Current Report Filing (8-k)

June 07 2018 - 5:13PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): June 5, 2018

PAR Technology Corporation

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

1-09720

|

16-1434688

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

PAR Technology Park, 8383 Seneca Turnpike, New Hartford, New York 13413-4991

(Address of Principal Executive Offices) (Zip Code)

Registrant's telephone number, including area code: (315) 738-0600

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

☐

|

Soliciting material pursuant to rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement

On June 5, 2018, PAR Technology Corporation (the “Company”) entered into a Credit Agreement (the “Credit Agreement”) by and among the Company, as the Borrower thereunder, together with certain of the Company’s US subsidiaries, as “Subsidiary Guarantors” (together with the Company, the “Loan Parties”), and Citizens Bank, N.A., as the “Lender”. The Credit Agreement provides for revolving loans in an aggregate principal amount of up to $25.0 million to be made available to the Company (the “Credit Facility”). The Credit Facility includes a $15.0 million accordion option, which can be requested by the Company, in $5.0 million increments. The accordion increase is uncommitted and is not available if an event of default exists. In connection with the Company’s entering into the Credit Agreement, the Company repaid in full all outstanding obligations owed by the Company under the credit agreement dated November 29, 2016 (as subsequently amended, modified, and supplemented) with JPMorgan Chase Bank, N.A. (“JPMorgan Chase”), and terminated the JPMorgan Chase credit agreement and all commitments (other than an undrawn letter of credit) by JPMorgan Chase to extend further credit thereunder.

The Credit Facility matures three (3) years from the date of the Credit Agreement and is guaranteed by the Subsidiary Guarantors. The Credit Facility is secured by substantially all of the assets of the Company and of the other Loan Parties. The Credit Agreement contains customary representations and warranties and affirmative and negative covenants, including certain financial maintenance covenants that require maximum consolidated leverage ratios and minimum consolidated EBITDA, and covenants that restrict the ability of the Company and its subsidiaries to incur additional indebtedness, incur or permit to exist liens on assets, make investments and acquisitions, consolidate or merge, engage in asset sales, pay dividends, and make distributions. The revolving loans bear interest at the LIBOR rate plus 1.5%. Obligations under the Credit Agreement may be accelerated upon certain customary events of default (subject to grace or cure periods, as appropriate).

The foregoing description of the Credit Agreement and resulting Credit Facility does not purport to be complete and is qualified in its entirety by reference to the complete text of the Credit Agreement, a copy of which will be filed as an exhibit to the Company's Quarterly Report on Form 10-Q for the period ending June 30, 2018 to be filed with the Securities and Exchange Commission.

Item 1.02. Entry into a Material Definitive Agreement

The disclosure required by this item is included in Item 1.01 above and is incorporated herein by reference.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

.

The disclosure required by this item is included in Item 1.01 above and is incorporated herein by reference.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

PAR TECHNOLOGY CORPORATION

|

|

|

(Registrant)

|

|

|

|

|

Date: June 7, 2018

|

/s/ Bryan A. Menar

|

|

|

Bryan A. Menar

|

|

|

Chief Financial Officer

|

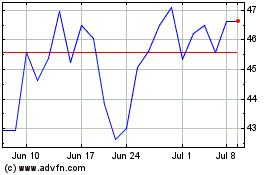

PAR Technology (NYSE:PAR)

Historical Stock Chart

From Mar 2024 to Apr 2024

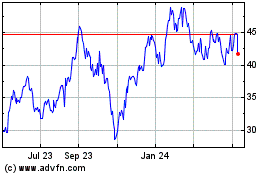

PAR Technology (NYSE:PAR)

Historical Stock Chart

From Apr 2023 to Apr 2024