Current Report Filing (8-k)

June 25 2018 - 7:13AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported):

June 20, 2018

ENLINK MIDSTREAM, LLC

(Exact name of registrant as specified in its charter)

|

DELAWARE

|

|

001-36336

|

|

46-4108528

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

|

(Commission File

Number)

|

|

(I.R.S. Employer Identification No.)

|

|

1722 ROUTH STREET, SUITE 1300

DALLAS, TEXAS

|

|

75201

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code:

(214) 953-9500

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Item 1.01.

Entry into a Material Definitive Agreement.

On June 20, 2018,

EnLink Midstream, LLC (“ENLC”) entered into a Second Amendment to Credit Agreement and Limited Consent (the “ENLC Credit Agreement Amendment”), which amends the Credit Agreement, dated as of March 7, 2014 (as amended, the “ENLC Credit Agreement”), by and among ENLC, Bank of America, N.A., as Administrative Agent, and the lenders party thereto.

The ENLC Credit Agreement Amendment amends the change of control provisions of the ENLC Credit Agreement to, among other things, designate certain affiliates of Global Infrastructure Partners (“GIP”) as Qualifying Owners (as defined in the ENLC Credit Agreement Amendment) from and after the closing of the previously announced proposed acquisition by affiliates of GIP of all of the equity interests held by subsidiaries of Devon Energy Corporation in EnLink Midstream Partners, LP (the “Partnership”), ENLC, and

EnLink Midstream Manager, LLC (the “Manager”), the managing member of ENLC.

Also on June 20, 2018, the Partnership entered into a Second Amendment to Credit Agreement and Limited Consent (the “Partnership Credit Agreement Amendment”), which amends the Credit Agreement, dated as of February 20, 2014 (as modified and amended, the “Partnership Credit Agreement”), by and among the Partnership, Bank of America, N.A., as Administrative Agent, and the lenders party thereto. The Partnership Credit Agreement Amendment amends the change of control provisions of the Partnership Credit Agreement in substantially the same manner as the amendments described above with respect to the ENLC Credit Agreement.

The foregoing descriptions of the ENLC Credit Agreement Amendment and the Partnership Credit Agreement Amendment do not purport to be complete and are qualified in their entirety by reference to the ENLC Credit Agreement Amendment and the Partnership Credit Agreement Amendment, which are attached as Exhibit 10.1 and Exhibit 10.2, respectively, to this Current Report on Form 8-K (this “Current Report”) and are incorporated herein by reference.

Item 2.03.

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information provided in Item 1.01 of this Current Report is incorporated herein by reference.

Item 5.02.

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Officer Appointments

On June 21, 2018, the Board of Directors (the “Manager Board”) of the Manager appointed Mr. Benjamin D. Lamb to Executive Vice President and Chief Operating Officer of

2

the Manager and Ms. Alaina K. Brooks to Executive Vice President, Chief Legal and Administrative Officer,

and Secretary of the Manager, in each case, effective as of June 21, 2018. Additionally, the Board of Directors (the “Company Board”) of EnLink Midstream GP, LLC (the “Company”), the general partner of the Partnership, appointed Mr. Benjamin D. Lamb to Executive Vice President and Chief Operating Officer of the Company and Ms. Alaina K. Brooks to Executive Vice President, Chief Legal and Administrative Officer, and Secretary of the Company, in each case, effective as of June 21, 2018.

Benjamin D. Lamb, 39, joined the Company in December 2012. Mr. Lamb has served in a number of leadership roles within the Company, most recently as Executive Vice President — North Texas and Oklahoma, and previously as Executive Vice President — Corporate Development, Senior Vice President — Finance and Corporate Development, and Vice President — Finance. Prior to joining the Company, Mr. Lamb served as a Principal at the investment banking firm Greenhill & Co., which he joined in 2005. In that role, he focused on the evaluation and execution of mergers, acquisitions, and restructuring transactions for clients primarily in the midstream energy, power, and utility industries. Prior to joining Greenhill, he served as an investment banker at UBS Investment Bank in its Mergers and Acquisitions Group and in its Global Energy Group, and at Merrill Lynch in its Global Energy and Power Group. Mr. Lamb received his Bachelor of Business Administration from Baylor University in 2000.

Alaina K. Brooks, 44, joined the Company in 2008. Ms. Brooks has served in several legal roles within the Company, most recently as Senior Vice President, General Counsel, and Secretary, and previously as Deputy General Counsel. In Ms. Brooks’ new role, she serves on the Company’s Executive Leadership Team and leads the legal, regulatory, public and industry affairs, environmental health and safety, and human resources functions. Before joining the Company in 2008, Ms. Brooks practiced law at Weil, Gotshal & Manges LLP and Baker Botts LLP, where she counseled clients on matters of complex commercial litigation, risk management, and taxation. Ms. Brooks is a licensed Certified Public Accountant and holds a Juris Doctor from Duke University School of Law and Bachelor of Science and Master of Science in accounting from Oklahoma State University.

Officer Compensation

In connection with his appointment as Executive Vice President and Chief Operating Officer of the Company and the Manager, the Company Board and the Manager Board (as applicable) approved the following actions with respect to Mr. Lamb’s compensation, in each case, effective as of June 21, 2018: (1) increasing his base salary from an annual rate of pay of $435,000 to $475,000; and (2) increasing his target percentage for the short-term incentive program (the “STI Program”) from 90% to 100%. A description of the STI Program is provided in each of the Partnership’s annual report on Form 10-K (the “Partnership 2018 10-K”) and ENLC’s annual report on Form 10-K (the “ENLC 2018 10-K”, and, together with the Partnership 2018 10-K, the “2018 10-Ks”), respectively, each filed with the Securities and Exchange Commission on February 21, 2018. Each of the Compensation Committee of the Company Board and the Governance and Compensation Committee of the Manager Board recommended that the applicable Board approve the foregoing appointment and compensation changes.

