Current Report Filing (8-k)

March 05 2018 - 4:14PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 5, 2018 (February 27, 2018)

GREIF, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

Delaware

|

|

001-00566

|

31-4388903

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

|

425 Winter Road, Delaware, Ohio

|

43015

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: (740) 549-6000

Not Applicable

(Former name or former address, if changed since last report.)

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Section 2 – Financial Information

|

|

|

|

Item 2.02.

|

Results of Operations and Financial Condition.

|

On February 28, 2018, Greif, Inc. (the “Company”) issued a press release (the “Earnings Release”) announcing the financial results for its

first

quarter ended

January 31, 2018

. The full text of the Earnings Release is attached as Exhibit 99.1 to this Current Report on Form 8-K.

The Earnings Release included the following non-GAAP financial measures (the “non-GAAP Measures”):

|

|

|

|

(i)

|

the Company's consolidated operating profit, before special items, for the first quarter of 2018 and the first quarter of 2017, which is equal to the Company's consolidated operating profit for the applicable period plus restructuring charges, plus acquisition-related costs, plus non-cash asset impairment charges, plus gains on disposal of properties, plants, equipment and businesses, net, each on a consolidated basis for the applicable period;

|

|

|

|

|

(ii)

|

the Company's net income, excluding the impact of special items, for the first quarter of 2018 and the first quarter of 2017, which is equal to the Company's consolidated net income for the applicable period plus restructuring charges, plus acquisition-related costs, plus non-cash asset impairment charges, plus the provisional net tax benefit resulting from the Tax Cuts and Jobs Act of 2017 (the "Tax Reform Act"), plus non-cash pension settlement charges, plus gains on disposal of properties, plants, equipment and businesses, net, each net of tax and noncontrolling interest and on a consolidated basis for the applicable period;

|

|

|

|

|

(iii)

|

earnings per diluted class A share of the Company, excluding the impact of special items, for the first quarter of 2018 and the first quarter of 2017, which is equal to earnings per diluted class A share of the Company for the applicable period plus restructuring charges, plus acquisition-related costs, plus non-cash asset impairment charges, plus the provisional net tax benefit resulting from the Tax Reform Act, plus non-cash pension settlement charges, plus gains on disposal of properties, plants, equipment and businesses, net, each net of tax and noncontrolling interest and on a consolidated basis for the applicable period;

|

|

|

|

|

(iv)

|

the Company’s consolidated free cash flow for the first quarter of 2018 and the first quarter of 2017, which is equal to the Company’s consolidated net cash provided by operating activities for the applicable period less cash paid for purchases of properties, plants and equipment for the applicable period;

|

|

|

|

|

(v)

|

operating profit before special items for the Company’s Rigid Industrial Packaging & Services business segment for the first quarter of 2018 and the first quarter of 2017 which is equal to that business segment’s operating profit plus restructuring charges, plus acquisition-related costs, plus non-cash asset impairment charges, plus gains on disposal of properties, plants, equipment and businesses, net, each for the applicable period;

|

|

|

|

|

(vi)

|

operating profit before special items for the Company’s Paper Packaging & Services business segment for the first quarter of 2018 and the first quarter of 2017 which is equal to that business segment’s operating profit plus gains on disposal of properties, plants, equipment and businesses, net, each for the applicable period;

|

|

|

|

|

(vii)

|

operating profit before special items for the Company’s Flexible Products & Services business segment for the first quarter of 2018 and the first quarter of 2017, which is equal to that business segment’s operating profit plus restructuring charges, plus non-cash asset impairment charges, plus losses on disposal of properties, plants, equipment and businesses, net, each for the applicable period;

|

|

|

|

|

(viii)

|

operating profit before special items for the Company’s Land Management business segment for the first quarter of 2018 and the first quarter of 2017, which is equal to that business segment’s operating profit plus gains on disposal of properties, plants, equipment and businesses, net, each for the applicable period;

|

|

|

|

|

(ix)

|

net sales excluding foreign currency translation for the Company's Rigid Industrial Packaging & Services business segment for the first quarter of 2018 and the first quarter of 2017, which is equal to that business segment's net sales for the applicable quarter, after adjusting such sales for the first quarter of 2018 for foreign currency translation; and

|

|

|

|

|

(x)

|

net sales excluding foreign currency translation for the Company's Flexible Products & Services business segment for the first quarter of 2018 and the first quarter of 2017, which is equal to that business segment's net sales for the applicable quarter, after adjusting such sales for the first quarter of 2018 for foreign currency translation.

|

The Earnings Release also included the following forward-looking non-GAAP measures:

|

|

|

|

(i)

|

The Company's 2018 Class A earnings per share before special items, which is equal to earnings per diluted class A share of the Company for the applicable period plus restructuring charges, plus acquisition-related costs, plus non-cash asset impairment charges, plus non-cash pension settlement charges, plus the provisional net tax benefit resulting from the Tax Reform Act, plus gains on disposal of properties, plants, equipment and businesses, net, each net of tax, other income tax related events, noncontrolling interest and on a consolidated basis for the applicable period; and

|

|

|

|

|

(ii)

|

2018 projected free cash flow which is equal to the Company's consolidated net cash provided by operating activities for the applicable period and scenario less cash paid for capital expenditures for the applicable period and scenario. A reconciliation of this forward-looking non-GAAP financial measure was included in the Earnings Release.

|

No reconciliation of the forward-looking non-GAAP financial measures were included in the Earnings Release for item (i) because, due to the high variability and difficulty in making accurate forecasts and projections of some of the excluded information, together with some of the excluded information not being ascertainable or accessible, the Company is unable to quantify certain amounts that would be required to be included in the most directly comparable GAAP financial measures without unreasonable efforts.

