Current Report Filing (8-k)

July 02 2018 - 5:29PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of

1934

June 27, 2018

Date of Report (Date of earliest event reported)

Friendable, Inc.

(Exact name of registrant as specified in its charter

|

Nevada

|

000-52917

|

98-0546715

|

|

(State

or other jurisdiction

|

(Commission

|

(IRS

Employer

|

|

of

incorporation)

|

File

Number)

|

Identification

No.)

|

1821 S Bascom Ave., Suite 353, Campbell, California

95008

(Address of principal executive offices) (Zip Code)

(855) 473-7473

Registrant’s telephone number, including area

code

Check the appropriate box below if the Form 8-K is intended to

simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

☐

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

☐

Soliciting material

pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

☐

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17

CFR 240.14d-2(b))

☐

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17

CFR 240.13e-4(c))

☐ Emerging

growth company

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period

for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange

Act.

☐

|

Indicate

by check mark whether the registrant is a shell company (as defined

in Rule 12b-2 of the Exchange Act).

|

☐

Yes

☒

No

|

As used herein, the terms, “we,” “us,”

“our,” and the “Company” refers to Vapir

Enterprises, Inc., a Nevada corporation and its subsidiaries,

unless otherwise stated.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Form 8-K and other reports filed by Friendable, Inc.

(“Friendable” or the “

Company

”) from time to time with the Securities and

Exchange Commission (collectively, the “

Filings

”) contain or may contain forward looking

statements and information that are based upon beliefs of, and

information currently available to, the Company’s management

as well as estimates and assumptions made by the Company’s

management. When used in the filings the words

“anticipate”, “believe”,

“estimate”, “expect”, “future”,

“intend”, “plan” or the negative of these

terms and similar expressions as they relate to the Company or

Company’s management identify forward looking statements.

Such statements reflect the current view of the Company with

respect to future events and are subject to risks, uncertainties,

assumptions and other factors relating to the Company’s

industry, the Company’s operations and results of operations

and any businesses that may be acquired by the Company. Should one

or more of these risks or uncertainties materialize, or should the

underlying assumptions prove incorrect, actual results may differ

significantly from those anticipated, believed, estimated,

expected, intended or planned.

Although the Company’s management believes that the

expectations reflected in the forward looking statements are

reasonable, the Company cannot guarantee future results, levels of

activity, performance or achievements. Except as required by

applicable law, including the securities laws of the United States,

the Company does not intend to update any of the forward-looking

statements to conform these statements to actual results. The

following discussion should be read in conjunction with the

Company’s pro forma financial statements and the related

notes filed with this Form 8-K.

Item 1.01 Entry into a Material Definitive Agreement.

Share Exchange Agreement

On June 27, 2018, Friendable, Inc., a corporation organized under

the laws of Nevada (the “Acquiror” or

“Company”), shareholders of the Acquiror (the

“Acquiror Principal Shareholders”), and Sharps

Technology, Inc., a corporation organized under the laws of Wyoming

(the “Acquiree”) entered into a Share Exchange

Agreement (the “Agreement”) pursuant to which each

person who is a shareholder of the Acquiree (the “Acquiree

Shareholders”) (who are the holders of all of the issued and

outstanding shares of common stock of the Acquiree (the

“Acquiree Interests”)) have agreed to transfer to the

Acquiror, and the Acquiror has agreed to acquire from the Acquiree

Shareholders, all of the Acquiree Interests, in exchange for the

issuance of 17,000,000 shares of Acquiror’s common stock to

the Acquiree Shareholders (the “Acquiror Shares”),

which Acquiror Shares shall constitute approximately 85.00% on a

fully diluted basis of the issued and outstanding shares of

Acquiror Common Stock immediately after the closing of the

transactions contemplated herein, in each case, on the terms and

conditions as set forth in the Agreement. The 17,000,000 share

number is subject to adjustment for any shares of Acquiree issued

subsequent to June 27, 2018 for financing purposes. The transaction

shall be consummated upon the satisfaction of certain closing

conditions set forth in the Share Exchange Agreement which include

but are not limited to: a reverse split of the Acquiror’s

outstanding common stock so that no more than 3,000,000 shares will

be outstanding in total prior to issuance of the Acquiror Common

Stock, exchange of $1.5 million principal amount of notes for $1.5

million principal amount of post-closing notes and disposition of

its Fan Pass, Inc. business and filing of an S-1 Registration

Statement with respect thereto.

For accounting purposes, the Share Exchange will be treated as an

acquisition of Acquiror and a recapitalization of Acquiree.

Acquiree will be the accounting acquirer, and the result of its

operations carryover.

In issuing the Acquiror Shares to the Acquiree Shareholders, the

Company will rely upon the exemption from registration provided by

Section 4(a)(2) of the Securities Act of 1933, as amended, as,

among other things, the transaction did not involve a public

offering and the securities were acquired for investment purposes

only and not with a view to or for sale in connection with any

distribution thereof.

Disposition of Fan Pass, Inc.

On June 27, 2018, Acquiror, Acquiree and Fan Pass, Inc. entered

into a Spin Off Agreement pursuant to which the Acquiror shall

distribute 100% of the issued and outstanding stock of Fan Pass,

Inc. to the Acquiror’s shareholders existing immediately

prior to the Closing. The Spin Off Agreement also requires that Fan

Pass, Inc. file a registration statement on Form S-1 for the

registration of all of its shares distributed to Acquiror’s

shareholders.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

Exhibit Number

|

|

Description

|

|

|

|

|

|

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of

1934, the registrant has duly caused this report to be signed on

its behalf by the undersigned hereunto duly

authorized.

|

|

Friendable, Inc.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Robert Rositano

|

|

|

|

Robert

Rositano

|

|

|

|

CEO

|

|

|

|

|

|

|

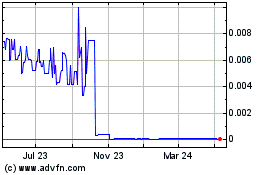

Friendable (CE) (USOTC:FDBL)

Historical Stock Chart

From Mar 2024 to Apr 2024

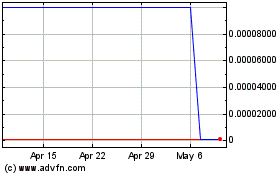

Friendable (CE) (USOTC:FDBL)

Historical Stock Chart

From Apr 2023 to Apr 2024