial Obligation or an

Obligation under an Off-Balance Sheet Arrangement of a Registrant.

On June 28, 2018, Alliance MMA Inc. (the “Company”

or “Registrant”) entered into a Securities Purchase Agreement (“SPA”) with SCWorx Acquisition Corp. (“Purchaser”),

under which it agreed to sell up to $1M in principal amount of convertible notes and Warrants to purchase up to 671,142 shares

of common stock. The Note is convertible into shares of common stock at a conversion price of $.3725 and the Warrants are exercisable

for shares of common stock at an exercise price of $.3725.

Prior to the Company entering into a business

combination agreement with the Purchaser, the conversion and exercise prices are subject to adjustment to the price of any lower

priced securities issued by the Company (subject to certain exceptions and a floor price equal to 20% of the original conversion/exercise

price). The Note is subject to automatic conversion upon the closing of a business combination transaction with the Purchaser.

No adjustment to the conversion or exercise price will be given effect if the Company and the Purchaser consummate a business combination

transaction. At this time, there is no definitive agreement between the Company and the purchaser with respect to a business combination

transaction.

On June 29, 2018, the Company sold the

Purchaser convertible notes in the principal amount of $500,000 and warrants to purchase 335,570 shares of common stock, for an

aggregate purchase price of $500,000. The Note bears interest at 10% annually and matures on or about June 27, 2019. The Purchaser

has agreed in the SPA to fund (i) a second tranche of $250,000 upon the signing of a merger agreement with the Purchaser and (ii)

a third tranche of $250,000 upon mutual agreement of the Purchaser and Company.

Repayment of the note is subject to acceleration

in the following circumstances:

|

|

·

|

In the event of a breach of the SPA, warrant

Agreement or Note, including the repayment provisions

|

|

|

·

|

if a bankruptcy or similar proceeding

for the benefit of our creditors is instituted against the Company

|

|

|

·

|

if the Company’s common stock is

no longer listed on the Nasdaq stock Market

|

|

|

·

|

if the Company fails to comply with its

SEC reporting obligations

|

|

|

·

|

if the Company fails to meet the current

public information requirements under Rule 144

|

|

|

·

|

if the Company breaches a material agreement

and the amount involved exceeds $250,000

|

|

|

·

|

if there is a change of control or business

combination transaction with a party other than the Purchaser

|

|

|

·

|

if the company fails to reserve sufficient

shares under the Note and Warrants

|

|

|

·

|

if a judgment in excess of $250,000 is

entered against the company

|

In the event of a default under the Note,

the Company is required to pay an amount equal to 110% of all amounts due under the Note.

Negative covenants in the Note include

restrictions on incurring additional indebtedness and sales of assets without approval of the outside directors.

The note may be prepaid at any time following

issuance, subject to payment of a variable premium ranging between 10% (redemption within 90 days of issuance) and 20% (redemption

after 90 days).

If the Company enters into a merger/acquisition

transaction or change of control transaction with a party other than the Purchaser, then the Purchaser shall have the option to

have the outstanding Notes and Warrants redeemed for an amount of cash equal to their “Black Scholes Value.”

The

Company applied a portion of the proceeds of the $500,000 note to repay the

$90,000

it recently borrowed from a third-party shareholder. This Note was secured by the capital stock of Roundtable Creative, Inc.,

(d/b/a/ “SuckerPunch Entertainment”) owned by the Company. Accordingly, the lien on the capital stock of SuckerPunch

Entertainment has been released and the Company now owns that capital stock free and clear of all liens.

On July 5, 2018, Joe Gamberale,

a director of the Company, agreed to convert $150,000 of Company debt into 402,685 shares of common stock and warrants to purchase

100,671 shares of common stock at an exercise price of $.3725 (the same basic terms as the SCWorx investment outlined above (a

conversion rate and exercise price of $.3725, with the same warrant coverage).

******************

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

ALLIANCE MMA, INC.

|

|

|

|

|

|

By:

|

/s/ John Price

|

|

|

|

John Price

|

|

|

|

Co-President, Chief Financial Officer

|

|

|

|

|

|

Dated: July 5, 2018

|

|

|

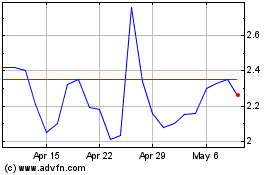

SCWorx (NASDAQ:WORX)

Historical Stock Chart

From Mar 2024 to Apr 2024

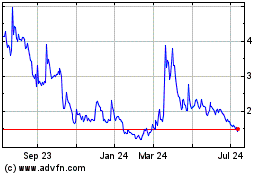

SCWorx (NASDAQ:WORX)

Historical Stock Chart

From Apr 2023 to Apr 2024