Current Report Filing (8-k)

January 31 2018 - 10:01AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

January 19, 2018

|

INTEGRATED VENTURES, INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

000-55681

|

|

82-1725385

|

|

(State or other jurisdiction

of incorporation or organization)

|

|

(Commission file number)

|

|

(I.R.S. Employer

Identification No.)

|

|

73 Buck Road, Suite 2, Huntingdon Valley, PA

|

|

19006

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

215-613-1111

(Registrant’s telephone number, including area code)

________________________________________________

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17CRF 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CRF 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CRF 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CRF 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

Item 1.01. Entry into a Material Definitive Agreement.

Securities Purchase Agreement

On January 19, 2018 the Company entered into a Securities Purchase Agreement (the “

Agreement

”)with St. George Investments LLC (the “

Purchaser

”) for the purchase by the Purchaser, for an aggregate purchase price of $750,000 (the “

Purchase Price

”) of: (a) 462,900 shares of restricted Common Stock of the Company; and (b) a three-year common stock purchase warrant to purchase 347,175 shares of common stock of the Company at an exercise price of $2.16 per share (the “

Warrant

”).

THE FOREGOING DESCRIPTIONS OF THE AGREEMENT AND WARRANT DO NOT PURPORT TO BE COMPLETE AND ARE QUALIFIED IN THEIR ENTIRETY BY REFERENCE TO THE FORMS OF AGREEMENT AND WARRANT THAT ARE FILED AS EXHIBITS 10.19 AND 10.20, RESPECTIVELY, TO THIS CURRENT REPORT ON FORM 8-K AND ARE INCORPORATED HEREIN BY REFERENCE. DEFINED TERMS USED IN THE DESCRIPTIONS IN THIS CURRENT REPORT SHALL HAVE THE MEANINGS PROVIDED IN THE AGREEMENT OR WARRANT, AS APPLICABLE, UNLESS SPECIFICALLY DEFINED ABOVE IN THIS REPORT.

Item 3.02. Unregistered Sale of Equity Securities.

The following table sets forth the sales of unregistered securities since the Company’s last report filed under this item.

|

Date

|

|

Title and Amount(1)

|

|

Principal

Purchaser

|

|

Underwriter

|

|

Total Offering Price/

Underwriting Discounts

|

|

|

January 24, 2018

|

|

462,900 shares of common stock issued to St. George Investments, LLC, at a per share purchase price of $1.62.

|

|

Private Investor

|

|

NA

|

|

$

|

750,000/NA

|

|

|

January 24, 2018

|

|

Three-year Common Stock Purchase Warrant issued to St. George Investments, LLC to purchase 347,175 shares of common stock at an exercise price of $2.16 per share.

|

|

Private Investor

|

|

NA

|

|

$

|

-0-/NA

|

|

(1) The debt or equity issuances by the Company to lenders and investors are viewed by the Company as exempt from registration under the Securities Act of 1933, as amended (“Securities Act”), alternatively, as transactions either not involving any public offering, or as exempt under the provisions of Regulation D promulgated by the SEC under the Securities Act.

Item 8.01. Other Events.

The use of proceeds for this $750,000 funding round is as follows:

|

|

·

|

to purchase mining rigs and related equipment from Bitmain Technologies

|

|

|

·

|

to fund a security deposit for the purchase of Commercial Real Estate

|

|

|

·

|

to initiate the development of the LoanFunder

|

In January 2018, the Company placed Purchase Orders with Bitmain Technologies for in excess of $600,000 of digital currency mining rigs and related mining equipment.

On January 17, 2018, the Company ordered the following mining rigs and assorted mining equipment with a total value of $276,429:

|

|

·

|

Antminer L3. Qty: 20 units. Cost: $49,142.00. ETA: 02/10/2018.

|

|

|

·

|

Antminer L3. Qty: 30 units. Cost: $73,795.59. ETA: 02/10/2018.

|

|

|

·

|

Antminer L3. Qty: 50 units. Cost: $122,992.59. ETA: 02/10/2018.

|

|

|

·

|

Antminer S9. Qty: 10 units. Cost: $23,991.00. ETA: 03/20/2018.

|

|

|

·

|

Antminer PSU APW3++. Qty: 30 units. Cost: $2,783.24. ETA: 02/10/2018.

|

|

|

·

|

Nemesis 1600W PSU. Qty 50 units. Cost: $3,725.00. ETA: 02/01/2018.

|

On January 25, 2018, the Company placed a Purchase Order for 140 mining rigs and related mining equipment with a total value of $344,430:

|

|

·

|

Antminer L3. Qty: 20 units. Cost: $49,225.32. ETA: 02/28/2018.

|

|

|

·

|

Antminer L3. Qty: 20 units. Cost: $49,225.32. ETA: 02/28/2018.

|

|

|

·

|

Antminer L3. Qty: 30 units. Cost: $73.838.18. ETA: 02/28/2018.

|

|

|

·

|

Antminer L3. Qty: 10 units. Cost: $24,465.67. ETA: 02/28/2018.

|

|

|

·

|

Antminer L3. Qty: 60 units. Cost: $147,675.96. ETA: 02/28/2018.

|

On January 30, 2018, the Company had placed a purchase order for one (1) Mobile Mining Center ("MMC").

Estimated delivery date is March 15, 2018.

The specifications as follow:

|

|

·

|

Size: 20' (6058mm x 2438mm x 2896mm)

|

|

|

·

|

Cooling: AC

|

|

|

·

|

Ventilation: 4 fans (24")

|

|

|

·

|

Power: 220V

|

|

|

·

|

Mining Capacity (# of rigs): 50-75

|

|

|

·

|

Additional Equipment: metal cabinets/shelving/desk

|

|

|

·

|

Color: Black

|

|

|

·

|

MSRP: $299,000 (fan cooled)/$349,000 (air cooled)

|

Item 9.01. Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of Section 12 of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Integrated Ventures, Inc.

|

|

|

|

|

|

|

|

Dated: January 31, 2018

|

By:

|

/s/ Steve Rubakh

|

|

|

|

Name:

|

Steve Rubakh

|

|

|

|

Title:

|

Chief Executive Officer

|

|

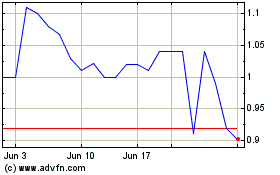

Integrated Ventures (QB) (USOTC:INTV)

Historical Stock Chart

From Mar 2024 to Apr 2024

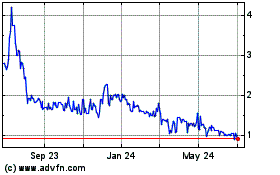

Integrated Ventures (QB) (USOTC:INTV)

Historical Stock Chart

From Apr 2023 to Apr 2024