Current Report Filing (8-k)

April 24 2018 - 9:31AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

April 13, 2018

|

INTEGRATED VENTURES, INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

000-55681

|

|

82-1725385

|

|

(State or other jurisdiction

of incorporation or organization)

|

|

(Commission

file number)

|

|

(I.R.S. Employer

Identification No.)

|

|

73 Buck Road, Suite 2, Huntingdon Valley, PA

|

|

19006

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

215-613-1111

(Registrant’s telephone number, including area code)

________________________________________________

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17CRF 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CRF 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CRF 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CRF 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

Item 1.01 Entry into a Material Definitive Agreement

Asset Purchase Agreement

On April 16, 2018, the Company entered into an Asset Purchase Agreement (the “Agreement”) with digiMine LLC (the “Seller”) for the purchase of Seller’s Mining Equipment located in Marlboro, New Jersey, the principal assets of the Seller’s business consisting of 150 Bitmain Mining Machines (“Equipment”); all of Seller's or its Affiliates' right, title and interest in, the lease for the premises on which Seller’s business operates, all obligations under which we assumed at the closing on April 18, 2018; all books and records pertaining to ownership of the Equipment and Seller’s business as applicable; and cash assets of $175,000.

We also entered into a separate Security and Pledge Agreement, dated as of April 13, 2018, securing our obligations to the Seller under the Agreement.

Seller has the right (the “

Put-Back Right

”), at any time commencing April 1, 2019, to require that the Company redeem for cash any of Seller’s then-outstanding Preferred Shares at a redemption price equal to 72% of the Shares. The Conversion Amount on execution is equal to $1,200,000 (the “

Put-Back Price

”) of such Series B Preferred Shares;

provided

, that the Put Back Right expires with respect to any share of Series B Preferred stock at such time as the Shares for such Series B Preferred Shares are registered for resale. Each Series B Preferred Share for purposes of the Put-Back Price is equal to a fixed price of One Hundred Dollars ($100.00) per share.

THE FOREGOING DESCRIPTIONS OF THE AGREEMENT AND SECURITY AND PLEDGE AGREEMENT DO NOT PURPORT TO BE COMPLETE AND ARE QUALIFIED IN THEIR ENTIRETY BY REFERENCE TO THE FORMS OF THESE AGREEMENTS THAT ARE FILED AS EXHIBITS 10.21 AND 10.22, RESPECTIVELY, TO THIS CURRENT REPORT ON FORM 8-K AND ARE INCORPORATED HEREIN BY REFERENCE. DEFINED TERMS USED IN THE DESCRIPTIONS IN THIS CURRENT REPORT SHALL HAVE THE MEANINGS PROVIDED IN THE RESPECTIVE AGREEMENTS, AS APPLICABLE, UNLESS SPECIFICALLY DEFINED ABOVE IN THIS REPORT.

Item 3.02. Unregistered Sale of Equity Securities.

The following table sets forth the sales of unregistered securities since the Company’s last report filed under this item.

|

Date

|

|

Title and Amount(1)

|

|

Principal

Purchaser

|

|

Underwriter

|

|

Total Offering Price/

Underwriting Discounts

|

|

|

April 18, 2018

|

|

16,666 shares of Series B Preferred Stock issued to digiMine LLC, at a per share purchase price of $72 per share.

|

|

Private Investor

|

|

NA

|

|

$

|

1,200,000/NA

|

|

_____

(1) The equity issuance by the Company to the Seller is viewed by the Company as exempt from registration under the Securities Act of 1933, as amended (“Securities Act”), alternatively, as a transaction either not involving any public offering, or as exempt under the provisions of Regulation D promulgated by the SEC under the Securities Act.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of Section 12 of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Integrated Ventures, Inc.

|

|

|

|

|

|

|

|

Dated: April 23, 2018

|

By:

|

/s/ Steve Rubakh

|

|

|

|

Name:

|

Steve Rubakh

|

|

|

|

Title:

|

Chief Executive Officer

|

|

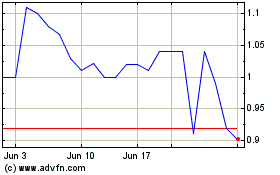

Integrated Ventures (QB) (USOTC:INTV)

Historical Stock Chart

From Mar 2024 to Apr 2024

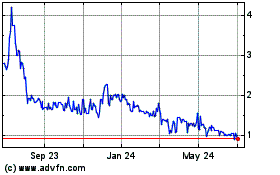

Integrated Ventures (QB) (USOTC:INTV)

Historical Stock Chart

From Apr 2023 to Apr 2024