Management of the Company uses the non-GAAP Measures to evaluate ongoing operations and believes that these non-GAAP Measures are useful to investors. The exclusion of the impact of the identified special items (restructuring charges, acquisition related costs, non-cash asset impairment charges, non-cash pension settlement charges, the provisional net tax benefit resulting from the Tax Reform Act and disposals of properties, plants, equipment and businesses, net) enable management and investors to perform meaningful comparisons of current and historical performance of the Company. Management of the Company also believes that the exclusion of the impact of the identified special items provide a stable platform on which to compare the historical performance of the Company and that investors desire this information. Management believes that the use of consolidated free cash flow, which excludes cash paid for capital expenditures from the Company's consolidated net cash provided by operating activities, provides additional information on which to evaluate the cash flow generated by the Company and believes that this is information that investors find valuable. The non-GAAP Measures are intended to supplement and should be read together with our financial results. The non-GAAP Measures should not be considered an alternative or substitute for, and should not be considered superior to, our reported financial results. Accordingly, users of this financial information should not place undue reliance on the non-GAAP Measures.

Section 5 - Corporate Governance and Management

Item 5.07. Submission of Matters to a Vote of Security Holders.

The Annual Meeting of Stockholders (the “Annual Meeting”) of the Company was held on February 27, 2018. At the Annual Meeting, the holders of the Company’s Class B Common Stock (the “Class B Stockholders”) voted on the following proposals and cast their votes as described below.

Proposal 1

To elect as directors for one-year terms Vicki L. Avril, Bruce A. Edwards, Mark A. Emkes, John F. Finn, Michael J. Gasser, Daniel J. Gunsett, Judith D. Hook, John W. McNamara, Patrick J. Norton and Peter G. Watson, the ten persons recommended by the Nominating and Corporate Governance Committee (the “Nominating Committee”), all of whom are currently directors of the Company.

|

|

|

|

|

|

|

|

PROPOSAL 001 ELECTION OF DIRECTORS

|

|

***

|

FOR

|

WITHHELD

|

|

VICKI L. AVRIL

|

19,561,807

|

28,220

|

|

BRUCE A. EDWARDS

|

19,529,750

|

60,277

|

|

MARK A. EMKES

|

19,553,593

|

36,434

|

|

JOHN F. FINN

|

19,542,645

|

47,382

|

|

MICHAEL J. GASSER

|

18,148,632

|

1,441,395

|

|

DANIEL J. GUNSETT

|

18,128,674

|

1,461,353

|

|

JUDITH D. HOOK

|

19,549,282

|

40,745

|

|

JOHN W. MCNAMARA

|

19,546,226

|

43,801

|

|

PATRICK J. NORTON

|

19,533,650

|

56,377

|

|

PETER G. WATSON

|

19,574,565

|

15,462

|

Proposal 2

To consider and act upon a proposal to amend certain material terms of the Company’s Amended and Restated Long Term Incentive Compensation Plan, hereinafter referred to as the “Long Term Term Incentive Plan” or “LTIP,” and to reaffirm the material terms of the LTIP as modified and described in the Company's definitive Proxy Statement for its 2018 Annual Meeting of Stockholders (the "Proxy Statement").

|

|

|

|

|

|

|

|

|

|

|

PROPOSAL 002 PROPOSAL TO AMEND MATERIAL TERMS OF THE AMENDED AND RESTATED LONG TERM INCENTIVE COMPENSATION PLAN AND TO REAFFIRM SUCH PLAN

|

|

***

|

FOR

|

AGAINST

|

ABSTAIN

|

BROKER NON-VOTES

|

|

TOTAL SHARES VOTED

|

15,255,421

|

4,324,191

|

10,415

|

—

|

The Transformation Committee of the Board of Directors of the Company has been discontinued because the Company's Transformation Initiative concluded in fiscal 2017.

Section 9 – Financial Statements and Exhibits

|

|

|

|

Item 9.01.

|

Financial Statements and Exhibits.

|

|

|

|

|

|

|

Exhibit No.

|

Description

|

|

|

Press release issued by Greif, Inc. on February 28, 2018 announcing the financial results for its first quarter ended January 31, 2018.

|

|

|

File transcript of conference call with interested investors and financial analysts held by management of Greif, Inc. on March 1, 2018.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

GREIF, INC.

|

|

Date: March 5, 2018

|

By

|

/s/ Lawrence A. Hilsheimer

|

|

|

|

Lawrence A. Hilsheimer,

Executive Vice President and Chief Financial Officer

|

EXHIBIT INDEX

|

|

|

|

|

|

Exhibit No.

|

Description

|

|

|

Press release issued by Greif, Inc. on February 28, 2018 announcing the financial results for its first quarter ended January 31, 2018.

|

|

|

File transcript of conference call with interested investors and financial analysts held by management of Greif, Inc. on March 1, 2018.

|

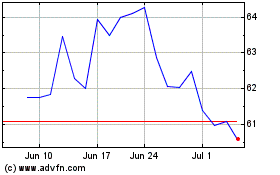

Greif (NYSE:GEF.B)

Historical Stock Chart

From Mar 2024 to Apr 2024

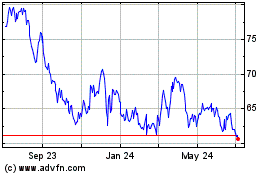

Greif (NYSE:GEF.B)

Historical Stock Chart

From Apr 2023 to Apr 2024