Current Report Filing (8-k)

June 27 2018 - 11:38AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported):

June 27

, 2018

ARGENTUM

47, INC.

(Exact

name of registrant as specified in its charter)

GLOBAL

EQUITY INTERNATIONAL, INC.

(Former

name of registrant until March 29, 2018)

|

Nevada

|

|

000-54557

|

|

27-3986073

|

|

(State

or other jurisdiction

|

|

(Commission

|

|

(I.R.S.

Employer

|

|

of

incorporation)

|

|

File

Number)

|

|

Identification

Number)

|

X3

Jumeirah Bay, Office 3305,

Jumeirah

Lake Towers

Dubai,

UAE

(Address

of Principal Executive Offices) (Zip Code)

Registrant’s

telephone number, including area code:

+ (971) 42767576 / + (1) 321 200 0142

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2., below):

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.133-4(c))

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule

12b-2 of the Securities Exchange Act of 1934.

Emerging

growth company [X]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section13(a) of the Exchange Act. [ ]

Item

8.01 OTHER EVENTS

Shareholders

Update

On

December 4, 2017, the Company executed an agreement with Mammoth Corporation in which it was

agreed

to that Mammoth would suspend further conversion of debt into equity and receive the remaining debt in six equal and manageable

payments.

Today,

June 27, 2018, the Company would like to inform its shareholders that the outstanding debt with Mammoth Corporation has now been

paid in full hence no further monies are owed or outstanding.

Also,

the Company´s remaining convertible debt with Xantis Private Equity Fund, William Marshal Plc. and also Xantis Aion Securitization

Fund will become convertible 366 days after each tranche of funding was received, to date, January 13, 2019, January 24, 2019

and June 9, 2019 respectively. The agreed conversion terms of these financing agreements, as per the Forms 8-k filed with the

SEC, were the following:

“On each Maturity Date, the outstanding

Convertible Notes shall be automatically converted into shares of Borrower’s common stock at a conversion price equal to

the greater of US$0.02 or the average closing price of Borrower’s common stock on the Over-the-Counter Bulletin Board for

the prior 60 trading days.

”

Finally,

the Company would like to confirm that there is no default clause contemplated in any of the three funding agreements whereby

either William Marshall Plc, Xantis Private Equity Fund and Xantis Aion Securitization Fund could convert their investment into

equity at a price lower than $0.02.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed

on its behalf by the undersigned hereunto duly authorized.

Dated:

June 27, 2018

|

|

ARGENTUM

47, INC.

|

|

|

|

|

|

|

By:

|

/s/

Enzo Taddei

|

|

|

|

Enzo

Taddei

|

|

|

|

Chief

Financial Officer

|

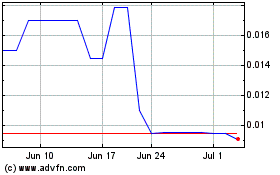

Argentum 47 (PK) (USOTC:ARGQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

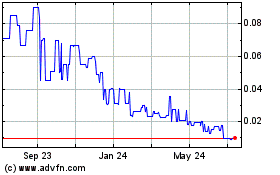

Argentum 47 (PK) (USOTC:ARGQ)

Historical Stock Chart

From Apr 2023 to Apr 2024