3

In connection with her appointment as Executive Vice President, Chief Legal and Administrative Officer, and Secretary of the Company and the Manager, the Company Board and

the Manager Board (as applicable) approved the following with respect to Ms. Brooks’ compensation, in each case, effective as of June 21, 2018: (1) a base salary annual rate of pay of $425,000; and (2) a target percentage for the STI Program of 90%. A description of the STI Program is provided in each of the 2018 10-Ks. Each of the Compensation Committee of the Company Board and the Governance and Compensation Committee of the Manager Board recommended that the applicable Board approve the foregoing appointment and compensation changes. In addition, effective June 21, 2018, Ms. Brooks and a subsidiary of the Partnership entered into (i) an agreement (the “Amended CIC Agreement”) that amends and restates Ms. Brooks’ prior change in control agreement, which is materially consistent with the form of change in control agreement described in the 2018 10-Ks that the Manager Board previously approved and (ii) an agreement (the “Amended Severance Agreement”) that amends and restates Ms. Brooks’ prior severance agreement, which is materially consistent with the form of severance agreement described in the 2018 10-Ks that the Manager Board previously approved. The Amended CIC Agreement is materially consistent with Ms. Brooks’ prior change in control agreement except that the multiple used to determine the cash severance amount that would be payable to Ms. Brooks upon a qualifying termination during the period that begins 120 days prior to a change in control (as defined in the Amended CIC Agreement) and ends 24 months following a change in control was increased from 1x to 2x. The Amended Severance Agreement is materially consistent with Ms. Brooks’ prior severance agreement except that the multiple used to determine the cash severance amount that would be payable to Ms. Brooks upon a qualifying termination (as defined in the Amended Severance Agreement) was increased from 1x to 2x. The foregoing description of the Amended CIC Agreement does not purport to be complete and is qualified in its entirety by reference to the text of the Form of Amended and Restated Change in Control Agreement, which is filed as Exhibit 10.12 to the ENLC 2018 10-K and incorporated herein by reference. The foregoing description of the Amended Severance Agreement does not purport to be complete and is qualified in its entirety by reference to the text of the Form of Amended and Restated Severance Agreement, which is filed as Exhibit 10.11 to the ENLC 2018 10-K and incorporated herein by reference.

In addition, on June 21, 2018, the Company Board and the Manager Board approved increasing Eric D. Batchelder’s base salary from an annual rate of pay of $380,000 to $435,000 in order to compensate Mr. Batchelder for adding corporate development responsibilities to his role as Executive Vice President and Chief Financial Officer. Each of the Compensation Committee of the Company Board and the Governance and Compensation Committee of the Manager Board recommended that the applicable Board approve the foregoing compensation changes.

Officer Departure

On June 25, 2018, ENLC announced that Mr. McMillan (“Mac”) Hummel, Executive Vice President/Business Unit President, will depart the Company and the Manager after an appropriate transition period.

4

Item 7.01.

Regulation FD Disclosure.

On June 25, 2018, ENLC issued a press release announcing the appointments and departure described in Item 5.02 of this Current Report. A copy of the press release is furnished as Exhibit 99.1 to this Current Report. In accordance with General Instruction B.2 of Form 8-K, the information set forth in this Item 7.01 and in the attached exhibit shall be deemed to be furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Item 9.01.

Financial Statements and Exhibits.

(d)

Exhibits.

In accordance with General Instruction B.2 of Form 8-K, the information set forth in the attached Exhibit 99.1 shall be deemed to be furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Exchange Act.

|

EXHIBIT

NUMBER

|

|

DESCRIPTION

|

|

|

|

|

|

10.1

|

—

|

Second Amendment to Credit Agreement and Limited Consent, dated as of June 20, 2018, by and among EnLink Midstream, LLC, Bank of America, N.A., as Administrative Agent, and the lenders party thereto.

|

|

|

|

|

|

10.2

|

—

|

Second Amendment to Credit Agreement and Limited Consent, dated as of June 20, 2018, by and among EnLink Midstream Partners, LP, Bank of America, N.A., as Administrative Agent, and the lenders party thereto.

|

|

|

|

|

|

99.1

|

—

|

Press Release dated June 25, 2018.

|

5

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

ENLINK MIDSTREAM, LLC

|

|

|

|

|

|

|

By:

|

EnLink Midstream Manager, LLC,

|

|

|

|

its Managing Member

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: June 25, 2018

|

By:

|

/s/ Eric D. Batchelder

|

|

|

|

Eric D. Batchelder

|

|

|

|

Executive Vice President and

|

|

|

|

Chief Financial Officer

|

6

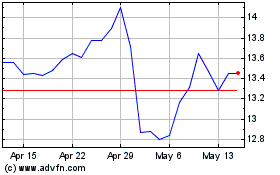

EnLink Midstream (NYSE:ENLC)

Historical Stock Chart

From Mar 2024 to Apr 2024

EnLink Midstream (NYSE:ENLC)

Historical Stock Chart

From Apr 2023 to Apr 2024