Current Report Filing (8-k)

February 16 2018 - 5:21PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 15, 2018

Instructure, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-37629

|

|

26-3505687

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

6330 South 3000 East, Suite 700

Salt Lake City, UT

|

|

84121

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (800)

203-6755

Check the appropriate box below

if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as

defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule

12b-2

of the Securities Exchange Act of 1934

(§ 240.12b-2

of

this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

In this report, “Instructure,” “we,” “us” and “our” refer to Instructure,

Inc.

Underwriting Agreement

On February 15, 2018, we entered into an underwriting agreement (the “

Underwriting Agreement

”) with Morgan Stanley & Co.

LLC and Credit Suisse Securities (USA) LLC (collectively, the “

Underwriters

”), relating to the issuance and sale (the “

Offering

”) of 2,500,000 shares of our common stock, par value $0.0001 per share.

The price to the public in the Offering is $39.50 per share, and the Underwriters have agreed to purchase the shares from us pursuant to the Underwriting Agreement at a price of $38.315 per share. The net proceeds to Instructure from this Offering

are expected to be approximately $95.4 million, after deducting underwriting discounts and commissions and other estimated offering expenses payable by us. The Underwriters have a

30-day

option to

purchase up to an additional 375,000 shares of common stock. All of the shares in the offering are being sold by us.

The Offering

is being made pursuant to our effective registration statement on Form

S-3

(Registration Statement

No. 333-223048),

as previously filed with the Securities and

Exchange Commission and a related prospectus.

The Underwriting Agreement contains customary representations, warranties and agreements by us, customary

conditions to closing, indemnification obligations of Instructure and the Underwriters, including for liabilities under the Securities Act of 1933, as amended, other obligations of the parties and termination provisions. The representations,

warranties and covenants contained in the Underwriting Agreement were made only for purposes of such agreement and as of specific dates, were solely for the benefit of the parties to such agreement, and may be subject to limitations agreed upon by

the contracting parties.

The Underwriting Agreement is filed as Exhibit 1.1 to this report, and the description of the terms of the Underwriting

Agreement is qualified in its entirety by reference to such exhibit. A copy of the opinion of Cooley LLP relating to the legality of the issuance and sale of the shares in the Offering is attached as Exhibit 5.1 hereto.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

Instructure, Inc.

|

|

Dated: February 16, 2018

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Matthew A. Kaminer

|

|

|

|

|

|

|

|

Matthew A. Kaminer

|

|

|

|

|

|

|

|

Senior Vice President, General Counsel and Secretary

|

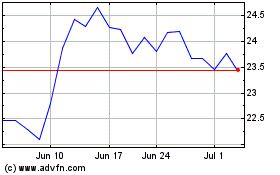

Instructure (NYSE:INST)

Historical Stock Chart

From Mar 2024 to Apr 2024

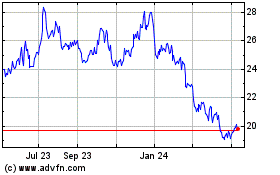

Instructure (NYSE:INST)

Historical Stock Chart

From Apr 2023 to Apr 2024